by Alan Pryor

Measure H is a 20-year parcel tax for Parks Maintenance at $49 per year per residential parcel (or per apartment for multifamily dwellings) increasing at 2% per annum.

The signers of the Argument Against the Measure and the Rebuttal to the Argument For the Measure are all the same, as follow;

Michael Nolan, Acting President of Yolo County Taxpayers Association,

John Munn, Former Member of the Board of Education of the Davis Joint Unified School District,

Don Price, Emeritus Professor of History, University of California Davis,

Pam Nieberg, Former Co-Chair, Yes on Measure O (City of Davis Open Space Ordinance)

These signers are a disparate group of individuals representing fiscal conservatives and social progressives in Davis.

In their Arguments Against Measure H and their Rebuttal to the Argument in Favor of Measure H, these signers made some serious claims and allegations against the City  as a fiscally responsible agent and the trustworthiness of the statements made by the Measure’s proponents in fairly assessing the Measures’ impacts and honestly reporting them to the electorate.

as a fiscally responsible agent and the trustworthiness of the statements made by the Measure’s proponents in fairly assessing the Measures’ impacts and honestly reporting them to the electorate.

This article investigates these claims and attempts to quantitatively verify their accuracy. In doing so, some independent investigations and fact-checking were done and some of the information was obtained in response to direct inquiries to the campaign.

Following is the Argument Against the Measure and the Rebuttal to the Argument in Favor of the Measure. Immediately after each one of the claims in the Argument Against or Rebuttal, a bold blue statement is highlighted in parentheses stating the authors opinion if the claim is CORRECT/TRUE or INCORRECT/FALSE and a numerical reference to the appendices to this paper which has the independent data supporting or negating the claim.

Argument Against Measure H – Parks Tax

Davis does not have a revenue problem in maintaining our beloved Parks. Davis has an employee spending problem! For far too long Davis voters have approved tax increases, ostensibly for maintaining critical City functions, only to see the new revenues instead go to increased employee compensation.

- In 2004, the voters approved a half cent sales tax increase after being told it was necessary to keep from laying off police and firefighters. Yet the very next year, all of that money and more was used to give employees the biggest pay increases in City history. Firefighters received a 36% increase over 4 years and our average firefighter total compensation is now over $206,000 annually! (CORRECT/TRUE – See Fact Check Item 1)

- In 2012, voters approved a $49 parcel tax for Parks and then another half cent sales tax increase in 2016. Where did all that money go? Well, from 2012 to 2016 the average total salary and benefits for all full-time City employees increased over 25% from $99,849 to $124,954 (Source: TransparentCalifornia.org). (CORRECT/TRUE- See Fact Check Item 2) Current average municipal employee salaries are now more than twice that of the private sector in Davis.

But the City government has done virtually nothing to control employee compensation which now totals almost $38 million annually for just over 300 employees. (CORRECT/TRUE – See Fact Check Item 2) The Finance and Budget Commission, our watchdog citizen commission, recommended over 2 years ago that before any new tax measures are put on the ballot the City should,

“Work to accelerate the completion of a full staffing analysis to determine match between service delivery needs and staffing….This should save $1 million per year in employee costs”. (CORRECT/TRUE – See Fact Check Item 3)

Yet this simple study was never even done! We clearly cannot trust our City government to otherwise spend our hard-earned money wisely for the 20-year duration of this tax.

Please vote “No” on Measure H.

Rebuttal to Argument in Favor of Measure H – Parks Tax

Our City is claiming that our financial problems are all because the State is not giving them as much money as before. They state,“At the beginning of the last decade, the state returned about 27% of local property taxes to our city. Today, approximately 18% is returned. The State annually has shifted a total of over $3 million in property tax from the City”.

Funny thing…this is the exact same language used the City’s ballot argument for the Parks Tax Measure when it was last renewed 6 years ago in 2012.(CORRECT/TRUE – See Fact Check Item 4) Some things never change!

Only now the City is also claiming it is continuing “efforts to prudently manage city costs”. Not true! For example, the average total annual compensation of our Park Maintenance II workers has risen from $66,412 in 2012 to $83,745 in 2016 – a 26% increase. (CORRECT/TRUE – See Fact Check Item 5) So much for prudently managing costs!

Additionally, our last Parks Tax Measure renewal was for 6 years. But the City is now asking us to approve a 20-year renewal…and with no built-in accountability. Every bit of this Parks Tax Measure and other Parks budget money can be legally diverted for other uses in the City and the citizens footing the bill have no legal recourse.(CORRECT/TRUE – See Fact Check Item 6) Do you trust our government to spend your tax money wisely for the next 20-years?

