One of the questions that has arisen, going through the discussions on the Davis Downtown, is whether the only redevelopment we are likely to see is going to be very high density. One of the recent quotes is that the fiscal analysis showed “redevelopment only made financial sense when it was greater than or equal to 4 stories tall.”

But longtime City Planner Bob Wolcott believes that is “too simple” a conclusion to reach as there are “too many factors.”

For example, he notes, “A new one-story pizza restaurant is being built at the southeast corner of B and 3rd right now.” At the same time, he believes that is “atypical” and “in general the following studies show how challenging it is to feasibly redevelop / build downtown using basic assumptions.”

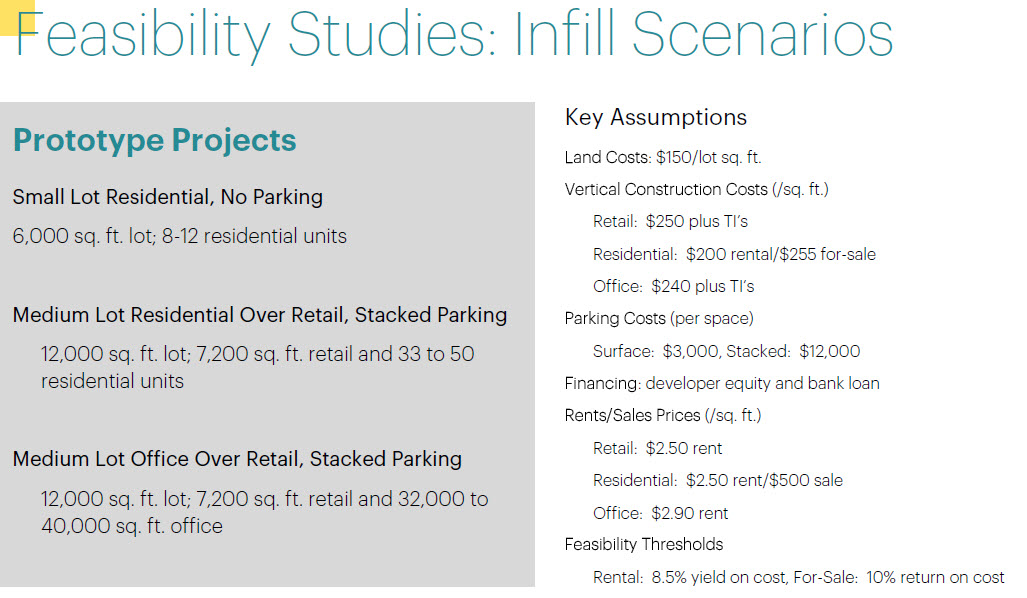

The Bay Area Economics (BAE) group prepared a pro forma on the financial feasibility “to evaluate the feasibility of retail, office, and residential (for-sale and for-rent) projects, including mixed-use projects.”

This was presented back in June.

They note: “A pro-forma financial analysis models the costs of developing a real estate project and then calculates the financial returns (either net rental income for net sales proceeds) to the developer. Then the rate of financial return is compared to a target rate of return that is considered acceptable under current market conditions, to determine if the project would be financially attractive to developers, investors, and lenders.”

There are a number of cost assumptions. For instance, BAE “has assumed a site acquisition cost of $150 per square foot.” They believe the demolition costs, based on consultations with contractors as well as private experience, will be about $5 per lot square foot, for the removal of old structures.

The new construction cost will range between $200 and $255 per square foot, that depends on the use type, “plus additional TIs of $25 per square foot for office and retail spaces.”

There are also parking costs: “BAE estimated parking construction costs will range from a low of $3,000 per surface parking space, to $12,000 per space for spaces created using car stacking systems, to $30,000 per  space for podium parking, to $45,000 per space for subterranean parking space. The financial model also includes an assumption of $8,000 per space for projects paying a parking in-lieu fee.”

space for podium parking, to $45,000 per space for subterranean parking space. The financial model also includes an assumption of $8,000 per space for projects paying a parking in-lieu fee.”

There are other costs as well, including a “range of miscellaneous costs when undertaking development projects,” which they estimate at “20 percent of demolition and construction costs.”

There are also permits and fee costs. Financing is assumed at a 1.5 percent loan fee with a six percent annual interest. They write: “The bank financing terms are based on interviews with a range of local construction lenders, and assume that a developer would be able to finance 65% of the project cost, at an annual interest of 6.0 percent.”

In terms of feasibility targets: “To determine if prototype projects are financially feasible, it is necessary to establish an assumption about the level of project profitability that will be necessary to attract interest from developers and their investors and lenders.”

