The school district commissioned a poll to determine interest in a parcel tax for employee compensation. The district will use the results of the $27,000 poll to determine whether they should go forward with an additional parcel tax.

The district is aiming for a November 2018 vote, and surveyed likely November voters from February 5 to 11, with a 4.9 percent margin of error.

The primary purpose of this voter opinion research was “to identify the level of support for a potential $198 parcel tax measure for the November 2018 ballot to support District programs and personnel.”

The key findings: “Although most indicate that maintaining the quality of schools and increasing teacher salaries are worth raising taxes for, fewer than two-thirds see a need for additional funding for local schools.”

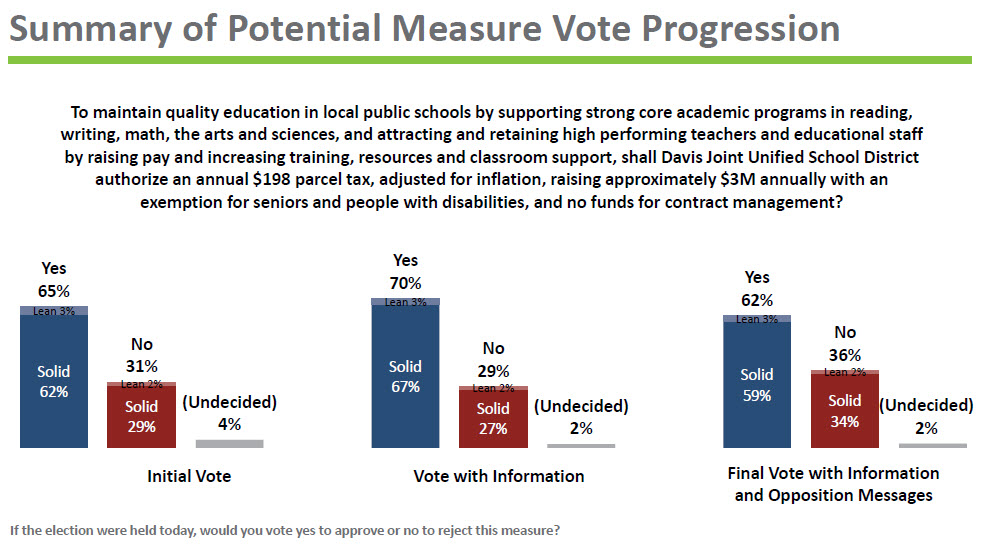

Indeed, the survey found, “Initial support for a parcel tax measure is just shy of the two-thirds threshold in this poll.” However, “Once voters have heard how additional revenue will benefit local schools and students, total support increases.”

However, the pollsters warn, “a measure could be vulnerable to opposition.”

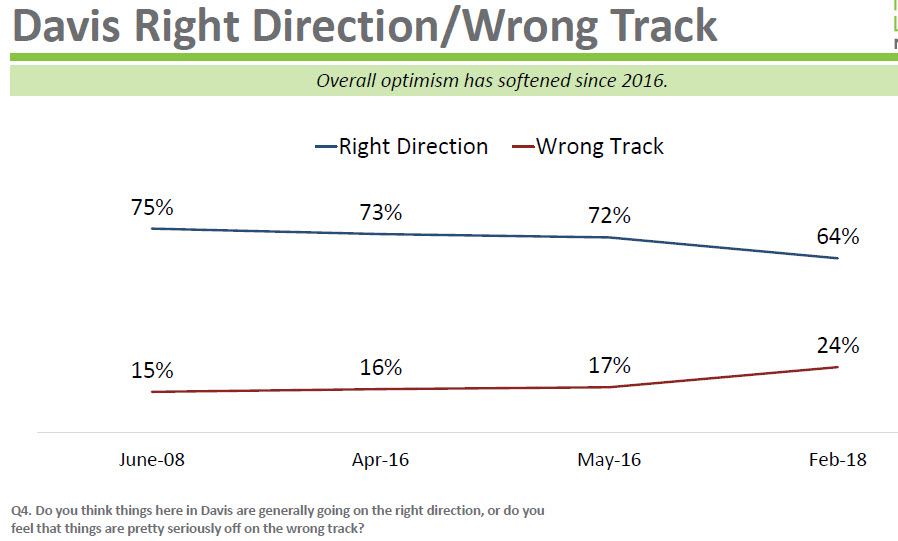

Polling shows that optimism has declined over the last ten years, and strongly since May 2016, going from 72 percent to 64 percent.