We all have household budgets that we are forced to live within. Our City government must learn to do the same.

Please vote “No” on Measure H.

Fact Check Item 1

Claim -”In 2004, the voters approved a half cent sales tax increase after being told it was necessary to keep from laying off police and firefighters. Yet the very next year, all of that money and more was used to give employees the biggest pay increases in City history. Firefighters received a 36% increase over 4 years and our average firefighter total compensation is now over $206,000 annually!”

Judged to be CORRECT/TRUE

Basis for Claim – On March 4, 2018, the Davis Vanguard published an article entitled “Yes Politicians Can Be Bought in Davis” (see https://www.davisvanguard.org/2018/03/sunday-commentary-yes-politicians-can-bought-davis/). In discussing the somewhat sordid history of bundled firefighter political contributions to Don Saylor, Stephen Souza, and Ruth Asmundson, the article reported,

“The next year, the council – just a year after voters supported a half-cent sales tax – used that money to deliver the biggest pay increases in city history. Truth be told, everyone in the city received at least a 15 percent increase over a three- to four-year-period. But the firefighters cleaned up. From 2005 to 2009 they received a 36 percent pay increase.”

On July 10, 2017, the Finance and Budget Commission considered Agenda Item 7A – Budget Presentation – Fire Department (see http://cityofdavis.org/city-hall/city-council/commissions-and-committees/finance-and-budget-commission/agendas-and-minutes) in which it was reported that the FY 17-18 Fire Department total payroll (salary and benefits) for 43.4 FTE positions was $8,888,373. This equals $204,801 per firefighter – or very slightly less than the $206,000 actually claimed

