The Occupy Woodland event from earlier this week triggered some interesting discussions. Unfortunately, it appears a lengthy discussion on Supervisor Matt Rexroad’s page has been removed so we cannot quote from it.

Others on our own discussion board argued that “the banks were essentially being strong-armed by the FHA to provide loans to people who couldn’t afford them, and then those loans were guaranteed by the government via Fannie and Freddie. It seems to me that the Federal Government was the bad actor.”

In my view, there are plenty of bad actors to go around, and limiting the blame to the government probably avoids the fact that banks and other predatory lenders accumulated a huge amount of wealth off the misfortune of others.

In examining this problem further, we quote the non-profit, Center for Responsible Lending, who released a rather sobering study earlier this year.

In their executive summary they write, “As the nation struggles through the fifth year of the foreclosure crisis, there are no signs that the flood of home losses in America will recede anytime soon. Among the findings in this report, Lost Ground,2011, we show that at least 2.7 million households have already lost their homes to foreclosure, and more strikingly, that we are not even halfway through the crisis.”

Toward that point, they find, “Among mortgages made between 2004 and 2008, 6.4 percent have ended in foreclosure, and an additional 8.3 percent are at immediate, serious risk.”

Foreclosure patterns, they argue, follow patterns of risky lending, where “foreclosure rates are consistently worse for borrowers who received high-risk loan products that were aggressively marketed before the housing crash, such as loans with prepayment penalties, hybrid adjustable-rate mortgages (ARMs), and option ARMs. Foreclosure rates are highest in neighborhoods where these loans were concentrated.”

“Aggressively marketed” suggests that, far from being the innocent victims of government pressure, these lenders were actually out there marketing very risky loans.

While the majority of the people impacted by foreclosures have been white families, “borrowers of color are more than twice as likely to lose their home as white households.” Writes the Center for Responsible Lending, “These higher rates reflect the fact that African-Americans and Latinos were consistently more likely to receive high-risk loan products, even after accounting for income and credit status.”

That last part is important because there would be a tendency to see this as merely an income/credit status problem, but these data suggest something more than that.

They argue that for new mortgages, “The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 addresses the core problems of risky underwriting and abusive loan terms that led to this crisis. Unfortunately, flawed mortgages made prior to reform and high unemployment rates have combined to fuel a continuous flow of foreclosures.”

However, “Voluntary efforts by mortgage loan servicers have not been effective in stopping the foreclosure epidemic. Mortgage servicers have been embroiled in legal battles related to improper and sometimes fraudulent handling of delinquent loans and foreclosures.”

They found, “Mortgage defaults are strongly tied to abusive loan terms, such as prepayment penalties, ‘exploding’ adjustable-rate mortgages, and loans originated by mortgage brokers, which generally included kickbacks for placing borrowers in riskier, more expensive loans than borrowers qualified for.”

“The Dodd-Frank Act addresses these abuses directly, and requires lenders to ensure a borrower’s ability to repay the loan,” they write.

Along those lines, the Center for Responsible Lending advocates that the Consumer Financial Protection Bureau should implement the rules established under Dodd-Frank, “including the common-sense requirement to ensure ability to repay.” However, they argue, for these rules to actually work, “they must apply to everyone and cannot immunize lenders from accountability for loans made recklessly or in bad faith, even for ‘Qualified Mortgages’ – loans presumed to meet the ‘ability to repay’ standard.”

Moreover, they argue “Congress should reject any attempts to weaken protections against predatory lending. For example, there are efforts to allow lenders to exclude certain fees when determining whether a loan is classified as ‘high cost.’ Excluding these fees would in some cases effectively circumvent basic legal protections for riskier, high-cost loans.”

But the Dodd-Frank law is not universally admired. Back in September, Barney Frank, the retiring Congressman who was the author of this financial overhaul bill, “warned banking executives this morning that mortgage lenders must bear some of the financial risk for extending loans to home buyers.”

Mr. Frank said that “there is a ‘revolt’ under way against regulations intended to keep lenders from making risky loans to borrowers. Those regulations keep some of the financial risk for mortgages with the lenders who grant them, without which lenders will return to giving loans to those who can’t afford them.”