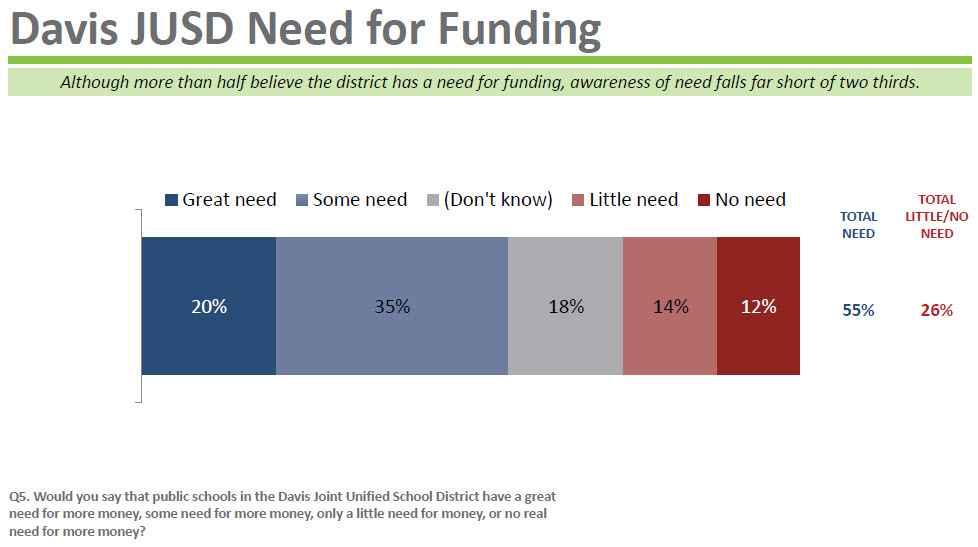

Awareness of the need for funding is only at around 55 percent. That represents a drop from 71 percent in June of 2008. But there was only a one percent drop from April 2016 prior to the passage of the last parcel tax.

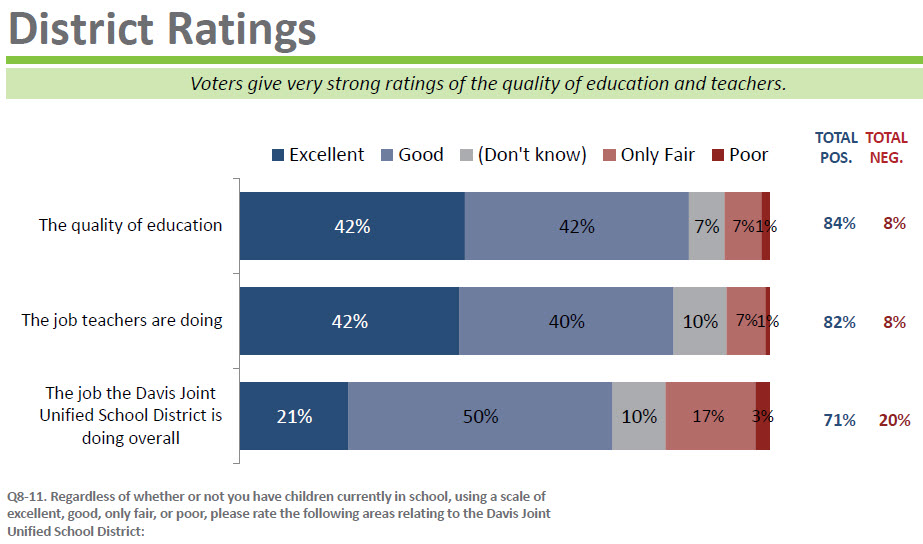

Voters continue to give strong ratings for both the quality of education and the quality of teachers in this school district. The overall job satisfaction has dropped from 80 percent to 71 percent in under two years, but the view of the quality of education has remained steady.

