For the third year in a row, the Davis school district is facing multimillion dollar cuts in school funding for the 2010-11 budget as discussed at last night’s school board meeting. As Superintendent James Hammond said last night, their hope is that by addressing the cuts early, they can mitigate some of the harmful impacts on school programs by working together through a spirit of joint sacrifice.

For the third year in a row, the Davis school district is facing multimillion dollar cuts in school funding for the 2010-11 budget as discussed at last night’s school board meeting. As Superintendent James Hammond said last night, their hope is that by addressing the cuts early, they can mitigate some of the harmful impacts on school programs by working together through a spirit of joint sacrifice.

In early 2008, the schools faced a variety of cuts in part because of the state budget, but due in large part to local issues such as declining enrollment and other structural damages. However, the Davis Schools Foundation raised $1.7 million in emergency funds and the state’s May Revise avoided massive layoffs and possible school closing. To close that structural deficit, the district put Measure W on the ballot in the fall of 2008. The Measure passed by a 3 to 1 margin and enable the district to fill the $2.5 million structural deficit.

Superintendent Hammond on Thursday pointed out that this once again reflect the budget realities in Sacramento. $3.5 million represents their best current estimate, but that might be the tip of the iceberg as the state once again seeks to cut billions from its budget, less than a year after multiple rounds of multibillion dollar budget cuts resulted in a net of $15 billion in cuts to education in California.

The cuts for DJUSD and other schools districts would have been far worse last year had it not been for one-time federal stimulus money that was used to offset some of the state funding cuts and helped to avert widespread layoffs of teachers. But these funds were one-time and will likely not come again this year.

As Superintendent Hammond laid out his plan last night, he stressed that the goals that would be taken into the cuts would be to first and foremost protect programs, protect student safety, and preserve the programs that Measure Q and Measure W fund.

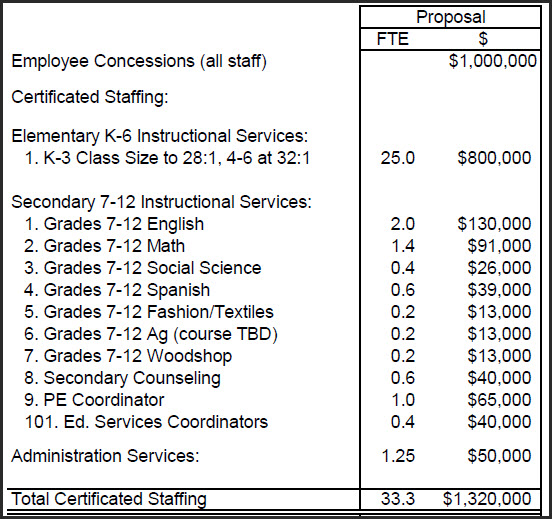

The budget starts with $1 million in savings through employee concessions, a large number to be sure, but the Superintendent stressed that through joint sacrifice the pain of these cuts could be spread across all employees and thus not has a disparate impact on any one group. He praised the bargaining unit leaders for both the teachers and the classified staff for their willingness to work together for a common solution.

Nevertheless the impact will be painful. Right now they are looking at cuts primarily through a reduction in CSR (class size reduction). By raising K-3 class size to 28 to 1 and grades 4-6 to 32 to 1, they will save $800,000. But that is a euphemism for cutting 25 teachers from elementary school and another 7 teachers from secondary school that will add up to a total of $1.3 million.