“I am disappointed at this revolt against risk retention that was so clearly at the center of this,” he said. “All the other problems we had … they all centered on the system for selling to other people loans that shouldn’t have been made in the first place.”

The same day, the New York Times ran an article arguing that the “Dodd-Frank Act” has become “a favorite target for Republicans laying blame.”

The Times argues that Republican presidential candidates have used the “Dodd-Frank Act, the sprawling regulatory effort to address the causes of the financial crisis, as their newest anti-Obama target for what ails the economy.”

Writes the Times, “Republicans have repeatedly invoked the law’s 848-page girth – and its rules on, among other things, trading derivatives and swaps – as a symbol of government overreach that is killing jobs.”

However, supporters argue that “Republicans are largely ignoring the basic trade-off that the financial law represents.”

“Dodd-Frank is adding safety margins to the banking system,” said Douglas J. Elliott, an economic studies fellow at the Brookings Institution. “That may mean somewhat fewer jobs in normal years, in exchange for the benefit of avoiding something like what we just went through in the financial crisis, which was an immense job killer.”

“Dodd-Frank aims to rein in abusive lending practices and high-risk bets on complex derivative securities that nearly drove the banking system off a cliff,” the article writes.

Said Mr. Frank, “Their claims are literally based on nothing but misconception. The legislation is very popular. Nobody wants to go back to totally unregulated derivatives. Nobody wants banks to go back to making loans without having to retain some of them. This is a debate that is being conducted for the right wing.”

On the other hand, Texas Governor Rick Perry argued that we have to end it immediately, while former Congressman Newt Gingrich called it “a devastatingly bad bill” that is “killing small banks, killing small business, killing the housing industry.”

Analysts argue that “unless Republicans capture the presidency and can also muster 60 votes in the Senate, it appears unlikely that Dodd-Frank will be repealed in full. Senate and House Republicans introduced such bills, but they have never been brought up for floor votes.”

At the same time, they have cast blame on Democrats who, they say, have put little into the defense of the effort. “Without someone on the Democratic side actively fighting on its behalf, Dodd-Frank, for the moment at least, has been left without a champion,” the Times reports.

Lost in all of this is a reasonable discussion as to whether the banking industry should be able to lend to people without assurances of their ability to pay the loan back. In the debate that emerged on Wednesday, it would appear that many on the conservative side of the aisle are willing to let the risk rest with the people who take out the loan without any onus on those who issue the loan.

In terms of a target for the occupy movement, the banks would appear to be a fair target, as would the government.

[quote]They found, “mortgage defaults are strongly tied to abusive loan terms, such as prepayment penalties, “exploding” adjustable-rate mortgages, and loans originated by mortgage brokers, which generally included kickbacks for placing borrowers in riskier, more expensive loans than borrowers qualified for.”[/quote]

I have seen first hand some of these abusive practices. In one case I had, the bank put the interest rate as monthly instead of yearly, so it appeared as if the APR was 1.5% annually instead of the real 18% per year. I also listened to a webinar about “redlining”, in which documented data showed how banks sent representatives into poor minority neighborhoods (especially those with people who speak English as a second language), and signed folks up for option pay variable rate mortgages they could not afford, even tho many qualified for a much lower interest rate fixed rate mortgage they could afford. So the banks most definitely engaged in shady banking practices.

However, that does not leave the federal gov’t off the hook, including Barney Frank himself (and Dodd as well Alan Greenspan). The gov’t has pushed adjustable rate mortgages, which are an abomination. Now credit cards are adjustable rate. Take a look at your credit card statement and look for the small “v”. Betcha didn’t notice that before, huh? Why weren’t consumers notified of this change in a way that was meaningful?

See following websites on Barney Frank debacle:

[url]http://www.theatlantic.com/business/archive/2011/12/hey-barney-frank-the-government-did-cause-the-housing-crisis/249903/[/url]

[url]http://dailycaller.com/2011/11/28/krauthammer-franks-retirement-best-thing-he-has-ever-done-to-prevent-future-economic-crash/[/url]

“In the debate that emerged on Wednesday, it would appear that many on the conservative side of the aisle are willing to let the risk rest with the people who take out the loan without any onus on those who issue the loan.”