Most voters agree that high quality schools and increasing pay for teachers are priorities. That remains the case, even if it means that the district needs to raise taxes. However, a lesser majority (64 percent) trusts the district to properly manage tax dollars.

Moreover, the voters continue to prioritize maintaining the quality of schools, with a strong 81 percent agreeing that maintaining the quality of the schools should be a top priority even if it means raising taxes. That has largely held steady since April 2016 (when it was 83 percent).

The portion that has fallen somewhat dramatically is the trust in DJUSD to manage tax dollars, which has fallen from 73 percent to 64 percent in just two years.

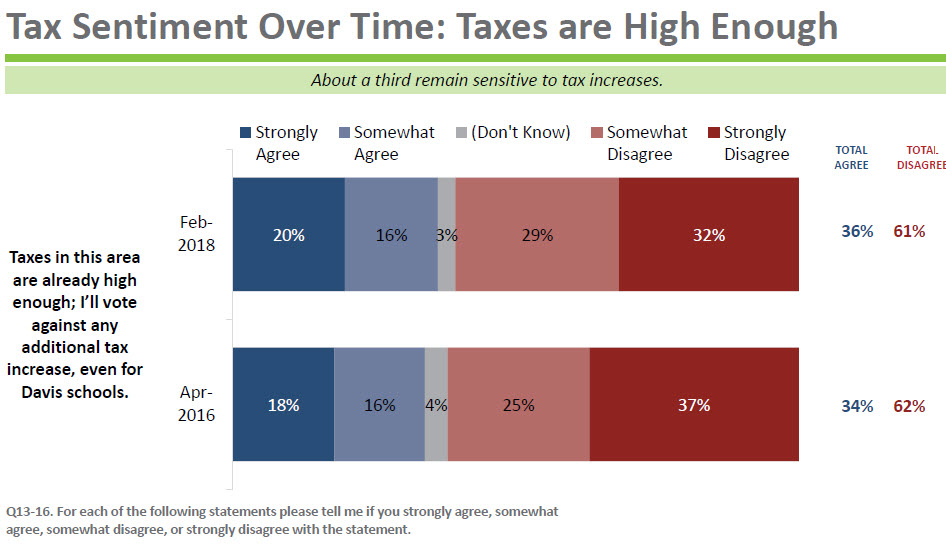

The polling shows the view that “taxes in this area are already high enough” and “I’ll vote against any additional tax increase, even for Davis schools,” is around 36 percent. That is up very slightly, but perhaps significantly from 34 percent in April 2016.

That puts not only the DJUSD Parcel Tax on the bubble but also the potential city parcel taxes as well.

Support for the parcel tax is right below the bubble. They find initially around 62 percent support with another 3 percent lean. With information, that number increases to 67 percent with 70 percent total with leans.

Once they introduce information and the opposition messages, that number drops to 59 percent with another 3 percent lean.