Fact Check Item 2

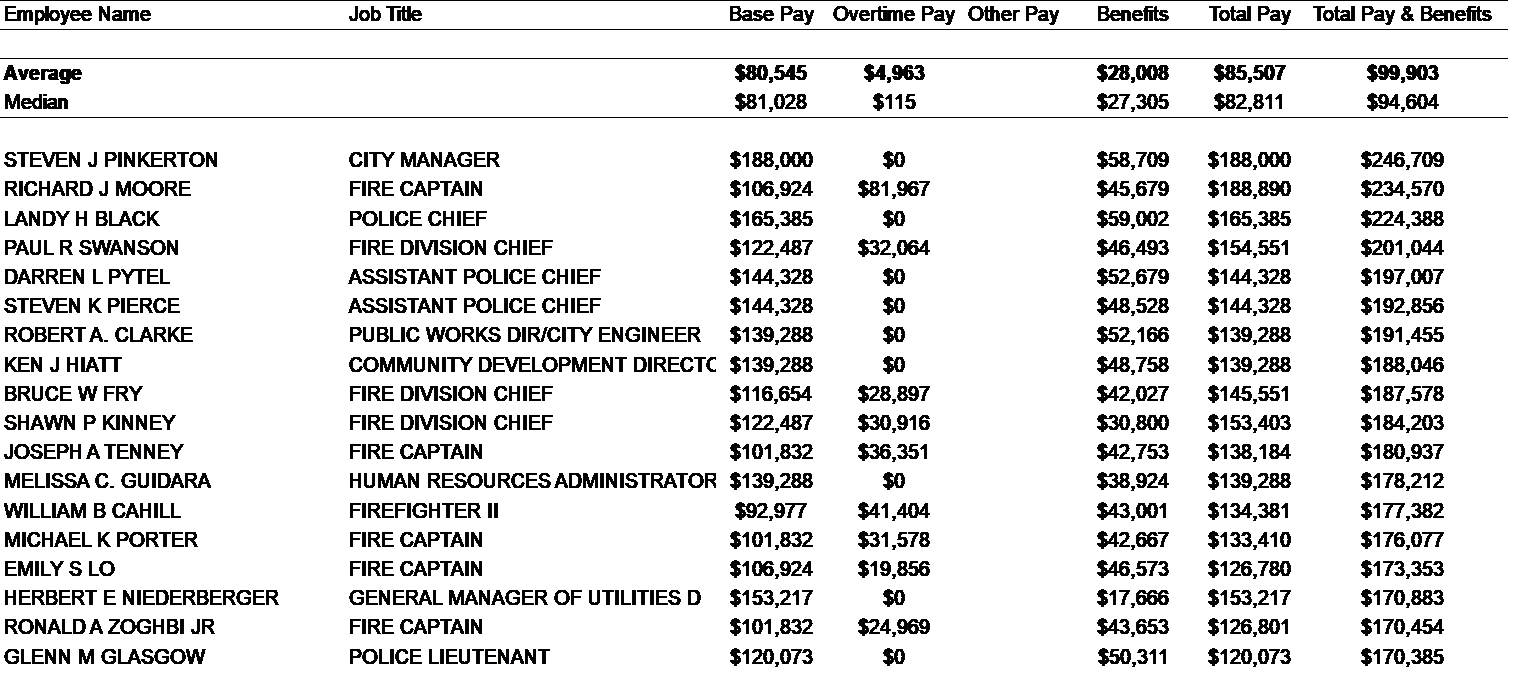

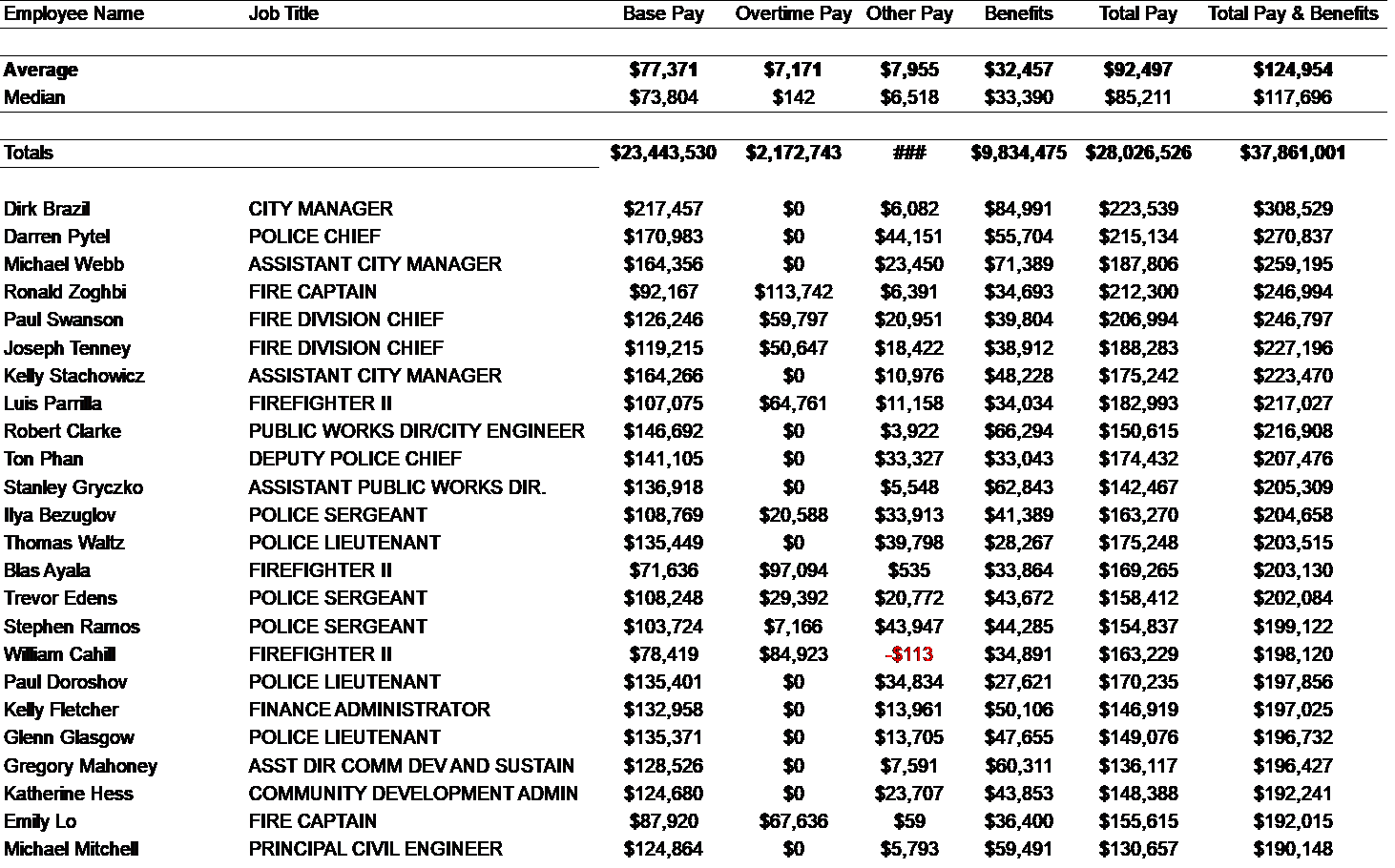

Claim -”Well, from 2012 to 2016 the average total salary and benefits for all full-time City employees increased over 25% from $99,849 to $124,954 “