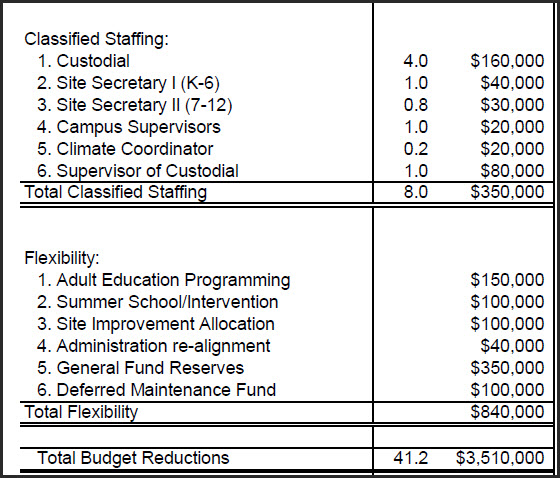

In addition, they are looking at cutting 8 classified staffing positions that would save $350,000, that includes the .2 of the Climate Coordinator position–a position that we have fought for in the past as it took years of struggle to get the position in the first place.

Finally, once again they are banking on categorical flexibility to get them the rest of the way home with $840,000 there including $350,000 eating in General Fund Reserves.

Commentary

The district did not present the long-term picture, but it cannot possibly look good at this point.

Think of the advantages that the Davis school district has over others. The community was willing in 2007 to pass Measure Q to re-authorize a parcel tax and then just the next year the District was able to secure another $2.5 million per year through Measure W. Most districts have a hard time getting a bond measure passed to build or renovate classrooms. This district was able to raise several million in two ballot measures in consecutive years.

But there is more, in 2008, the Davis Schools Foundation was able to raise $1.7 million from the community to prevent drastic and devastating cuts. This past year the Davis Schools Foundation raised $643,000 during the worst recession since the 1930s this will fund a half-time vice principal’s position at Davis High, and a full-time classified position at the college and career center at Davis High.

Davis schools will likely survive even the next round of cuts, but not emerge unscathed as another 25 teachers and numerous more staff members lose their jobs. If we believe that smaller classrooms are the key to educational success, then that is now out the window.

The district has rightly chosen to preserve its programs as class size is far easier to bring back down than it is to restart defunct programs.

However, the people I really feel for are those schools that are not as fortunate as Davis. Those whose communities cannot afford or are unwilling to come up with millions each year to save education. Those students who are far more vulnerable than Davis’ students.

We have mortgaged our future in California. We have cut funding to K-12 education and if the students are lucky enough to emerge with a high school degree they will emerge to a public higher education system where the costs have increased, placing a burden on middle class families, opportunities are limited, and so for many students the bright future is not nearly as bright. We may well recover in a few years with another boom, but for these students the losses are permanent and catastrophic. They only get once chance to go to school and to thrive and that chance is passing them by. Will this end up being a lost generation?

The news is bad and getting worse. The US Commerce Department reported Thursday that the recession is over as the economy grew for the first time in a year at 3.5 percent in the third quarter. But the Bee reports this morning that will be of little consolation in Sacramento as the local economy battered by furloughs and job losses in nearly every sector and the state is in shambles.

The Sacramento area lost 40,5000 jobs in the last 12 months and 80,000 jobs since 2007. The employment base is in fact smaller than it was in 2003. And some have suggested that the economic recovery is artificial, helped by billions in federal stimulus money. The job market is in bad shape and will continue to be in Sacramento for some time.

Meantime, higher education remains in a tough position, with students facing an additional 32% fee increase that will have tripled the cost of a UC education since 2000. Students and faculty are now eyeing a three day strike from November 18 to November 20.

The state government has shown its impotence to deal with crisis throughout. Crippled with partisan-strife, the legislature has not been able to overcome the two-thirds hurdle to produce any meaningful changes to the way the state operates.

Groups such as the Bay Area Council have pushed for a Constitutional Convention as a means to solve the state’s problems. They have filed two initiatives for the November 2010 ballot that would allow Californians to call for a Constitutional Convention. The first would change the existing constitution to allow voters themselves to call for a convention, under the current law, only the legislature can do so. And second, they have an initiative that actually would convene the convention. The measure prescribes how the convention would operate, including delegate selection and definition of the scope of the new constitution.

However, despite such efforts, the latest Field Poll from a few weeks ago suggests that the public is not ready for reform, with the majority opposing changes to either the two-thirds requirement or term limits.