That’s not true at all. We on the conservative side are/were saying that those who signed mortgage contracts knew the terms of their contracts and to say later that they were fooled is just trying to deflect their poor decision on someone else. We were also pointing out that the government through pressure on the banking industry forced them to ease their standards for securing a home loan. Going forward I would also say that us on the conservative side applaud the higher bar that the banking industry has now implemented to get a home loan, believe me I just refinanced my house and had to jump through many more hoops than I ever did before the meltdown.

“We on the conservative side are/were saying that those who signed mortgage contracts knew the terms of their contracts and to say later that they were fooled is just trying to deflect their poor decision on someone else.”

Of the actors involved here which one had a better handle of the precise nature of the risks involved in these kinds of loans and did the banks profit from this arrangement?

rusty49

Three questions regarding your post:

1) Do you not believe that deceptive loan practices existed. If you do believe that they did, whose responsibility is the deceptive practice ?

2) The government “forced the banking industry to ease their standards for securing a home loan”. But you are not suggesting that the government forced them into a lack of transparency, or deliberate attempts to hide the true costs are you ?

3) ” Those of us on the conservative side applaud the higher bar that the banking industry has now implemented to get a home loan”

Do you believe that this “higher bar” would have been implemented without significant public and governmental pressure on the industry ?

I love your sources for the story, the New York Times, which we all know where they stand on the political aisle and the Center for Responsible Lending which is a Soros backed left leaning think tank. Here’s a couple of different takes on the Center:

“Center for Responsible Lending: Funneled bad mortgages to Fannie Mae & Freddie Mac; player in the subprime mortgage crisis. According to Phil Kerpen (vice president for policy at Americans for Prosperity), CRL “shook down and harassed banks into making bad loans to unqualified borrowers.” Moreover, CRL negotiated a contract enabling it to operate as a conduit of high-risk loans to Fannie Mae.”

and here’s another description:

“The Center for Responsible Lending is the most influential liberal advocacy group dealing with the financial services industry in the nation’s capital. It is the policy arm of credit unions based in North Carolina and California. Yes, its parent organization has a vested interest in the outcome of CRL’s advocacy.

The Center performs both public policy research and lobbying. (Lots of lobbying, but that is for another day.) Despite its well known left wing prejudices, the media uncritically accepts the Center’s published papers, giving the group extra heft on Capitol Hill.

The Center aggressively criticizes lending discrimination and pushes lenders to increase their underwriting to poor neighborhood where borrowers are less likely to be able to pay back mortgages. The Center is keenly interested in the redistribution of wealth and cares little about the financial safety and soundness of the banks it targets.

Lenders who fail to cooperate with the Center are accused of “redlining,” i.e. illegally discriminating against borrowers in low-income neighborhoods.”

[quote]That’s not true at all. We on the conservative side are/were saying that those who signed mortgage contracts knew the terms of their contracts and to say later that they were fooled is just trying to deflect their poor decision on someone else.[/quote]

No, many on the conservative side ARE NOT SAYING those who signed the mortgage contracts knew the terms of their contracts. We know the banks misled many of them… or at least I know they did, bc I saw it first hand (see my post above). I agree that some customers did know what they were getting into (jailed convict’s wife was given a huge loan for a house, a loan that could never be repaid), but many more did not, and were targeted with misleading information by the banks…

Also, conservatives know Barney Frank et al should not be allowed off the hook for their unsavory part in the mortgage meltdown…

BTW it is interesting that I caught this on the news this morning:

[quote]US securities regulators have sued six former executives at Fannie Mae and Freddie Mac, including ex-CEOs of both mortgage finance companies, saying they misled investors over exposure to risky home loans.[/quote]

ERM

“No, many on the conservative side ARE NOT SAYING those who signed the mortgage contracts knew the terms of their contracts. We know the banks misled many of them… or at least I know they did, bc I saw it first hand (see my post above). I agree that some customers did know what they were getting into (jailed convict’s wife was given a huge loan for a house, a loan that could never be repaid), but many more did not, and were targeted with misleading information by the banks…”

Like anything else there are always going to be some examples of fraud, but overall people knew what they were signing and didn’t care, they just wanted to get into the house. The government forced the banking industry into giving out shaky loans because they used the threat of suing them for illegally discriminating against borrowers in low-income neighborhoods. Then the gov’t further exacerbated the problem by backing the bad loans with Federal Loan guarantees. So maybe you ERM had a few cases of fraud, but by no means was that the norm.

