by Chris Prevatt

by Chris Prevatt

ORIGINALLY PUBLISHED on PublicCEO.com

While I appreciate his highlighting the contributions of Dan Chmielewski and myself to the debate with Steven Greenhut and Supervisor John Moorlach, I do have to take issue with the way he presented some of my comments, including the attribution of some statements out of context.

“The battle is sure to remain intense because the LiberalOC blog’s Chris Prevatt (who is also a county union official) isn’t willing to concede that government pensions is a topic for public debate. He even says that specific retiree benefits-like the ones causing so much outrage-should be secret, and he has blasted inquisitive reporters.”

First, to claim that I feel that government pensions are not a topic for public debate is not accurate. I believe that the public does have a role in participating in debate over public employee pensions. That is accomplished through the election of officials to manage our government. The public is entitled to know what benefits have been negotiated, and in Orange County the voters even approved a county ballot initiative that requires a vote of the public to increases public employee pension benefits. In fact, the Orange County Employee’s Association (OCEA) spent no time or effort opposing that initiative. In a July 14th OC Register Guest Commentary OCEA General Manager Nick Berardino pointed out that OCEA has saved the taxpayers millions:

“This past year OCEA and the county negotiated a truly innovative option that provides employees the ability to select (and pay more for) a straight defined-benefit plan or, in the alternative, select a lesser defined-benefit plan combined with a defined-contribution plan. In both cases, OCEA-represented employees will continue to pay their entire employee contribution and a portion of the employer contribution.”

Moxley went on to attribute the following quote from me incorrectly as though it was a justification for not revealing actual pension payouts.

“It is not the job of individual taxpayers to evaluate the performance of public employees.”

Moxley’s misapplication of my comment resulted in the following from Greenhut:

“How arrogant to want to further shut down public records,” responds Greenhut, who can’t hide his contempt that union leaders want “a shield from accountability.”

From his view, “Taxpayers have every right and duty to be concerned. Actually, Prevatt’s ‘It’s none of your business; we know best’ attitude epitomizes the core thesis of my book. The public servants have become the public’s masters. It’s time for the public to remind the government-employee class that it is supposed to work for us.”

My objection was over where the line between the public right to know crosses over the right to some level of privacy. Pensions are not as claimed in the OC Register investigation I was commenting on, “paid by the taxpayer.” Pensions are paid by the employer, in this case public agencies, and the employees. Even if the employer picks up 100% of the employee share of retirement contributions, it is the employee’s contribution and was negotiated by those employees as part of their regular compensation when they were employees. The only interest the public has is in what compensation, including benefits, an active employee is being paid. Unfortunately, the state courts have ruled differently, so that “point” is moot.

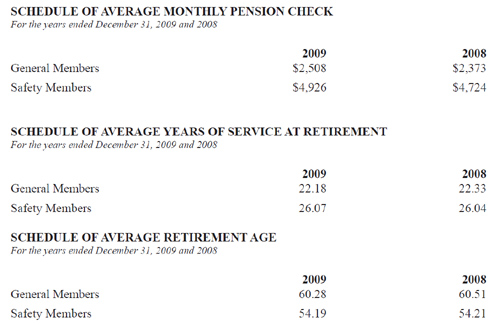

The resulting revelation of pension benefits for County retirees has proven what I and union officials have been saying all along. The rank and file employees do not receive excessive or bloated pension benefits. In fact, senior executives are the people getting bloated pension payouts. These managers contribute nothing to the employee share of their pension benefits, and they get the highest payouts. And even with the excessive retirement payouts for managers factored in, the average annual payout for General Members in the entire OCERS system was $30,108 in 2009 (Fig. 1).

My comment, taken in context, was related to the overall debate about how much of a role the general public has in the details of in the administration of government functions. My point was simply that a municipality cannot be effectively or efficiently managed directly by each resident individually. In the case of the County of Orange, we elect a Board of Supervisors and task them with the responsibility to hire and supervise managers to run the nuts and bolts of county government functions. That is what I meant when I wrote “It is not the job of individual taxpayers to evaluate the performance of public employees.”