What will likely happen without reform is that the economy will improve, lessening the urgency for change, business as usual will return and we will face the exact same problems the next time we hit a bump in the economic road–an occurrence that is inevitable.

For Davis schools and indeed school across California, the task should be to look for more steady ways to fund schools so that we do not have to repeat what has happened the last few years. For many students, the impact of this crisis may well be irreparable. And that will be the true tragedy of the situation.

—David M. Greenwald reporting

There is also the reorganization of administrative functions at UCD later this year and a further reduction in funding for UCs next year. The layoffs have already begun. In addition, staff will be temporarily laid off this Spring for some weeks due to the unions stubborn refusal to agree to the furlough plan. Lecturers are being laid off for entire quarters and classes canceled if faculty cannot step in to teach the courses. The impact of these ongoing and future actions on the local economy will have to be seen, but it will be getting worse.

…the legislature has not been able to overcome the two-thirds hurdle to produce any meaningful changes to the way the state operates.

Let’s consider another way to word this: …the Democrat monopoly running the state legislature has resisted trimming lower priority programs coveted by special interests and public employee unions that provide their campaign dollars, and instead, have placed a larger than necessary burden on education to help promulgate public support for raising taxes.

That’s a pretty conservative and partisan spin. The way I see it, the Democrats in the legislature have fought against cuts, the Republicans in the legislature have fought against tax increases, and the result is no one is willing to budget and thus there have been no reforms.

Yes, the economy is bad, but it is misleading to just dwell on that. What makes it worse is that tax revenue in California is a wild bronco ride compared to what it could be. The state budget depends too much on capital gains taxes, which are the most volatile and the most mobile type of tax revenue. Property taxes are the most stable type of broad-based tax revenue. If the state used smoothed property assessments, say five-year averages, then property taxes would be even more stable. Unfortunately, Proposition 13 undermined the stability of state taxes in the name of providing stability.

[i]instead, have placed a larger than necessary burden on education[/i]

I don’t know why you think that there is any “larger than necessary” burden on education, since K12 education is better protected than almost anything else in the state budget.

[i]Students and faculty are now eyeing a three day strike from November 18 to November 20.[/i]

I found a petition for it on-line. “Rescind all lay offs and halt all pay cuts! Stop the student fee increases!” Yeah, right. The problem with this new protest is the same as with the old protest. These protests don’t carry any viable ideas; people are just resenting bad news.

That’s a pretty conservative and partisan spin.

Yes, well, I read some of your piece the same way. We see our world though our own ideological-colored glasses.

I agree though from an idealist perspective. However, the problem with compromise in this case is that we are already overtaxed in this state. Look at the level of budget and economy problems in highest-taxed states like Michigan and New Jersey for example. What a mess these states are in. High wealth citizens and businesses are leaving for droves to low-tax states.

I know you and others partially blame prop-13 for funding shortfalls and support raising property taxes. Remember that prop-13 was a voter response to the constant ratcheting up of property taxes. Assuming we overturned prop-13 years ago, the controlling Democrats would have already spent the excess. Instead of $150k prison guards that could retire at age 55, we would have $200k prison guards retiring at age 50, and California would have a myriad of additional pet programs placating progressive special interest… and education would still be the sob story used to try and suck even more dollars from our pockets.

Our problem isn’t taxation, or problem is years of chronic over-spending by our Democrat-controlled state legislature. Now there is no stomach – due the political ramifications to the politicians having to make the touch decisions – to unwind these things created by the years of excess.

When you add up all federal and state taxation, at the top tax brackets, in CA families are paying over 60% of their earned wealth in taxes. It is by far their largest item on their budget (exceeding mortgage payments and healthcare costs combined). When these families are small-business owners, the additional business taxes and regulatory fees only increase the tax burden. Prop-13 has been one bright spot for attracting business and high-wealth individuals to CA. However that has been offset by the relatively high property values. Now that property values have dropped, once the CA economy starts to move again, there are more small business models that start to pencil out with more affordable rent or mortgage payments. Raise property taxes or other taxes and many will not pencil out. Remember that Obamacare will also cause a hit to the income statement for small businesses.