In general, these are the feasibility targets:

- 5% yield on cost for income-producing projects

- 10% return on cost for for-sale projects

They then looked at three prototypes:

- Small lot residential with no onsite parking

- Medium lot mixed-use residential over retail; 30 stacked parking spaces

- Medium lot mixed-use office over retail; 30 stacked parking spaces

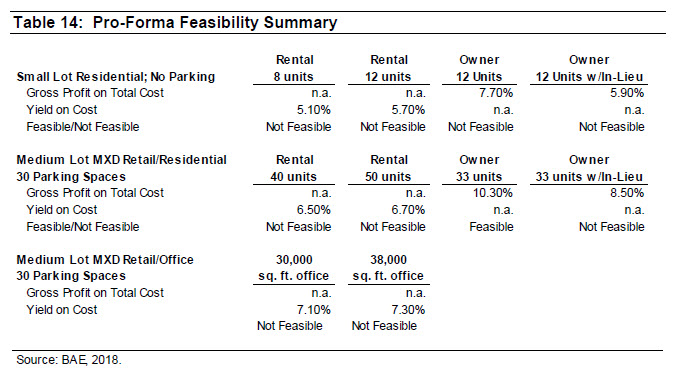

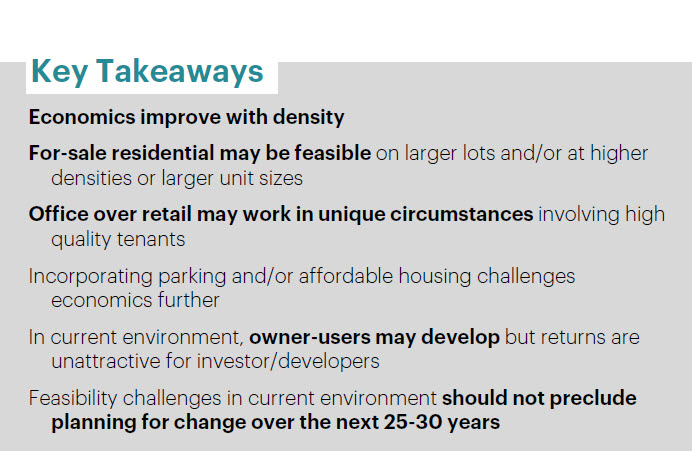

BAE concludes: “These results indicate that under current conditions, it will be very difficult for developers to undertake projects similar to the prototype projects, with a few exceptions. As mentioned previously, it appears that a medium-sized mixed-use project incorporating high density for-sale residential units could be feasible.”

However, they do caution that “the pro-forma analysis models project feasibility strictly from the standpoint of investor/developers, and not from the standpoint of owner/users.”

They note: “For the owner/user, the evaluation of ‘feasibility’ may be influenced by considerations of establishing control of the premises where they operate their business…” They specifically cite the mixed-use office/laboratory over residential project on C Street between 2nd and 3rd Streets as well as the Coldwell Banker real estate office.

That was a point made to the Vanguard when someone cited the C Street project. It was an owner who was a user at the site who initiated the project. They noted that “a developer or investor would never, ever initiate a project like that.” It appears BAE would agree and cited that project specifically, as well as the Pizza 101 project Bob Wolcott cited as examples of owner/users undertaking projects.

BAE concludes that “development feasibility in Downtown Davis is challenging under current conditions.”

The takeaway is that “developers undertaking speculative real estate development projects in Downtown Davis face unique challenges, including scarcity of sites, high site acquisition costs, and limited profitability.”

There are important ways that the City of Davis can positively influence development feasibility, including:

- Reduce project risk and project timelines by establishing clear planning guidelines for the desired development types and reducing or eliminating discretionary review processes;

- Allow increased densities, so that developers can achieve greater efficiencies of scale on the limited number of available sites, including better spreading the high cost of site acquisition;

- Limit requirements imposed on downtown development projects which would translate to increased costs that do not bring corresponding revenue increases; and

- Consider entering into public-private partnerships with developers to help put together feasible development projects that attract new businesses to downtown. This could include utilization of City-owned land on terms that help to bridge feasibility gaps where there is an expected return on the City’s involvement.

A huge consideration would be to reduce time and risk for developers.

BAE suggests providing “clear planning guidelines,” limiting discretionary decision-making, provide environmental clearance such as Specific Plan EIRs, provide fast-track path to entitlements, and “follow through with streamlines and efficient building permit and inspection procedures.”