Far from objecting to accountability, union leaders have been on the forefront of calling for management accountability. What union officials and I object to is the abuse of public information requests for the purpose of distorting the image of public employees. Given the way Greenhut and Moorlach have distorted facts, I think there is a valid cause for concern.

Moxley also quotes Greenhut saying:

“The public increasingly understands the level of plundering that has gone on, as public employees have used their union power to gain an unsustainable level of pay and especially benefits,” he says. “People are starting to understand that this is an issue of fairness. It’s not fair to create a society in which those who are supposed to serve the public get to live much better than the rest of us.”

Greenhut here is using the excessive salaries of government executive managers to portray ALL public employees as being overpaid and living better than the “rest of us.” I am not sure when Steven Greenhut became a member of the down-trodden working class, but I am pretty sure he “earns” significantly more than the average county worker while sitting on his tail pontificating about public employees living high on the hog. I am having a difficult time figuring out who he is referring to when he uses the phrase “rest of us.” County workers do earn more than the average salaries of the general population. But when those salaries are compared to salaries of similar private sector professions, public employees – for the most part – earn less than their private sector counterparts.

As far as public employees getting better pension benefits compared to people retiring on Social Security alone; yes they get more. Public employees contribute about double the amount to their pension plans than private sector workers pay into Social Security and draw about double the benefit of those receiving Social Security. It is disingenuous to characterize all public employee pensions as excessive. It simply isn’t the case.

Moxley quotes Orange County 2nd District Supervisor John Moorlach from his July 28th guest editorial in the Orange County Register.

“The voters have seen public sector greed (thank you, city of Bell), and they have had enough,” wrote Moorlach, who says it’s time for a voter referendum against “Rolls-Royce” public pension plans.

Again, we have another example of how hypocrites like Moorlach – who will benefit from the same county pension plan I will while also taking home an additional 8% of his salary in a 401(k) style defined contribution plan – tailor their rhetoric to raise public ire against public employees. He, like all county executives and managers, doesn’t pay any of the employee normal costs towards his pension benefits, and doesn’t pay for the 401(k) style pension program (Managers and elected officials do contribute a small percentage to cover the pension enhancements of 2005).

Unfunded Pension Liabilities Do Not Mean Insolvency

Moorlach and Greenhut incorrectly portray “unfunded pension liabilities” as some looming catastrophe hanging over our heads ready to crush our government services into oblivion as well as taxpayers into financial ruin. That is simply not the case.

- FACT: In the 1950s through 1970s, pension funding levels were the same or lower than today’s levels, without rampant municipal bond defaults or bankruptcies;

- FACT: The Pew Center on States, authors of a definitive study on pension funding and a major critic of unfunded liabilities, points out that average state pension funding was at 84% in 2008, higher than the average in the 1970s, and a “relatively positive outcome, because most experts advise at least an 80 percent funding level”;

- FACT: Even states with some of the weakest pension funding rates, like New Jersey, had enough assets at the end of 2009 to cover their pension costs by 10 times or more.

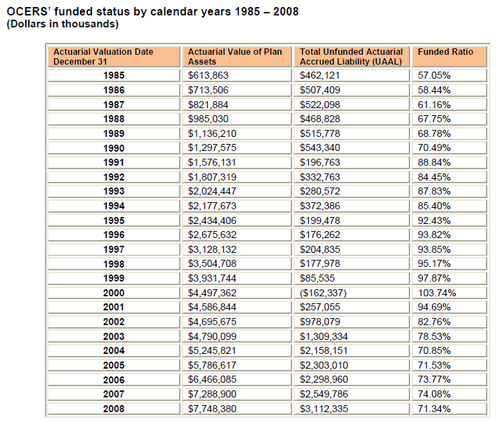

Unfunded pension liabilities have existed before (Fig. 2), and they will exist in the future. In a cyclical manner, unfunded pension liabilities will rise and fall with economic conditions. Greenhut and Moorlach would have us believe that a fully funded pension plan is required for fiscal solvency and financial stability. This is not the case as public employee pension funding ratios have grown and declined over time. Funding levels were as low as 50% in the 1970s, 80% in the 1980s, and only reached 100% in the mid- 1990s after stock market returns averaged 28% per year.