The Laffer curve is real. The key is to have the optimal level of taxation that continues to incentivize economic activity that produces jobs and tax revenue. You seem to think we still have capacity to raise taxes. I think we are already exceeding capacity and would be better off lowering taxes. Meanwhile we need to cut spending to balance the budget.

[quote]the Democrats in the legislature have fought against cuts [/quote] Regardless of that fight, it’s irrelevant. The cuts are being made, as they have to be made. There is no other choice. [quote]the Republicans in the legislature have fought against tax increases[/quote] That may be true, but it’s mostly irrelevant. The legislature cannot raise property tax rates. And every other tax rate and fee in California is absurdly high already. As such, raising taxes even more is just not an option. I’m not a believer in the Laffer curve, generally, but it seems to me that our state is pushing toward that edge, where higher tax rates just don’t bring in more revenues.

I think the relevant question moving foreward that the Democrats need to solve — the Republicans, being a perpetual minority don’t matter in this regard and will go along with a sensible Democratic plan — is how to smooth out the spending curve, so a recession does not result in dramatic cuts and a recovery does not result in dramatic spending splurges.

The one person who holds the key to this is David Sanchez ([url]http://www.cta.org/about/officers/President+David+Sanchez.htm[/url]). If his union, which controls a majority of votes in the legislature*, would behave responsibly, this problem over the long-term, could be solved. But the CTA has a long history since Prop 98 (21 years ago) of insisting that when new tax revenues come in, they MUST go out in high proportion to the schools (and thus to their members), regarless of the consequences that brings about in a downturn.

*The CTA spends about $1 million a month ([url]http://cal-access.ss.ca.gov/Campaign/Committees/Detail.aspx?id=1045740&session=2009[/url]) funding Democrats in the legislature. It is the most important PAC of all, even more than the prison guards or the firefighters.

[quote]The CTA spends about $1 million a month funding Democrats in the legislature.[/quote]Correction: they spend about $1 million a month. It’s not true that all of that goes to “Democrats in the legislature.” Sorry for my error.

[i]And every other tax rate and fee in California is absurdly high already.[/i]

There will always be plenty of evidence for that given that California’s taxes are so lumpy and volatile. For every “absurdly” high tax or fee in one place, there is a loophole or an exemption somewhere else. State and local government spending is roughly the same for most of the 50 state. What California has is higher than average, but does not set a record.

But I do know of two features of state spending in California that do set a record: Prison guards are the highest paid, and the state is the least reliable at long-term planning.

Okay, I see that California does have the highest sales tax rate on non-food items. Four states have 7%, while California has 7.25%. So yes, that’s higher, but I’m not sure why it should be called “absurd”. California doesn’t tax food, while a number of states do.

I don’t know why you think that there is any “larger than necessary” burden on education, since K12 education is better protected than almost anything else in the state budget.

Yes, but how many politicians in the State Legislature stood up against the education spending mandate proposition? You know that most (all?) Democrats in the state legislature supported these propositions. It is pretty darn convenient that these mandates are the scapegoat, don’t you think? Public support of the mandates was in fact influenced by the “larger than necessary” budget burdens places on education precisely because the state Democrats knew this would influence outrage and they could count on the wealthy teachers unions to do their heavy lifting so they could keep their hands clean.

[i]Yes, but how many politicians in the State Legislature stood up against the education spending mandate proposition?[/i]

Jeff, you need to stick to one story. First you said that the K12 education cuts are “larger than necessary”. Now you say that the legislature failed to stand up against state propositions to protect K12 education. I agree with you the second time, but what you said the first time has everything to do with why these propositions passed.