Judged to be CORRECT/TRUE

Basis for Claim – The website www.transparentgovernment.org provides salary and pension benefits by name for all municipal employees in California. In 2012, the listings for full-time employees provides to following information (Note: For brevity, only the highest ranking employees are listed along with the summary information):

In 2016, the listings for full-time employees provides to following information

Fact Check Item 3

Claim –The Finance and Budget Commission, our watchdog citizen commission, recommended over 2 years ago that before any new tax measures are put on the ballot the City should,

“Work to accelerate the completion of a full staffing analysis to determine match between service delivery needs and staffing….This should save $1 million per year in employee costs”

Judged to be CORRECT/TRUE

Basis for Claim –

The need for cost-containment by controlling City employment costs through increased efficiency was first proposed by Mayor Robb Davis as part of a an 8-point plan on cost containment presented to the Council on February 2, 2016.

“Cost Containment as an Element of Fiscal Resilience

- Undertake a full staffing analysis to determine match between service delivery needs and staffing.”.

When discussing the elements of the Cost Containment Plan with the Council, At that time Mr. Davis commented that ,”Whatever we do we need to send a clear signal to the Community that were adding cost containment to our discussion about fiscal resilience”.

This can be viewed at 4 hr:16 min:of the City Council meeting which is accessible through streaming video which can be viewed at http://davis.granicus.com/MediaPlayer.php?view_id=2&clip_id=428

The language in the ballot argument above was in a background position report to the Finance and Budget Commission by a Commission subcommittee. The actual language forwarded to the Council on February 13, 2017 by the Commission was actually even more comprehensive and recommended that the Council adopt the following 4 objectives as part of the formal Council goals with the objective of completing them all by the end of 2017 (see http://documents.cityofdavis.org/Media/Default/Documents/PDF/CityCouncil/Finance-And-Budget-Commission/Agendas/20170213/Item-6B-2017-02-13-Updated-Council-Goals-Fiscal-Resilience.pdf).

- “Complete a full staffing analysis by July 1, 2017 to determine match between service delivery needs and staffing including comparison to nearby cities.

- Concurrent with the full staffing analysis, hire a consultant to complete a thorough Business Process Re-engineering to improve inefficient, ineffective service delivery.

- Based on the results of the full staffing analysis, during the July 1 – December 1, 2017 period, identify and implement best practices for providing services going forward with a strong focus on training workers to take on multiple tasks.

- Examine all means to further reduce growth in compensation costs including analysis of OPEB and Pension options (as other CA cities are doing).”

None of these recommendations were even formally considered by the Council because no Council member allowed a discussion of Robb’s motion for the purposes of discussion, and as a result the Goals were never adopted.

Fact Check Item 4

Claim – “They state,“At the beginning of the last decade, the state returned about 27% of local property taxes to our city. Today, approximately 18% is returned. The State annually has shifted a total of over $3 million in property tax from the City”.

Funny thing…this is the exact same language used the City’s ballot argument for the Parks Tax Measure when it was last renewed 6 years ago in 2012”

Judged to be CORRECT/TRUE

Basis for Claim –

The following excerpted paragraphs were taken in their entirety from the 2012 Argument in Favor of Measure D – Parks Tax: The similarities to the current Argument in Favor of the current Measure H are obvious and it appears the Measure supporters functionally simply copied the ballot arguments from 6 years earlier.

The passage of Measure D is part of a comprehensive plan to fund adequately our needed City services. For more than a decade, the state has been shifting away a large share of our local property taxes. At the beginning of the last decade, the state returned about 27% of local property taxes to the city. Today approximately 18% is returned. The State annually has shifted a total of over $3 million in property tax from the City and eliminated funding for state-mandated programs.

Measure D will renew the existing $49 per year parks maintenance tax, allowing the City to continue to pay for parks maintenance, including family parks, greenbelt maintenance, streetscapes and street tree planting and maintenance, swimming pools, open space and habitat maintenance, and vandalism repair. This is the same cost as when voters first approved the tax in 1998. The current tax will expire in June of this year.