Unfunded liabilities are not, as Steven Greenhut would have us believe, like credit card debt. Credit Card debt is based upon unsecured debt; public employee pensions are not. Pension debt is more akin to a home mortgage. You have a liability secured by some cash and a projected market value of an asset if sold. You do not have a responsibility to pay that debt in full unless you sell the home (cash out).

While lower than average pension funding levels are not equivalent to insolvency, they are certainly important and should be addressed to prevent further erosion of pension reserves. Full funding is an ideal goal, but not required to maintain stable pension reserves. OCERS’ independent actuary, Segal, Inc. performed an actuarial valuation as of December 31, 2009 and determined that OCERS’ funding ratio of actuarial assets to the actuarial accrued liability is 68.77%, which decreased from the prior year’s funded status of 71.34%. (See Letter of Transmittal, page 3 of CAFR).

Public employees are not opposed to responsible pension reform. Public employees and their union leaders in Orange County have worked with the County to, create options including hybrid pension plans, increase the retirement eligibility age for new employees, and require pension contributions from employees who previously paid nothing towards the employee portion of their pension contributions.

The Orange County Employee’s Association, representing the vast majority of employees in the County retirement system, has taken the lead in offering innovative solutions that help relieve future county costs while protecting existing benefits. Government workers are willing to be part of the solution, but they are not the only participants in this process. Management needs to step up to the plate and start paying a portion of their pension costs. If management and public safety employees paid their full share of the employee share of their pension contribution, or even a portion of it, we would be on the path to full funding of our pension liabilities. From my perspective, that of a county worker, everyone needs to pay their share of the costs.

I am a CALPERs member and a member of a public employees union so I am glad to hear that unions are trying to help, but I am a bit skeptical. I also have a couple of comments.

First, while CALPERS and other pension funds are composed of member/employee contributions, the actuarial assumptions made to justify the defined benefits just don’t work. That means State and local governments have to pick up the tab or the pension fund will reneg on its obligations. I doubt governments will pick up the full burden in the future but there may be some sharing of the pain, in particular people with six figure pensions may see cuts.

Second, some unions (unfortunately not mine!) have been astute at lobbying State and local governments for increases in wages in benefits. This is particularly true for public safety officers, who according to the data above, receive twice the avg pension benefit while retiring 6 years earlier. Perhaps some premium makes sense, but this is too much.

THe results have been presented on this blog many times–the potential bankrupting of many cities as well as our State. The unfunded health care liabilities are staggering as well. The other State and local debt is very manageable for most cities and for our State, but the unfunded liabilities are out of control and can kill us. This already happened to GM.

I have been a union member for most of my adult life. I raised money for a union drive when I was in graduate school. But unfortunately now I see our public employee unions as just another special interest group which does not see the general public good. I hope I am mistaken, but I doubt it.

I heard on the radio yesterday that the average public employee salary with benefits is now $133,000 vrs. $61,000 in the private sector. It’s totally out of hand and time reel in the public giveaways.

rusty49: $133,000 vrs. $61,000

While you were sleeping over the past thirty years, real wages in the private sector have dramatically declined, while public sector wages have barely kept pace with inflation. In short: government workers have barely maintained their edge on costs of living over the past forty years, while the private sector has gone *backwards*.

rusty49-turn off the radio. For a senior maintenance worker $60,000 would be more like it. It is the management where the salaries reach the astronomical range and skew the average. Before flogging the people who deliver the services harder, ask what makes an interim city manager worth $200,000 or more. What are the actual values of the services delivered. Park maintenance, street light repairs, water mains, weed abatement animal control, and all the other services that you see performed daily, to the benefit of all citizens, are not performed by people making $133,000/yr, unless Davis’ overtime situation is even worse than reported. While the Vanguard tends to lump them all together, most public employees have a modest defined benefit pension plan of 2%@55, not the 3%@50 that first complainers, oops, I meant police and fire got. The people who make everyday life good in the city are not sitting on gold commodes, although I believe Rush Limbaugh does. There I go, characterizing pejoratively again. Mea culpa!