But I agree that the cuts to higher education have been disproportionate. The higher education compact has fallen apart compared to K12. I won’t call anything larger or smaller than “necessary”, because the budget process is too crazy to have any notion of necessities.

[quote]Remember that prop-13 was a voter response to the constant ratcheting up of property taxes. [/quote]I don’t think that’s quite right. Prop 13 was a voter response to unprecedented real estate inflation. The “ratcheting up” was not a matter of policy changes by the state or by municipalities.

A house which was bought for $50,000 was suddenly valued at $100,000. So with the exact same rates, a homeowner, whose income may have not grown* by much, had to pay twice as much in property taxes.

A good question is why real estate was inflating so much at that time. I think these were some of the most important reasons:

1. Bad policies by the Federal Reserve were inflating the money supply, causing general price inflation.

2. As married professional women entered the workforce in big numbers, household income was going up fast in general**. That was pushing up home prices on the demand side.

3. Growth control, in some markets, caused a supply shock.

4. Massive migration to California created a demand shock.

* It’s probably worth considering the elderly vote in Prop 13. They were big savers, but had little or no increase in their incomes in the 1970s. So general price inflation hurt them (made their savings worth less) and real estate price inflation hurt them (because they did not have increased incomes to cover the higher taxes or rents). Also, because they did not have school aged kids, they were less concerned about the effect lower property taxes would have on the schools. And elderly people turn out at the polls in much higher numbers.

** For blue-collar-ish households with only one income earner, household income was declining slightly in real dollars in the 1970s. Thus, the increased values of their homes was harming their cash flow.

[quote] For every “absurdly” high tax or fee in one place, there is a loophole or an exemption somewhere else. [/quote]We have the highest marginal state income tax rate*, the highest sales tax rate (and in places like Davis with its own sales tax an even higher rate) and our fees at the California DMV are among the highest. Our gas tax is not the highest, but it is among the highest. Prior to the current crisis, we were something like the 17th highest state for property taxes/income of any state.

*Hawaii may be higher. They passed a new higher rate this year to cover their big state deficit. I’m not sure if the “California millionaire tax” increase we passed still makes us higher than Hawaii.

[i]”Our gas tax is not the highest, but it is among the highest.”[/i]

I should clarify that. Our gas tax is actually among the lowest ([url]http://www.gaspricewatch.com/usgastaxes.asp[/url]) if you don’t count the sales tax portion of the gas tax. Added together and comparing apples to apples with other states, we move up into the top third among states. New York, Pennsylvania and Wisconsin still are much higher.

[i]I don’t think that’s quite right. Prop 13 was a voter response to unprecedented real estate inflation.[/i]

Like every state proposition, Proposition 13 was a voter response, but a response that was organized and manipulated by special interests. Howard Jarvis, who at the time was Mr. Prop 13, was not some ordinary guy who had just been minding his own business. As the Wikipedia page says, Jarvis was a lobbyist for landlords. He was an employee of the Los Angeles Apartment Owners Association; in fact the “Yes on 13” campaign was headquartered in a LAAOA office.

It’s always the big cliche that [b]my[/b] ballot measures are grassroots, while [b]yours[/b] are astroturf. Actually, every important ballot measure is well-watered sod. That’s why the whole system is bad for California.

Greg, I admit that my point is a bit convoluted. You said …don’t know why you think that there is any “larger than necessary” burden on education, since K12 education is better protected than almost anything else in the state budget.

Because of these spending mandates (which I view as Democrat initiatives because they were supported by state Dems in the Legislature and the campaign against was funded by their CTA pals), we can have “larger than necessary” cuts to education as a percentage of the total cuts that should be made. The mandates allow the Dems to semi-protect their other more obscure, campaign-contributing constituents, while continuing to leverage the public outrage for education cuts.

I don’t think that’s quite right. Prop 13 was a voter response to unprecedented real estate inflation. The “ratcheting up” was not a matter of policy changes by the state or by municipalities.