“people knew what they were signing and didn’t care”

What do you make of revelations that Freddie Mac and Fannie Mae misled investors on the size of the risk of subprime mortgages and if they misled investors, they certainly misled the people taking out loans – no?

David, read what the lawsuit is about again. It’s the SEC that’s suing Freddy and Fannie or misleading their investors, which I am one, over risky home loan exposure. The lawsuit isn’t about the defrauding of people who took out loans, it’s about the fraud committed on investors of Freddy and Fannie.

Also from the same article:

“The SEC accused former Fannie Mae CEO Daniel Mudd, former Freddie Mac CEO Richard Syron and four other defendants of knowingly approving false statements to INVESTORS that drastically misrepresented the extent of the firms’ exposure to toxic mortgages.”

“Obama chum Franklin Raines, who worked on the president-elect’s transition team and who ran Fannie Mae when it was piling up all that bad paper, is not named in the suit, although he probably should be. Nor are some directors and members of congress named in the suit either.”

The article actually says “Obama chum”?

Be that as it may, you’ve missed my point which is that if they misled their investors, they certainly misled the people who took out the loans.

[quote]In terms of a target for the occupy movement, the banks would appear to be a fair target, as would the government.[/quote]

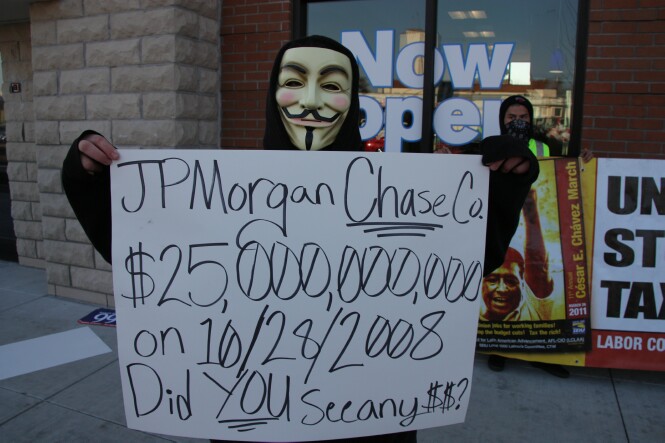

Maybe. But that is not what the protesters are saying. Talk to the people and look at the pictures.

[quote]“JP Morgan [u]Chase[/u] Co.

$25,000,000,000″

on 10/28/2008

Did [u]you[/u] see any $$?[/quote]

Is this a protest against the foreclosure process? Or is this sour grapes over a perceived notion that the banks got some sort of benefit, and they as individuals did not?

* Chase did not want to take any money, and it was forced on them by the federal government via rule changes.

* The money was not “given” to Chase, but was a forced sale of preferred stock with warrants.

* Chase paid back the entire $25,000,000,000 less than a year later, as soon as the government allowed them to do so.

* The federal government made $1,745,457,131 off of Chase alone on dividends and warrants.

Yeah, shame on you Chase! Really?

Additionally, the two biggest actors in the lending industry that have received the most money, and have not paid any back, are Fannie at $112B and Freddie at $71B.

Again, this was a forced purchase of stock, so it is not as if the government gets nothing. However, it is interesting to note that while the banks didn’t want the bailout, The GSO’s needed it.

rusty49

“Like anything else there are always going to be some examples of fraud, but overall people knew what they were signing and didn’t care, they just wanted to get into the house. The government forced the banking industry into giving out shaky loans because they used the threat of suing them for illegally discriminating against borrowers in low-income neighborhoods. Then the gov’t further exacerbated the problem by backing the bad loans with Federal Loan guarantees. So maybe you ERM had a few cases of fraud, but by no means was that the norm”

Your evidence for this statement other than your personal opinion ?