cp: “Moorlach and Greenhut incorrectly portray “unfunded pension liabilities” as some looming catastrophe hanging over our heads ready to crush our government services into oblivion as well as taxpayers into financial ruin. That is simply not the case”

cp: “Unfunded pension liabilities have existed before (Fig. 2), and they will exist in the future. In a cyclical manner, unfunded pension liabilities will rise and fall with economic conditions. Greenhut and Moorlach would have us believe that a fully funded pension plan is required for fiscal solvency and financial stability. This is not the case “

cp: “While lower than average pension funding levels are not equivalent to insolvency, they are certainly important and should be addressed to prevent further erosion of pension reserves.”

cp: “Public employees are not opposed to responsible pension reform.”

cp: “If management and public safety employees paid their full share of the employee share of their pension contribution, or even a portion of it, we would be on the path to full funding of our pension liabilities.”

The author’s article defending unions is full of contradictions as shown above. On the one hand he argues reform isn’t really necessary, then admits that perhaps some reform is in order. You can’t have your cake and eat it too! Either we need reform or we don’t…

[i]”… in Orange County the voters even approved a county ballot initiative that requires a vote of the public to increases public employee pension benefits.”[/i]

I don’t think the initiative process is the right way to set salaries or benefits. However, you would have to be a complete dolt to not understand how meaningless that OC measure is. The unions successfully won unsustainably high salaries, pensions and benefits from pliant supervisors, every reasonable and objective person understand these benefits have to come down, and they have an initiative which only deals with BENEFITS GOING UP? Lewis Carroll would be impressed with the upside down world these avaricious syndicalists live in.

[i]”In fact, the Orange County Employee’s Association (OCEA) spent no time or effort opposing that initiative.”[/i]

Gee, I wonder why that is? Maybe because the OCEA understands that initiative means nothing?

biddlin: “While the Vanguard tends to lump them all together, most public employees have a modest defined benefit pension plan of 2%@55, not the 3%@50 that first complainers, oops, I meant police and fire got. The people who make everyday life good in the city are not sitting on gold commodes, although I believe Rush Limbaugh does”

What percentage of the total employee compensation in Davis do those making over $100,000 represent? Does anyone know? My thought here is if the percentage of total compensation is 20% versus 80%, it makes a big difference when arguing whether only those making over $100,000 are bankrupting the city…

I was just going to wait patiently for Rich to respond; but since Dr. Wu, rusty49, Neutral and ERM are already on point…

I see where Chris Prevatt is heading with this… somewhere we have been before and a place that has served the public employee unions well: feel sorry for the poor public sector employees who provide those difficult and necessary services.

While most of the “necessary services” argument cannot be denied, this old tired strategy of making a protected victims group out of public union employees is no longer going to fly. The unions have milked the old marketing campaign for all it it is worth, now it is time to face up to the reality that they have created.

Few are demonizing public employees; they are simply looking at our state and local budget mess and pointing out total public compensation that is way out of sync with reality.

There is a tendency for most workers in most industries to believe they are worth what they are paid and to defend it. However, having worked in both the private and public sector, there is an obvious and significant gap with the private sector hyper competition and the stress of constantly needing to perform at top levels, and the more relaxed feeling of public sector job security.

Of course this is all changing now because of the drop in tax receipts. However, had the Great Recession not occurred, it was only a matter of time before we would came to the same conclusion that public sector employee compensation adjustments are critically necessary. In addition, demand has been increasing to inject pay-for-performance structures into all public sector compensation systems. Basically, because of what more and more workers have experienced in the private sector, they have come to realize – despite the union marketing campaign – that we need to milk maximum efficiency/value from our public sector businesses the way the private sector has had to do the same.

[i]”First, while CALPERS and other pension funds are composed of member/employee contributions, the actuarial assumptions made to justify the defined benefits just don’t work.”[/i]

Not that it changes your argument in any way, but Orange County employees are not a part of CalPERS. They have their own system called OCERS.

It’s also worth noting that the defined benefit pension plans for OCERS (at least for new employees) are set up a bit differently than they are for employees with the City of Davis or Yolo County get.