Rich, correct. During this time there were quite a few county assessment offices aggressively pursuing increases, but only every 2nd or 3rd year and then the poor property owner would be hit with a big increase they didn’t expect or plan for. Also, however, many locales were tacking on copious special assessments. The problem was one of timing and a disproportionate hit to residential home owners.

While total property taxes rose by 11.8 percent between fiscal years 1975 and 1978, those collected on all single family dwellings rose by 74 percent and those per single-family dwelling rose by 62.9 percent. Raise any middleclass tax by 74 percent in three years and you will inspire tax-payer revolt.

It is a good thing for Prop-13, otherwise state Dems would have gorged even more and we would be dealing with a much bigger world of hurt with the big decline in CA property values.

[i]We have the highest marginal state income tax rate*, the highest sales tax rate (and in places like Davis with its own sales tax an even higher rate) and our fees at the California DMV are among the highest.[/i]

It isn’t a grown-up discussion to point to this tax, that tax, and the other tax, as if each tax is a separate kind of venereal disease. According to Wikipedia ([url]http://en.wikipedia.org/wiki/State_tax_levels[/url]), which cites the Census and the federal Bureau of Economic Analysis, California is 12th in total state taxes as a percentage of personal income. The total is the total and 12th is 12th. Or you could look at state and local if you like.

I personally don’t care all that much if our state taxes are 12th or 5th or 20th or 30th. First would be extreme; it would be incredible to outspend Alaska without having its oil wealth. Last would be extreme. All I would want in between the extremes is to make taxes equal to promises. Promise less or tax more, one of the two. This is why the state proposition system is so bad; it treats government in general as a conspiracy to rake in taxes and promise nothing.

[i]I admit that my point is a bit convoluted.[/i]

I’m still not following it. Should DJUSD get a $3.5 million funding cut or shouldn’t it?

I’m still not following it. Should DJUSD get a $3.5 million funding cut or shouldn’t it?

Without K-12 spending mandates that have managed to prevent more severe cuts in prior years, $3.5 million in current-year cuts would not be as palatable (because of the aggregate impacts) and therefore state Dems would be forced to balance the budget less on K-12 education and more by cutting other things.

[quote]the Democrat monopoly running the state legislature has resisted trimming lower priority programs coveted by special interests and public employee unions that provide their campaign dollars, and instead, have placed a larger than necessary burden on education to help promulgate public support for raising taxes. [/quote]

Jeff, I take it that you don’t see the CTA as one of those culprit public employee unions you mention above? I’m trying to follow your line of thinking.

Because it would seem to follow from your comments that the Republicans in the state legislature really want to fund K-12 education at a higher level, but the Dems want to cut K-12 education either to punish the CTA, or to browbeat the California voters into accepting higher taxes.

To me it’s an odd narrative that I haven’t encountered before.

[quote]It isn’t a grown-up discussion to point to this tax, that tax, and the other tax, as if each tax is a separate kind of venereal disease. According to Wikipedia, which cites the Census and the federal Bureau of Economic Analysis, California is 12th in total state taxes as a percentage of personal income. [/quote]You misread the list on Wiki. It puts California at #11.

Besides that minor mistake (of thinking #11 was #12), your patronizing tone is misplaced, if you follow my quasi-Laffer Curve argument. Do you not understand what Professor Laffer has arguemd about marginal tax rates not generating more revenues? If not, then you probably should not be complaining about a “grown-up discussion.” [quote]I’m not a believer in the Laffer curve, generally, but it seems to me that our state is pushing toward that edge, where higher tax rates just don’t bring in more revenues.[/quote] The reason I am generally not a believer in the Laffer Curve (as applied to the federal revenue stream) is because I don’t think our tax rates since 1981 have been high enough to change behaviors enough to actually reduce revenues. But with states in competition with each other and with a lot of anecdotal information about wealthy Californians able to move their income out of state, it seems likely that it does apply here. But if you dismiss it, then you think you are the only adult in the room, Greg.