This tax generates $1.36 million in annual revenue, used to offset park maintenance costs. In 1998 this funding source covered 75% of park maintenance costs. Today this tax covers 21% of this cost. Since 1998 we have seen an increase in total park acreage by one third.”

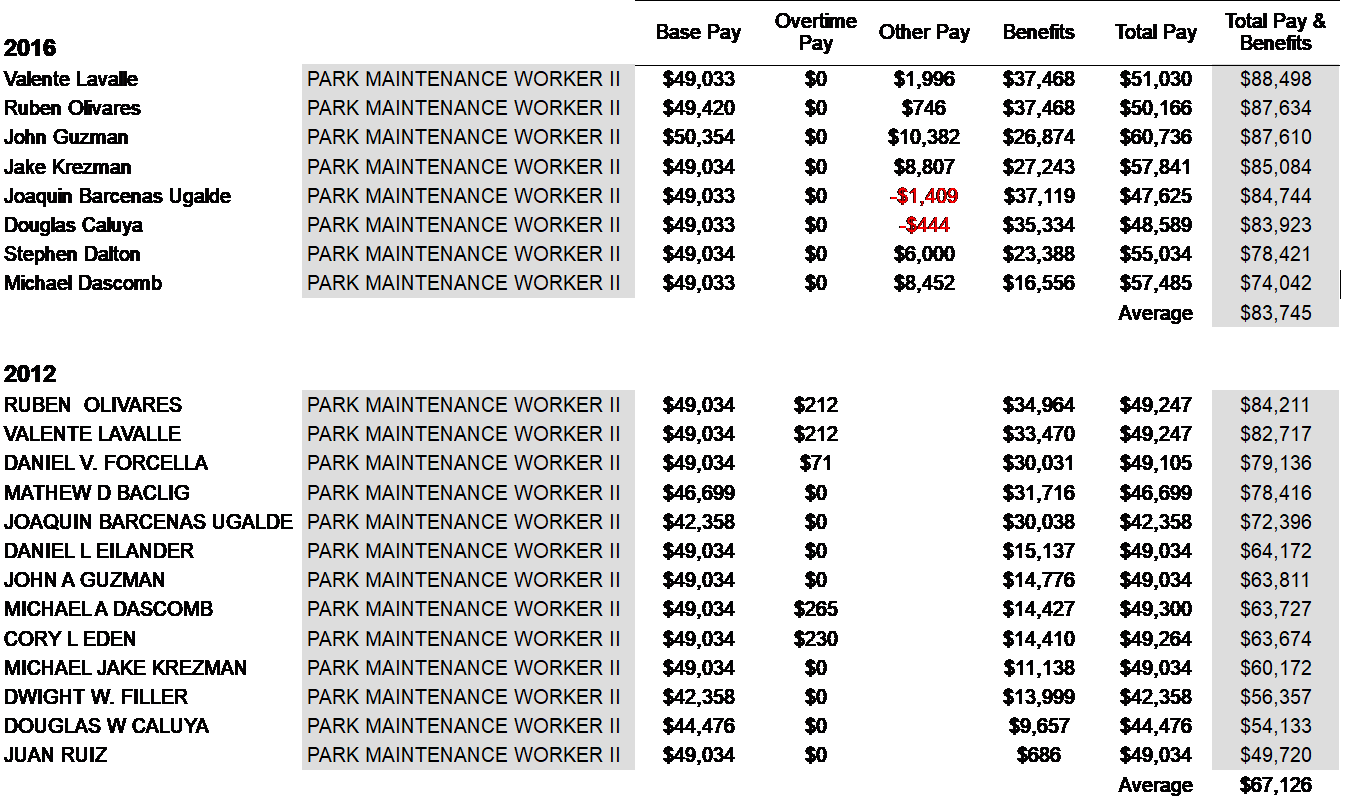

Fact Check Item 5

Claim -”Only now the City is also claiming it is continuing “efforts to prudently manage city costs”. Not true! For example, the average total annual compensation of our Park Maintenance II workers has risen from $66,412 in 2012 to $83,745 in 2016 – a 26% increase”

Judged to be CORRECT/TRUE

Basis for Claim – Data from www.TransparentCalifornia.org

Fact Check Item 6

Claim – “Every bit of this Parks Tax Measure and other Parks budget money can be legally diverted for other uses in the City and the citizens footing the bill have no legal recourse”

Judged to be CORRECT/TRUE

Basis for Claim – By law, Parcel Tax revenues can only be used for the stated purpose for which the taxes are collected. One would assume by the title of the Measure 2521, the “Parks Maintenance Tax” that all proceeds from the Parcel Tax would be used only for Parks maintenenace. This is not true, however. The Measure actually states that the proceeds can be used as follows:

“15.14.070. Limitation on Disposition of Revenue.