Here, fire and police get 3% at 50. I believe that is the same in OC for their public safety officer. But while non-safety here get 2.5% at 55, non-safety for Orange County get 2.7% at 55.

They have an option to take a lesser benefit plan of 1.62% at 65. AFAICT, the reason some would opt for the latter plan is because under 2.7% at 55, the employee has to pay a much larger share of his salary into the pension. How much more that is, I don’t know. But my guess is that our 2.5% at 55 (where employees up to now have paid NOTHING, but are now ramping up to 1% this year and 2% starting next July 1) is MORE GENEROUS than the 2.7% at 55 in OC.

“While you were sleeping over the past thirty years, real wages in the private sector have dramatically declined, while public sector wages have barely kept pace with inflation. In short: government workers have barely maintained their edge on costs of living over the past forty years, while the private sector has gone *backwards*. “

thank you for pointing that out, Neutral

maybe we should spend all this time and energy exploring why the private sector working people in this country are falling behind, not why the government employees are only keeping up with inflation. Sounds to me like the private sector needs more union representation.

“Sounds to me like the private sector needs more union representation. “

So we can have government bail out more of the private sector like they had to do for the wage and benefit-bloated US auto makers?

The private sector has to compete on price/value. Increase private wages through union extortion and the only thing that can be assured is fewer US companies able to compete in global markets and fewer US jobs.

There are very few examples where countries with highly unionized private industry seem to compete effectively. Germany and the a few northern European countries seem to do OK. Why is that?

“There are very few examples where countries with highly unionized private industry seem to compete effectively. Germany and the a few northern European countries seem to do OK. Why is that?” Perhaps because their governments put healthcare and education ahead of prisons and prosecuting drug crimes and hold corporations to higher ethical standards than the U.S.

We are now competing with countries with much lower wages–at all levels.

We have to get used to it.

THe era of US hegemony is over.

“Perhaps because their governments put healthcare and education ahead of prisons and prosecuting drug crimes and hold corporations to higher ethical standards than the U.S.”

Here is a good explanation relative to the current German and US economy.

http://www.becker-posner-blog.com/

I agree completely with the last paragraph; which does not list any of the reasons mentioned by biddlin. It is also mentioned that the US had a larger piece of the global financial services industry which took the biggest hit. That makes some sense. Lastly, it seems Germany has always run with a slightly higher unemployment rate than the US, so our fall has been a bit steeper.

@Jeff: from that last paragraph: “I continue to believe that the biggest factor in the sluggish employment recovery of the US is that many of the actual new and proposed anti-business legislation”

a very “pro-business” environment would have no protections for workers, resulting in low wages, unhealthy and unsafe working environments, such as the sweatshops in third world and developing countries. is that what you want here?

“a very “pro-business” environment would have no protections for workers, resulting in low wages, unhealthy and unsafe working environments, such as the sweatshops in third world and developing countries. is that what you want here?”

There’s a happy middle ground where you have workers protection without the job killing over-regulation like we have now. Double-dip coming to an economy near you, thank the current administration.

rusty69: “There’s a happy middle ground where you have workers protection without the job killing over-regulation like we have now. Double-dip coming to an economy near you, thank the current administration.”

Thank you. Exactly. It is not a debate of zero regulation verses complete government control. There is an optimum equilibrium. The article points out, I think, that socialist Germany has a more pro-business form of governance than the US.

davistownie: You are making the point of extremes. Note that in a robust economy, workers have choices, consumers have choices, and companies can be taken down by their poor management practices. I suspect that your mindset is that business owners, without government oversight, will act without adequate morals or ethics; and that the pursuit of profit is a corruptive pursuit. My view is that the pursuit of power is a more corruptive pursuit, therefore I am more apt to trust a typical business owner than I am a typical politician. You can say that we have choice in our representative form of government, but then why is Charlie Rangel still in office and will likely be re-elected by his state? The fact is that political power is acquired and protected by means that the average citizen is less and less powerless to affect. Business on the other hand, especially those traded publically, can be dealt with swiftly and definitively for their misdeeds. Case in point… if the government ran all offshore oil production and was responsible for the Deep Horizon Gulf spill, do you think the CEO would have been fired by now?

is less and less powerless to affect.

