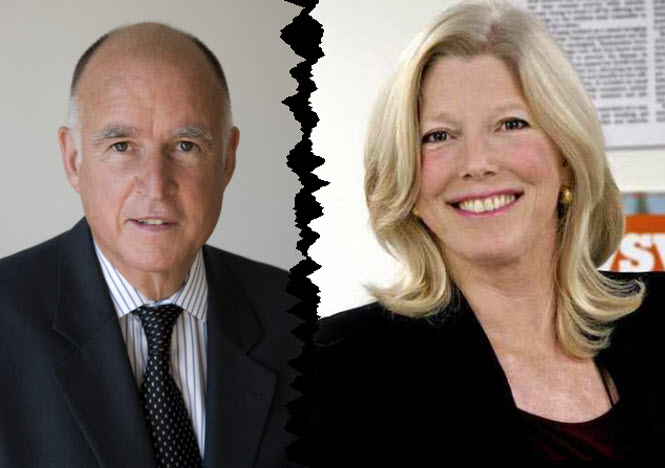

This week, just as the two sides were prepared to go to war, Molly Munger, the backer of Proposition 38, decided to pull statewide ads attacking Proposition 30.

This week, just as the two sides were prepared to go to war, Molly Munger, the backer of Proposition 38, decided to pull statewide ads attacking Proposition 30.

Proposition 30 is on life support, with recent polls showing it passing with barely 50 percent, what pundits are calling “a precarious position for a tax hike initiative with three weeks to go until Election Day.”

While the governor and campaign leaders have downplayed it, their actions speak louder than words, acknowledging on Monday, that the attacks “clearly weren’t good for us.” But adding, “But there was a public outcry, and we’re glad they’re pulling them.”

The real question is, with two competing tax bills, which one gets enacted.

There has been fear, of course, that the presence of both would be a competing factor and prevent either from passing.

As Senate President Pro Tem Darrell Steinberg said, “The real problem is that if you have multiple measures on the ballot, you dramatically increase the likelihood that they will all fail. That’s not an acceptable outcome.”

Steve Glazer, a political consultant working for Jerry Brown, added, “When voters are offered choices among competing [tax] measures, it depresses the support for each of them. The likely result will be all of them failing.”

However, there was the sense that most voters who supported one would support both. This is in part why Ms. Munger went on the attack against Proposition 30.

The reality is that the ballot measure that receives the most votes will win.

LA Times Columnist George Skelton analyzed what happens if each measure passes.

He notes that should Proposition 30 pass, “K-12 schools and community colleges will be spared $5.4 billion in budget cuts. Plus, the two university systems won’t be dinged $250 million each.”

However, he said, if voters reject Proposition 30, “Those education cuts automatically will be triggered by the current state budget that was enacted in June by the governor and Legislature.”

The problem with the scenario of Proposition 38 beating out Proposition 30 is, as Mr. Skelton points out: “In the unlikely event that Munger’s measure passes and prevails over Brown’s, the cuts still will be triggered. Her income tax increases – $10 billion annually – wouldn’t kick in soon enough to save the schools this academic year.”

The impact of that, he suggests, is, “Probably a shortened school year, by two or three weeks, and increased class sizes. That’s for starters. At the universities, tuitions again would rise.”

However, a lot of people dispute this will be the practical outcome.

Proposition 30’s opponents argue that the triggers cuts are just a threat, blackmail by the Democratic legislature that would “be rescinded by the Legislature and governor under pressure from the powerful California Teachers Assn.”

These opponents, however, ignore the history of cuts to education.

George Skelton argues that this scenario “seems improbable.”

Instead, he points out, “There’s no other spending program to cut to make up for anywhere near the $6 billion that would be lost in this budget year if Prop. 30’s sales and ‘soak-the-rich’ income taxes were rejected. The big money is in education.”

He argues that borrowing would be “irresponsible.” Though he allows, “There is ample precedence for such foolishness in the Capitol.”

He also finds it unlikely that “the governor and Legislature would do what they should have done in the first place: Raise taxes themselves without going to the voters.”

He notes that there are other revenue sources, aside from income and sales taxes. “There’s the vehicle license fee. An oil severance tax. Tobacco. Liquor. They could close the tax loophole that rewards out-of-state companies for not hiring and building in California if voters refuse to do it with Prop. 39.”

He rejects that possibility, noting that raising taxes would require a two-thirds vote and, “More problematic, it would necessitate courage and competence – the ability to compromise on a package, say, of taxes and regulatory reform. Therefore don’t count on it.”

The bottom line is he convincingly argues that if Proposition 30 fails, the schools will lose money.

If Proposition 38 passes but not Proposition 30 (unlikely), the school would be helped in the long run but like Measure E, these monies would kick in too late to save schools for January.

Everything else is really petty bickering.

—David M. Greenwald reporting

California Business Roundtable, Pepperdine University survey, Oct. 11, 2012 ([url]http://www.cbrt.org/initiative-survey-series-2012/[/url])

Prop. 30: yes, 49.5; no, 41.7

Prop. 38: yes, 41.9; no, 45.9

[quote]Millionaire Migration in California:

The Impact of Top Tax Rates ([url]http://uccs.ucdavis.edu/assets/event-assets/event-presentations/varner_young_paper[/url])

Using difference-in-differences models, which compare migration trends of the group experiencing the tax increase to a group of high-income earners not facing a tax change, neither in-migration or out-migration show a tax flight effect from the introduction of the 2005 Mental Health Services Tax.

….

There is a strong out-migration effect for high-income earners who become divorced. In the year of divorce, the migration rate more than doubles, and remains slightly elevated for two years after the event. This shows that there are circumstances that do generate millionaire migration. The tax policy changes examined in this report are very modest compared to the life impact of martial dissolution.

….

Most people who earn $1 million or more are having an unusually good year. Most “millionaires” earned less in years past, and they are not likely to earn this much again. A representative “millionaire” will only have a handful of years in the $1 million + tax bracket. The somewhat ephemeral nature of very high income is one reason why the top-income taxes examined here generate no observable tax flight. It is difficult to migrate away from an unusually good year of income.

[/quote]

In spite of the information offered above, there is this caveat:

[quote]July 7, 2010, Boston Globe: How facts backfire Researchers discover a surprising threat to democracy: our brains ([url]http://www.boston.com/bostonglobe/ideas/articles/2010/07/11/how_facts_backfire/?page=1[/url])

“when misinformed people, particularly political partisans, were exposed to corrected facts in news stories, they rarely changed their minds. In fact, they often became even more strongly set in their beliefs.”[/quote]

Oct. 24, 2012, Public Policy Institute of California Poll ([url]http://www.ppic.org/main/pressrelease.asp?i=1291[/url])

Prop. 30: yes, 48; no, 44

Prop. 38: yes, 39; no, 53