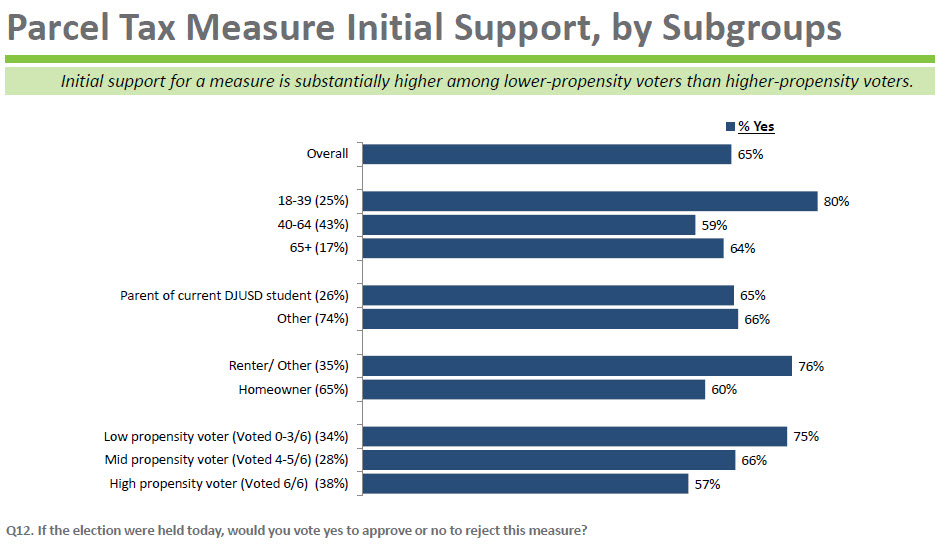

The breakdown is interesting.

In terms of age, the most likely to support the tax are young people under 39. The 40 to 64 range is least likely to support the parcel tax. And those over 65 are at 64 percent support – perhaps due to the senior exemption.

Parents of current students are no more likely to support the parcel tax than anyone else.

Renters are much more likely to support the parcel tax than homeowners – although homeowner support is still at 60 percent.

Finally, the bad news is that the more likely people are to vote, the less likely they are to support the measure.

The top messages for support are:

- All of the revenue from this measure will be spent here in our local schools and cannot be taken away by the state.

- This measure will help attract teachers in positions that are difficult to fill, such as those teaching vocational job skills, special education, bilingual education, and math and science.

- Great teachers are at the center of student achievement. This measure will make sure our schools have the financial resources needed to attract, support, and retain the highest quality teachers.

The pollsters conclude the following.

First, “While poll results indicate that reaching the two-thirds threshold may be challenging, in the right environment, a parcel tax measure on the November 2018 ballot could be successful.”

Second, “Voters are divided about whether the District needs additional funding, and a measure could be vulnerable to vocal opposition.”

Finally, “Ensuring that voters understand how additional revenue would benefit education outcomes for local students would be essential to success.”

The one advantage that the district has in this race is that the teachers’ association has a vested interest to provide the necessary labor and ground forces that could push a close measure over the top.

—David M. Greenwald reporting

The article notes the “confidence rate” of the polling, but am curious about the # of those polled…

Also curious as to company that did the polling…

Also, I believe that if DJUSD puts this measure on the ballot for November (way earlier to act on the intent to do so than they need to), greatly increases the odds that the City measure(s) will fail… just don’t see both City and DJUSD parcel tax measures passing within 5 months of each other… both may fail… perhaps part of DJUSD “calculus” is based on the same assumption… “first strike”, as it were… I may be wrong…

A tad ironic… City measure(s) has to convince voters that there will be little/no increases in City employee compensation as a result… DJUSD measure is designed to boost teacher compensation (and probably non-certificated staff due to reported “me too” clauses… and I have little doubt top DJUSD administration folk will get “their cut”, too)…

This will definitely be interesting…

“perhaps due to the senior exemption.”

I would like to see numbers on how many seniors actually take the “senior exemption”. We qualify but do not take the exemption as is true for most seniors I know who highly value education and believe we need to pay for what we value.

I don’t have a very recent list, my last request from 2011 showed just under 1000.

How many teacher salaries would that pay?

Would what pay?

The “exempted” assessments would be my guess as to Don’s question… ~1000 X ~$200/ year appears to be $200,000… given all compensation (salary, med/dental, pension), am guessing 3.2… but…

The issue is not new/existing teachers… it is apparently the increment of increased compensation for those currently here… or those who fill in due to retirements, ‘moving on’, etc.