Revenues collected under the provisions of this article shall be deposited in a special fund called the park maintenance special tax fund and shall be used only for the operation and maintenance of landscaping, park, open space, median, greenbelt, swimming pools, public recreational facilities and public lighting improvements, within the City and for the incidental expenses incurred in the administration of this tax, including, but not limited to the cost of elections, and the cost of collection.”

So the taxes collected by this Measure could also be used for maintenance of street medians, swimming pools and other recreational facilities, public lighting (such as street lighting and downtown or City Hall parking lot lighting), administration (this could be almost anybody sitting at a desk) and even the cost of this election and collecting the tax in subsequent years. It is possible that not a single dime of the proceeds of this Parcel Tax Measure would even be used for actual park maintenance.

Further, an amount equal to or far greater than the amount of this Parks Parcel Taxes collected can be legally removed by the Council from the Recreation and Parks Department budget otherwise funded by the General Fund resulting in a net loss of money for park maintenance compared to current levels!

The “fact checker” needs some fact checking… %-age total comp increases… partially true… partially misleading… the problem lies with the word “compensation”… vs. “city costs to provide current “compensation”

Salaries have increased… true… but not in the %-ages implied… direct ‘benefit to employee’, additional cost to City.

Medical premium compensation costs… false as to employee benefit… coverage has not increased, and the employees pay a portion of the increases… true is that City has more costs due to providers increasing rates.

Here’s the “biggie”… pension and other PREB (retiree medical)… false as to direct employee “gain” in ‘compensation’, as the employee gets the same retirement benefit over that period… new employees get less… but true that ‘City costs’ have gone up big time, as the charts show, due to the following factors:

City was doing retiree medical as “pay as you go”, and is now playing ‘catch up’ to have it fully funded… PERS contributions by City (even with increased contributions by emplyees) have gone up big time as the City wasn’t fully funded, and playing catch up, AND PERS is playing catch up… both are reflected in the apparent huge increases in “other benefits”… yet the “benefits” are unchanged even though the costs to City to provide the current benefits has dramatically increased.

Summary… the numbers present by the “team” (augmented by the ‘author’ who appears to be of the same ilk… more honest if he had signed on to the ballot arguments), are true in part, but a tad deceitful in implying that employees have received direct increased ‘compensation’ (salary and benefits) by using the City’s “costs”, in those numbers.

Howard, as is often the case, personal experience affects the way that an individual reader “hears” what is being said. The arguments do not explicitly or implicitly say individual employee take home pay has increased. The arguments do not try and walk in the shoes of the individual employees. They try and walk in the shoes of the individual taxpayer. That isn’t deceitful. It is biased. The numbers clearly tell us that the impact on each taxpayer is a substantial increase in the dollars spent on total employee compensation.

With that said, the argument does fall into the trap of painting all employees with the same brush when it says “the very next year, all of that money and more was used to give employees the biggest pay increases in City history. Firefighters received a 36% increase over 4 years.” My understanding is that the Police union refused to accept the same 36% raise, agreeing to a more modest 18% increase over 4 years, and the other bargaining units (public works employes and administrative employees for example) only got single digit raises. I personally do not think “overpaid” when I look at an orange vested city employee delivering city services to the taxpayers, residents, visitors, and businesses of Davis.

First paragraph, noted, but we can discuss over coffee…

Second paragraph… will have to clear up some of your “understandings” but correct in the main.

Again we get to salary and other benefits… the pension plan parameters also got a “boost”… it is what it was. Am just calling it for what it was…

But just like deferred maintenance, it is time to “pay the piper”… sins of the father, so to speak… should (not aimed at you, Matt) current employees take the entire brunt? Should retirees have their pensions/benefits pulled out from under them? Pay-back?

Pryor and others are trivilizing past ‘dues’ owed, to make their “arguments”… IMHO…

BTW, good luck (for those under SS and Medicare) getting any sympathy from me… both those systems are ‘tanking’…

And good luck with your 401’s… after the trend that had inertia in a previous admin. have you looked at your last quarter results? were they above 0.00%?