[quote]3) ” Those of us on the conservative side applaud the higher bar that the banking industry has now implemented to get a home loan”

Do you believe that this “higher bar” would have been implemented without significant public and governmental pressure on the industry ?[/quote]

Yes. I think it is obvious if you look at the higher bar required to get a non-conforming loan. That bar is higher because the bank is responsible for the loan. If the loan is conforming, then one of the GSE’s will purchase the loan, and the bank is no longer responsible. So, to answer your question, yes. When the bank is responsible for the loan, then they make sure to lend the money to people whom they are reasonable assured can pay it back. Banks don’t want to take on risky liability; it is not sound business.

Get rid of the GSE’s and the problem goes away.

[quote]In my view, there are plenty of bad actors to go around, and limiting the blame to the government probably avoids the fact that banks and other predatory lenders accumulated a huge amount of wealth off the misfortune of others.[/quote]

This is, in my interpretation, a serious misunderstanding of what happened.

Now certainly there were crooked mortgage lenders (often independent businesses, not banks) and real estate agents who encouraged their clients to misreport their finances. And this worked well for both parties as long as prices kept going up. And certainly the banks should have known better. They should have withstood government pressure to broaden home ownership by lowering lending standards.

But they didn’t as a result accumulate “a huge amount of wealth”.

If banks accumulated a huge amount of wealth, how come their market value on the stock exchanges has collapsed to a fraction of what it was before the mortgage crisis? Why have they cut their dividends? Why did Washington Mutual and numerous other banks go bankrupt?

Do you seriously believe that you can make a lot of money lending people money that they don’t repay you?

I realize there is a gap in economic interpretation on this board, but how someone could believe the above is just beyond me.

This entire debacle was about money, from all sides – investors, mortgage originators, government agencies and congress, and yes, borrowers.

It is well documented that there were cases of fraud and misleading schemes by mortgage originators. They earned profits based on loan originations, and, in many cases, they had no vested interest in the outcome of the loan. Investors bear the brunt of the bad loans, but they buying the bonds backed by riskier loans because they earned a higher interest rate for them. Government agencies, under pressure from Barney Frank to actually lend more money to less qualified borrowers, put pressure on the originators and the rating agencies to originate the risk loans.

So yes, some borrowers were duped, but these were comparatively few in number. Most borrowers were pushing to get as much money as they could, at the lowest interest rate possible. And the borrowers engaged in fraud as well by providing inaccurate and misleading documentation to the lenders. No doubt you’ve read stories of how lenders duped borrowers, but read that attached for a story on how borrowers duped lenders: [url]Good-Credit Holders Lend Their Histories for Cash[/url] Unfortunately, I can’t find the link to another story which described internet based businesses that provided false w-2 forms and provided job confirmation services for borrowers that had no jobs.

[quote]So maybe you ERM had a few cases of fraud, but by no means was that the norm.[/quote]

[quote]So yes, some borrowers were duped, but these were comparatively few in number. [/quote]

Color me frustrated at such ignorance (pardon my anger). See following website:

[url]http://www.publicintegrity.org/investigations/economic_meltdown/articles/entry/1309/[/url]

An excerpt:

[quote]With the passage of the Parity Act, a slew of new mortgage products was born: adjustable-rate mortgages, mortgages with balloon payments, interest-only mortgages, and so-called option-ARM loans. In the midst of a severe recession, these new financial products were seen as innovative ways to get loans to borrowers who might not qualify for a traditional mortgage. Two decades later, in a time of free-flowing credit, the alternative mortgages became all too common.

The Parity Act also allowed federal regulators at the Office of Thrift Supervision and the Office of the Comptroller of the Currency to set guidelines for the lenders they regulate, preempting state banking laws. In the late 1990s, lenders began using the law to circumvent state bans on mortgage prepayment penalties and other consumer protections.[/quote]

More:

[quote]The loans themselves also changed during the 2000s. Adjustable-rate mortgages, which generally begin at a low fixed introductory rate and then climb to a much higher variable rate, gained market share. And over time, the underwriting criteria changed, with lenders at times making loans based solely on the borrower’s “stated income” — what the borrower said he earned. A 2007 report from Credit Suisse found that roughly 50 percent of all subprime borrowers in 2005 and 2006 — the peak of the market — provided little or no documentation of their income.