[i]Without K-12 spending mandates that have managed to prevent more severe cuts in prior years, $3.5 million in current-year cuts would not be as palatable (because of the aggregate impacts) and therefore state Dems would be forced to balance the budget less on K-12 education and more by cutting other things.[/i]

I think I understand now. You’re ready to celebrate when the legislature is forced to cut welfare, and you don’t expect them to do it voluntarily. So you feel disappointed that Prop 98 has created room to cut K12 education instead of welfare.

Don’t worry about that. The state is cutting public assistance miles beyond any of its cuts to K12. Arguably, Prop 98 protects K12 even more in bad times than in good times. In fact, they’re trying to figure out what else they can cut from public assistance without turning away federal matching funds.

You’re ready to celebrate when the legislature is forced to cut welfare, and you don’t expect them to do it voluntarily.

Greg, I’m not ready to celebrate any public-service cuts… I’m a compassionate libertarian/conservative. However, I believe more people are helped with a robust economy incentivized by lower regulatory burdens and taxation. I think the public employees unions and over ambitious do-gooder government have taken much more than they need.

The reason I am generally not a believer in the Laffer Curve (as applied to the federal revenue stream) is because I don’t think our tax rates since 1981 have been high enough to change behaviors enough to actually reduce revenues.

Rich, there is no absolute way to measure what might have been with lower state taxes. I hear what you are saying though… for example, I continue to live in CA instead of moving to FL. If my tax burden was too high, according to Laffer I might take my family and company to a lower tax state. However, what you also need to factor my individual incentive to grow a business when the potential earned value relative to the cost of my additional time and the investment capital risk… does not pencil out when taxation hits a milestone. I’m still here but I may employ fewer people and make less taxable profit. Simply said, it takes the expectation of a certain return to incentivize business investment to grow a business, and taxation reduces the expected return. That is different than the incentive to move a family and a business to another state… which has other costs and benefits associated with it.

California may demand a premium like Davis can demand a premium, but don’t expect the people who choose to live here to be motivated to bust their business chops when so much goes back to the state politicians to spend on an endangered dung worm and an army of over-paid public sector employees.

Jeff, I agree with all your points on Laffer vis-a-vis an individual state. Especially with a state which, Greg’s snide comments aside, has the highest marginal income tax rate and the highest sales tax rates and various high fees, all of which give taxpayers and rate payers an incentive to avoid them if possible, which causes us (probably) to have lower tax revenues from those specific taxes. [quote]I continue to live in CA instead of moving to FL. If my tax burden was too high, according to Laffer I might take my family and company to a lower tax state.[/quote]Many wealthy people have done this ([url]http://www.nypost.com/p/news/local/tax_refugees_staging_escape_from_qb4pItQ71UXIc0i6cd3UpK[/url]). You think Tiger Woods, born and raised in California, chooses to live in Florida because they have better golf courses than they have in Orange County, where he grew up?

Here is Laffer himself in the WSJ ([url]http://online.wsj.com/article/SB124260067214828295.html[/url]) earlier this year: [quote]Finally, there is the issue of whether high-income people move away from states that have high income-tax rates. Examining IRS tax return data by state, E.J. McMahon, a fiscal expert at the Manhattan Institute, measured the impact of large income-tax rate increases on the rich ($200,000 income or more) in Connecticut, which raised its tax rate in 2003 to 5% from 4.5%; in New Jersey, which raised its rate in 2004 to 8.97% from 6.35%; and in New York, which raised its tax rate in 2003 to 7.7% from 6.85%. Over the period 2002-2005, in each of these states the “soak the rich” tax hike was followed by a significant reduction in the number of rich people paying taxes in these states relative to the national average. Amazingly, these three states ranked 46th, 49th and 50th among all states in the percentage increase in wealthy tax filers in the years after they tried to soak the rich.[/quote]

But it doesn’t just have to be a person physically moving himself or his business out of state. Some people — some very rich people who pay a lot of our marginal income taxes — have the ability to move their income out of state but not themselves*. That is not done without costs. But if you make the tax rates high enough, as we have done in California, the benefits outweigh those costs and the tax-shifting behavior follows.