Should have written:

“less and less able to affect.”

Rusty Limbough: “killing over-regulation like we have now.”

we are far from over-regulated. the middle ground that is best for all of us is going to require more worker safeguards and a far more labor friendly business environment.

Germany is a capitalist country, Jeff, they just have more social awareness than the US does.

“I suspect that your mindset is that business owners, without government oversight, will act without adequate morals or ethics; and that the pursuit of profit is a corruptive pursuit.”- enough will and have been that our real wages have been declining for may years.

Davistownie Olbermann: “enough will and have been that our real wages have been declining for may years.”

Our real wages have been declining for years because businesses are moving to countries with cheaper labor and less regulation. How is American unionization and more regulation going to fix that? Please explain Mr. Olbermann. In case you didn’t see it, unemployment were numbers higher this week than expected causing stock market to drop again. A trillion dollars of misguided stimulus and what do we have, more people out of work than ever. We now have an economy reliant on paying out unemployment benefits for years on years. This best stimulus plan is less taxes and regulation on business. It’s always worked in the past, but we now have a rookie in charge with ignorant consultants that are trying to spend our way out of this through bigger government and obviously it’s not working. It’s pretty sorry when the best the Democrats can say is “it could be worse”.

“This best stimulus plan is less taxes and regulation on business.”

Ok, since this is an ongoing theme here. Which regulations do you want to do away with?

so rusty, I gather that you’d rather see us become a third world country, with rampant crime, pollution and human rights abuses so that business would seek out our cheap labor?

How about creating trade boundaries (end NAFTA) as a start. tax the bejejus out of imports from countries that don’t treat their workers and our world respectfully. create incentives for smaller businesses that only use domestic products and labor. there are many ways to keep those businesses here that don’t sacrifice our working class.

the best stimulus plan is not less regulation and taxes on buisness, it’s enabling the consumer; we wont do that by decreasing his paycheck when we add a host of low paying jobs as you seem to advocate. Unemployment numbers do not tell the whole story, we need good paying jobs that come with security so our consumers will spend money, not a workforce of near slave labor.

First of all rusty, the rise and fall of the stock market and the reported unemployment numbers have no direct correlation. We see the market go down with the excuse of inflationary worries when unemployment numbers drop. Stock prices reflect investors valuation of a stock and their demand for liquidity. We have some agreement on the stimulus money. We gave too much of it back to the same people that ripped us off in the first place. Had President Obama given it to my wife, the economy would be booming, at least for retailers. If you want a great example of the results of deregulation, look at the banking industry. As George Bailey said in “It’s a Wonderful Life”:”Just remember this, Mr. Potter. This rabble you keep talking about does most of the working, paying and dying in this community. Is it too much to have them work and pay and die in two rooms and a bath?”

rusty49: “A trillion dollars of misguided stimulus and what do we have, more people out of work than ever. We now have an economy reliant on paying out unemployment benefits for years on years. This best stimulus plan is less taxes and regulation on business.”

I generally agree with you, but some gov’t regulation of the banking industry and investment industry (Wall St) is certainly in order – altho not what has come out of the Obama administration so far (shell regulations to kick the can down the road towards implementing regulation that gets at the real underlying problems/failing to implement regulation that gets at the real underlying problems).

davistownie: “Unemployment numbers do not tell the whole story…”

The unemployment rate hugely undercounts the number of unemployed. As I understand it, it fails for instance to count those out of work for more than a year, those fresh out of college who cannot find work, those who are no longer are eligible to collect unemployment, etc.

biddlin: “We have some agreement on the stimulus money. We gave too much of it back to the same people that ripped us off in the first place.”

Amen.

In the garment industry, according to a documentary I watched, in the year 1990, only 10% of garments sold in the U.S. were made outside this country. By the year 2008, the numbers completely reversed, and now 90% of the clothes we purchase are made outside the U.S. That is a huge number of jobs that have been lost to overseas countries, who exploit workers in sweatshops and use child labor. Worse, what we import from countries like China are of such poor quality, we would not allow our own businesses in this country to produce such inferior goods. Something is very wrong with how we are treating our own American businesses.