As the subprime lending industry grew, and accounts of abusive practices mounted, advocates, borrowers, lawyers, and even some lenders clamored for a legislative or regulatory response to what was emerging as a crisis. Local legal services workers saw early on that high-cost loans were creating problems for their clients, leading to waves of foreclosures in cities like New York, Philadelphia, and Atlanta.

Wall Street Changes Dynamic

Subprime loans weren’t designed to fail. But the lenders didn’t care whether they failed or not.

Unlike traditional mortgage lenders, who make their money as borrowers repay the loan, many subprime lenders made their money up front, thanks to closing costs and brokers fees that could total over $10,000. If the borrower defaulted on the loan down the line, the lender had already made thousands of dollars on the deal.[/quote]

The fact of the matter is the federal gov’t a la Barney Frank were allowing the banks free reign to sell financially risky loan products to unsophisticated borrowers who really did not understand what they were getting themselves into. I saw evidence of this myself with my clients. Then the banks went on to bilk investors, and the hardest hit were pension funds, 401ks and IRAs. To think that fraud/misrepresentation by banks was not rampant is putting your head in the sand…

So, one of the key elements in the quote you cite:

[quote]A 2007 report from Credit Suisse found that roughly 50 percent of all subprime borrowers in 2005 and 2006 — the peak of the market — provided little or no documentation of their income. [/quote]

Hmmm. People claimed they made more than they actually did and provided no documentation, but it is the bank’s fault.

[quote]To think that fraud/misrepresentation by banks was not rampant is putting your head in the sand…[/quote]

Re-read you own links. To think that the government isn’t the biggest problem with this scenario is putting your head in the sand…

[quote]Re-read you own links. To think that the government isn’t the biggest problem with this scenario is putting your head in the sand…[/quote]

There is no question the gov’t is just as much to blame, but so are the banks. To think otherwise is putting one’s head in the sand…

[quote]A 2007 report from Credit Suisse found that roughly 50 percent of all subprime borrowers in 2005 and 2006 — the peak of the market — provided little or no documentation of their income.[/quote]

It is the bank’s responsibility to make sure documentation of income is provided, no? What you don’t seem to understand is that the banks were guilty of filling in fictitious numbers for income. See following article:[url]http://4closurefraud.org/2011/07/20/federal-reserve-orders-85m-civil-penalty-against-wells-fargo-for-steering-potential-prime-borrowers-into-more-costly-subprime-loans-and-falsifying-income/[/url]

Here is an excerpt:

[quote]The Federal Reserve Board on Wednesday issued a consent cease and desist order and assessed an $85 million civil money penalty against Wells Fargo & Company of San Francisco, a registered bank holding company, and Wells Fargo Financial, Inc., of Des Moines. The order addresses allegations that Wells Fargo Financial employees steered potential prime borrowers into more costly subprime loans and separately falsified income information in mortgage applications. In addition to the civil money penalty, the order requires that Wells Fargo compensate affected borrowers.[/quote]

[quote]There is no question the gov’t is just as much to blame, but so are the banks. To think otherwise is putting one’s head in the sand… [/quote]

Wrong. The banks are partially to blame, but not “just as much.” If the federal government didn’t pressure banks to make loans to the under qualified, *AND* take away all responsibility of the banks for the loan by having Fannie and Freddie buy them up, then we wouldn’t be in this mess. The bank conduct is the symptom of the underlying root cause the federal government set up. Like I said earlier, these problems are few and far between with the non-conforming loans that were not guaranteed by the federal government.

3 Points on your article:

1. Alleged. Let’s wait and see what becomes of this.

2. Estimated at 3500 loans, a possibility of more than 10,000. That is a very small percent.

3. Like we discussed before. This is in regards to refinancing. This isn’t directed at the original loan that got people into houses that they could not afford. If this is true, then WF bilked people out of additional moneys by getting them into sub-prime loans when they “qualified” for prime loans. According to the article, they expect people to be compensated between $1,000 and $20,000, though a few could go higher. The article makes no mention on how many people are/were foreclosed on because of this.