But still, the $ will go to many others (non-credentialed, Admin, particularly top Admin) than teachers… that has been made clear…

This will be interesting…

Oh… and those who choose/have chosen the “Senior Exemption” also have far more less to pay in current DJUSD levies! But may well have voted for those as well!

The senior exemption is a lot like a mail in rebate, lots of people buy the motor oil or dry skin lotion with the $5 rebate but few actually put the receipt, UPC symbols and form in the mail to get the $5. I know many seniors in Davis that have told me they know they could be exempt from the tax but have not “got around to filling out the forms”. Like anything where you need to “opt out” vs. “opt in” the numbers of seniors paying the tax would be VERY different if we exempted ALL seniors and made the ones that wanted to support the schools fill out forms to “opt in” and pay the parcel tax.

Your point is well made, Ken… yet “seniors” get to opt all of us in, when they vote on these measures… representation without taxation…

Senior exemptions for tax measures subject to votes that seniors participate in, is ….

Thanks David. Can we get an update ?

Looks like the current number is 1523

Another proof of “all questions are equal, but some are more equal than others’… but your venue, your call…

Also, based on a previous ‘fact” you shared, my 9:26 post just went up by a third (33 or more)…

I don’t know what you’re first sentence means.

The number I previously shared was seven years old. To put it into perspective, that was only three years after the parcel tax went up from $100 a year. Now it’s over $600 a year.

It was 1307 in 2015-2016, fwiw

How does that compare to the total number of parcels? It is not the same as the number of parcels in the City as the School District’s boundaries are different. What percentage of the District’s taxpayers are claiming the exemption?

Ballpark calculation looks like roughly 17,000. That’s taking 9.6 million in gross revenue, dividing by 620 and adding the 1523 opt-outs.

1500/17000 = roughly 9%

Not chicken feed

%-ages of “seniors” taking the exemption?

Still question the concept of representation without taxation… but that is another topic… yeah, I could support and vote for a $5,000 parcel tax, if I knew I could exempt myself from it…

Old joke… which ends, “… he no play the game, he no make the rules”

All questions are equal, but some are more equal than others…

Walking and cycling modal share is our schools is great. But since most schools don’t have geographic catchment distances to school are excessive for many, especially for younger kids, even with excellent cycling infrastructure for the entire distance (not possible yet). This means a lot of car traffic. We see this all the time – it’s going to be at its peak this year in the next couple of days due to rain, which – as we know – melts children.

We need a school bus program. We need to pay for a school bus program. We can join an existing one – like Woodland’s – and save $$$ on upper-level management. The City of Davis and UCDavis are going after funding for electric buses for Unitrans, whereas DJUSD has no buses, and a high school parking lot full of student cars (and it’s not because students can’t ride pennyfarthings to school!). Students drive to sports tournaments in the region, and drive themselves and their fellow team members home after meets. It’s crazy!

Whatever this costs, we need to pay for it.

DJUSD used to have a bus system but that was one of the first things cut when there was budgeting cutting shortly after Prop. 13 passed.

Ah, yes… I know. Barbara Archer told me about that.

I’d love to know how much people are spending individually on fuel and upkeep for cars, and how’d we value the time of the parents and guardians involved. Schools already spent a bunch of time on getting all the drivers to sign all sorts of legal documents to e.g. minimize liability to the District.

It’s well known that the School Drop Off is a perfect circle of mobility clusterf*ck: Parents drive *because they don’t their kids to be hit by cars. These cars are driven by parents who drive (return to*).

If anyone wants to help change this, write me at todd(at)deepstreets.org.