“Don: Which regulations do you want to do away with?”

This is not a winnable argument, as all regulations can be defended with an alarmist’s extreme (as in “So you don’t mind that businesses dump toxic chemicals in your drinking water?”). By the way, have you tried to dispose of your florescent light bulbs lately, or purchased a PC lately where they tacked on another $26 to dispose of your monitor even though you just purchased a brand new laptop?

We are competing for markets, industries and jobs state to state and country to country. If the business regulatory footprint is not an issue, then why are companies exiting California at a record rate?

Labor availability and cost are the primary driver for US and multi-national companies to locate overseas; however, no country on the globe has as many pages of tax code, and many industries require even the smallest of businesses to hire attorneys to help them navigate industry regs, and professional HR people to navigate the copious employment and labor laws and regs.

The US has become increasingly difficult to start and grow business at the same time much of the world has ramped up their game to romance business away. California seems to be run by smug elites that assume we can continue to leverage our sunshine and beautiful landscapes as justification to abuse private business because we believe they are lucky to be allowed to reside here.

First, we need to understand that private businesses are the heart of the public funding pump. We need to attract them and tend to them, not chase them away. At the national and state level, we need to lower the tax and regulatory burden while we invest in bringing back manufacturing through low interest loans and other incentives. Meanwhile, we need to significantly ramp up education outcomes including a new emphasis on trade and trade schools.

With respect to manufacturing, I think some of what is occurring is a natural leveling of global wages. Americans were the first out of the gate and after WW-II we had massive public debt but very little consumer debt. We started consuming like mad, and this caused a steady inflation of all things including wages. Now we have massive public debt, massive private debt, and too high wages. Either we deflate and correct quickly, or ride out the storm of wage leveling. The government is propping up the economy to prevent the big deflation, but it is not enough to return us to gravvy days. So, we are stagnant and waiting.

However, there are things we should be doing while we are “waiting”; namely reducing regulations and lowering taxes. But, the government is doing the exact opposite. They are layering on debt to care for people damaged by the wage-leveling stagnation, and spending more to prop up the old high-wage era structures instead of investing in the future.

To Jeff Boone: Well said!

Jeff: “”Don: Which regulations do you want to do away with?”

This is not a winnable argument, as all regulations can be defended with an alarmist’s extreme (as in “So you don’t mind that businesses dump toxic chemicals in your drinking water?”). By the way, have you tried to dispose of your florescent light bulbs lately, or purchased a PC lately where they tacked on another $26 to dispose of your monitor even though you just purchased a brand new laptop?”

I am not an extremist. I suspect there are regulations that are poorly written, counterproductive, or byzantine. It’s just that “over-regulation” is a conservative mantra, and yet I am never given a clear example of any particular regulations that are truly onerous or having an adverse impact on the business climate.

For example, the fee you pay for your monitor is part of the Electronic Waste Recycling Act; retailers keep 3% of that fee, and the rest pays for recycling hazardous electronic wastes. You are aware that your computer monitor can’t go to the dump, and requires special handling? (There have been some interesting exposés of the mismanagement of that whole industry, where our e-waste is going to horribly polluting sites in developing countries).

How would you prefer to handle e-waste costs?

You really have three choices:

increase the cost of the product and let industry deal with it;

charge a fee that is specific to the problem;

pay for it out of general tax revenues.

Or, I suppose, pretend there isn’t a problem and just continue dumping them at landfills. Does recognizing the problem and supporting a process for dealing with it make me an alarmist? It is just this sort of thing that government does, because private industry has absolutely no incentive to set up a waste-disposal system. I do think that we can sometimes use incentives rather than regulations. But most often, it is legislation and regulation that leads to consumer safety or a cleaner environment.

So you’ve given me an example of a regulation/tax/fee that is a targeted approach to a specific problem, just like the regulations my industry contends with and the fees that we pay.