*I know a very wealthy writer who lives most of the year in California but makes all of his income in Arizona, where he “works.”

WHETHER YOU LIKE IT OR NOT, Gavin Newsom just quit the governor’s race ([url]http://www.latimes.com/news/local/la-me-newsom-out31-2009oct31,0,7017003.story[/url]).

[i]Some people — some very rich people who pay a lot of our marginal income taxes — have the ability to move their income out of state but not themselves[/i]

No kidding! A standard criticism of taxing the rich is that said taxes drive away fabulous people. Actually, if someone is so rich that his “car” is a private jet and he doesn’t know how many houses he owns, then he also may not know or care where he “lives”. A lot of these zillionaires are still around in California, they just moved on paper to Arizona or Wyoming or even the Cayman Islands.

Which is all the more reason to tax property instead of capital gains. You can move capital gains to another state with the stroke of a pen; the mansion would have to move for real.

This new posture is about like I figured. 4 lonely dudes and a computer.

“I continue to live in CA instead of moving to FL. If my tax burden was too high, according to Laffer I might take my family and company to a lower tax state.”

Frankly, this is one of the reasons I’m moving to Washington state next summer. I can telecommute, and my son is no longer in the public school system here, so why stay? Washington state has no state income tax, and my property taxes will be about $2200 a year on a 1750 square foot, $350K house, as opposed to the $6800 a year I pay in Davis on a 2300 square foot house I purchased for $450K. The tax savings alone will be nearly $8K a year – that’s a lot of money – not to mention the place I’m moving has such a better quality of life and much better weather than Davis! Why on earth would I pay so much to live here???

Monday’s (11/9) Sacramento Bee had this article on what the Folsom Cordova district is considering in advance of anticipated budget deficits:

[url]http://www.sacbee.com/education/story/2314310.html[/url]

Woodland JUSD has to plan for at least $3 million in cuts. Here’s what they’re considering:

[url]http://www.dailydemocrat.com/news/ci_13753229[/url]

Elk Grove USD talks of cutting back on sports. They have a $39 million budget deficit:

[url]http://www.egcitizen.com/articles/2009/11/05/news/doc4af369775ea7d639741270.txt[/url]

Dixon, Fairfield-Suisun, and Vacaville all held school board elections this past election day. This is about the Dixon school board:

[url]http://www.thereporter.com/ci_13710159?IADID=Search-www.thereporter.com-www.thereporter.com[/url]

DJUSD could well be looking at more than $3.5 million in cuts, based on this article in this morning’s (11/10) Sac Bee:

[url]http://www.sacbee.com/topstories/story/2316115.html[/url]

Elk Grove USD passes interim budget, cuts sports, librarians, etc.

[url]http://www.sacbee.com/education/story/2333191.html[/url]

Travis school district in Solano County reaches tentative contract agreement with teachers:

[url]http://www.thereporter.com/news/ci_13813749[/url]

Pleasant Ridge Union Elementary School District (Nevada County) is proposing to close an elementary school because of declining enrollment and lack of funding, but parents want to turn it into a charter school. (sound familiar?)

[url]http://www.theunion.com/article/20091119/NEWS/911189999/1001&parentprofile=1053[/url]

School closures are being discussed in Santa Rosa school district:

[url]http://www.pressdemocrat.com/article/20091119/ARTICLES/911199964/1350?Title=Santa-Rosa-school-cuts-will-be-aired-in-two-town-halls[/url]

Chico USD could go into state receivership (state takeover):

[url]http://www.chicoer.com/ci_13820821?source=most_viewed[/url]