OK… 1523 exemptions… $600+ in existing DJUSD parcel taxes… just less than $200 proposed…

600 + 200 = 800…. 800 X 1523 = $1,218,400… anyone should feel free to check my facts/math… as someone else posted, “that’s not chicken feed”…

https://www.djusd.net/parceltax

Note that it (exemption) is only aged based… fully separate from income and/or assets…

If there is not a change in the exemption criteria, focussed more on income than age (or the exemption eliminated entirely) we’ll tend to vote NO for new (or renewal) DJUSD parcel taxes, or take the exemption when we turn 65… less than 2 years from now…

The DJUSD board should think more than twice about continuing the exemption AND adding to the total assessments…

17,000*0= 0 if my calculations are correct.

Huh? zero “cost” for the exemption?

Just don’t understand your equation… please explain the 17,000 and the multiplier…

My equation refers to the fact that if you end the exemption, and the parcel tax fails because of it, you get nothing. And if you look at the poll, that is a distinct possibility.

Why not more exemptions to get it passed? DJUSD employees? Others?

You could get their votes, because it will be no skin off their noses… hell, could probably up the new assessment to $500+ /year, if you pick the right exemptions…

So much for the “equity” concept… but you are being “transparent”… whatever it takes to support teachers, administrators, other staff, because, after all, it is “for the kids”…

Age based, not means based exemptions… I think that is bad public policy, but can see that it’s a good “politics” move…

Got it…

Right now more exemptions aren’t allowable.

Two thirds threshold is a high bar, even in a place like Davis. If they lower the threshold to 50 or 55 percent, I’d be in favor of eliminating the exemption.

As I understand it, if it (proposal) came from the citizens, “the bar” could be @ 50% + 1…

You and others could start that…

I also agree “the bar” is too high… a perversion of Paul Gann, frankly…

Personally, believe it should be 60%… the margin needed to pass local ordinances @ CC level… seems to be more stringent than the 50%+1 (which I also could live with) but more reasonable…

I never take surveys. But the person on the phone said it was important to Davis issues and would take ten minutes. So I did.

Then they got to the question, “What is your impression of the quality of Davis Public Schools, whether or not you have a child in school”. I said I had no child in school, didn’t follow school issues and had no idea. They said that wasn’t an answer. I said, “I literally have no idea”. That didn’t work in their world, so the survey ended.

How much confidence you got in those numbers now?

Worse, each of the next two days, I got a call from TWO DIFFERENT survey companies, with the same survey. I asked, “is one of the questions about my impression of the quality of Davis schools?”. ‘Yes’

They each seemed surprised that another survey company had already called.

How much confidence you got in those numbers now?

And they called on my — almost cob-web filled — land line.

How much confidence you got in those numbers now?

Glad you shared… thank you… there are valid reasons to be skeptical of information we are fed, particularly by DJUSD…

I don’t agree. The polling results are believable and in line with previous results which were in line with actual electoral results. The polling here shows a proposal that would be on the bubble – I believe that’s largely accurate.

Yet, the pollster(s) identities have not been disclosed… # of those surveyed has not been disclosed… Alan’s comment about multiple pollsters has not been addressed…

Guess on certain matters, transparency and/or facts do not matter… but it’s “largely accurate”… we’ll take your word for that… I guess… for those of us who studied science, there is “lab work” and “dry lab work” (where you’re convinced what the ‘answer’ should be, and create data to support that)… not sure which is in play, here… just follow your bent… I’ll follow mine…

You’re mistaking what I reported, for what was disclosed. The group was EMC Research, same as previous surveys. 400 interviews.

Not to mention, the poll is heavily weighted towards those who will say yes to taking 10-15 minutes out of their lives, not to mentioned weighted towards those who answer land lines.

Almost all polls use land lines and mobile now a days. There is nothing here to indicate otherwise. I know we’ve been previously contacted by this group on our mobile phones.

Good point, Alan…

As to “land lines”, as to our extended household, only two of five use ’em, and for screening purposes the two of us who do, don’t tend to answer land-line calls if we do not recognize the number calling…

Curiouser and curiouser…

re:

Well, it is a parcel tax…