Don: Like I said, it is not a winnable argument on a regulation-to-regulations comparison because there is an environmentalist heart tug for many of these most onerous regulations. They sound reasonable, and standing alone they may certainly be reasonable, but the aggregate impact is suffocating enterprise. Just think of the guy that wants to start a nursery and might hire five people. As some point the cost of his startup stops penciling out because of the sixth hire he must make just to handle the administrative burdens from the copious laws and regulations he must comply with. So, there goes five jobs that might otherwise materialize. Now, you might like that because the bar is set higher to minimize your competition; but the net impact is fewer business startups and fewer jobs.

BTW: I didn’t mean to call you an extremist, I just meant the arguments in defense of most environmental regs use the extreme scenario. For example: “If we don’t control the disposal of florescent bulbs, we will cause mercury poisoning.” Interesting with that one… it is the fear of man-caused global warming causing the regulatory changes eliminating incandescent bulbs… which means more florescent bulbs will be purchased and discarded. A similar “jobs” issue exists with the monitor charge. $26 might not seem a big deal to you, but it causes the new PC purchase to no longer pencil out for some low income families. They purchase fewer computers, and so computer manufacturers, retailers, repair shops, software developers… on and on… require fewer employees. Ever looked a business phone bill, or a utility bill? How much of that additional taxation is making it impossible for a small business to hire that next person… especially one that does a lot of phone work or uses a lot of energy?

My point is that now is the time to start chopping and cutting taxes and regulations to lower the bar for new business startups and business expansion.

[quote]My point is that now is the time to start chopping and cutting taxes and regulations to lower the bar for new business startups and business expansion. [/quote]

it is real hard to have an intelligent discussion about “chopping and cutting taxes and regulations” until you can give examples of where to start, and then justify the cut. Your computer monitor example only works if as Don pointed out you are content to “pretend there isn’t a problem and just continue dumping them at landfills.” Is that your solution?

” you are content to “pretend there isn’t a problem and just continue dumping them at landfills.”

davistownie: thanks for proving my point that it is pointless to debate regulation-by-regulation because someone can always use emotive arguments like “so you are willing to just continue dumping them in landfills”. Personal computers have been around longer than this additional tax, so how do you explain the evolution of regulatory need? Regardless, it is not the specific regulation that should be debated, but the millions of pages of regulation that exists and continues to grow.

For me, the debate of regulation is interesting and, I believe, points out our ideological and social differences. I think those that support stronger regulation believe that free people are largely incapable of doing the right thing, so we need a central authority to ensure control and to legislate fairness. While I am no advocate of zero regulation and zero government, my view is that the tendency to seek and/or allow more central control is the genesis of the type of tyranny we revolted against to form our fabulous republic. I incorporate community and morality into this argument too… a growing secular society has fewer common cultural bonds of community, and a weaker cultural basis of morality… and therefore must resort to secular governance to make up the difference. Church creates a bond of community through congregation. Religion teaches things that help more people down lower on the hierarchy of needs to do the right thing. If it is known to be wrong – for instance: dumping oil and pesticides down the drain, and throwing old monitors into the trash bin – then it is immoral to do these things. People bound to their community through congregation might also think of themselves as part of the whole that would be damaged by their actions. They would be more apt to do the right thing of their own free will… and doing things of our own free will was a primary driver that caused this great country to be formed.

Ironically, progressives demand weakening of criminal law enforcement and punishment while simultaneously demanding stronger regulations and laws to constrain business. The end game for this: less safe streets and neighborhoods, fewer businesses, fewer jobs, less individual freedom… and expectations of an open-border, secular-diverse secular people without need, living in a pristine environment.

Frankly, as it relates to their desire for stronger regulations, I think many progressives cannot see the environmental forest for the trees.

What if you could see into the future? What if you could know just how the GM Pension Buyout Plan options would play out for you and your family? If you’ve read the free white paper at http://gmpensionbuyout.info/, you’ve seen scenario examples. You may not fit those demographics, however, leaving your future views cloudy. This is why GM retirees have been encouraged to seek the professional advice of experienced financial planners. The July 20 decision deadline is almost here – don’t guess about your future; let a professional help you make a decision you can be confident about.