—David M. Greenwald reporting

Well, the answer is simple then. Don’t have developers or investors initiate projects downtown.

Developer 101: Can’t make a profit under four stories downtown.

Pizza 101: Build 1 story building, sell pizza, and lose tons of money by not listening to above advice.

“Don’t have developers or investors initiate projects downtown.”

Then you’re not going to have a lot of redevelopment.

“Don’t have developers or investors initiate projects downtown.”

Owner/occupants are not going to build the office buildings downtown that are needed to generate the retail foot traffic required to keep our retail businesses and restaurants viable. We’re already seeing that decline in viability with the closure of current storefronts.

i see you took me seriously

Wow! If that isn’t Orwellian code. What do they mean by “high quality tenants”? Rich w–te people? None of those #&$%* “low quality” tenants?

No s–t Sherlock. So does a gold LEED rating, architecturally attractive add-ons, and the tri-sex unicorn landing pads.

“gold”, Alan? Thought the minimum we should accept is “platinum plus”… plus super affordable, aesthetically gorgeous, and all workers getting UBI plus 15%…

And 100% contribution to structures over SR-113 and I-80, jump-bikes free including those for folk over 250 lbs, fully funding obesity education/eradication, etc.

I am hoping the city “allows” people to build more housing downtown and if it works out great, but I don’t want to see tax money spent to bring more people downtown so the coffee shops, pizza joints and new pot stores have more customers.

P.S. My guess it that the city won’t be able to “get out of the way and see what get’s built” and will probably add even more restrictions like mandatory full electric JUMP “trikes” (and JUMP charging stations) for those over 250 who worry that even the little pedaling they have to do with the JUMP “bikes” might slow their progress to 300 when they can apply for obesity disability and get on SSI.

https://www.disability-benefits-help.org/disabling-conditions/obesity-and-social-security-disability

I think the analysis here is pretty clear. There is a very narrow path going forward on this.

Doublespeak 101: Public-Private Partnership = SUBSIDIZED

Actually, a lot of fluffy feel-good terms actually = subsidized.

Seek and yee shall find.

Public-Private Partnership:

Useful to achieve goals that would otherwise lack achievement feasibility.

We should be looking at almost all government services as being a public-private partnership.

So you’re in favor of corporate welfare?

Alan – you read the analysis, so what is your proposed path forward?

Why would there be 0% “return on cost” for for-sale projects?

Can someone explain what the various terms mean (and the differences between them), including “yield on cost”, “return on cost”, “return on investment”, etc.?

And, what investors expect for each one? And, why it’s different for outside investors, vs. owner/investors? Is outside investment (which generally results in dislocation of existing businesses) a “good” thing?

Google is your friend…

In this case it was a typo, 0% was missing a “1” so it should have been 10% return

I have removed several comments. Please stay on topic. Thanks.

If we were serious about meeting our fiscal obligations then any discussion of the downtown should have started with how we can create a downtown business district that addresses our ongoing budget shortfall. With that in mind, the feasibility study should have been one of the first things to be considered, not the afterthought that has been presented. If we know that the desired mixed-use redevelopment will need to be at least four-stories tall to be financially feasible, then we should not have wasted so much time contemplating maintaining the current two to four-story maximum through most of the downtown. In reality, if you are not willing to consider a six to an eight-story project located somewhere (anywhere) between the University and the railroad tracks, and first and fifth, then you really are not serious about having the City pay its bills or appropriately house our residents.

Mark… you are technically correct…

Yet am afraid most in town want Mayberry RFD, with a Lake Wobegone school system where every child (regardless of ethnicity, socio-economic status, parental education and/or motivation) is far above average… and, no local taxes, perfect streets, etc.

I think having downtown 50% 4-5 story, mixed use, economically viable, is possible… in 50 years, given the political climate and interest… if we made the commitment next week…

Yeah, am a tad cynical (or realistic?) today… look at the Davis track record for the last 101 years…

If we had implemented the plan the community came up with back in 1961 we might have a positive future, but the plan we are working on today will do nothing other than protecting the status quo, which will inevitably lead to insolvency (and/or much greater rates of taxation).

All because of the fear of tall buildings…

Like I said, Mark… 50 years…

I agree that the ’61 plan was basically good/sound, but, it would probably wouldn’t have brought forth great fruit until about 7 years ago. (opinion)

I agree we need to start doing something different now, but I still do not see a “harvest” of benefits in the near term… but if we don’t start, and commit to a plan now, folk will be having the exact same discussion 10, 20, 30 years from now… (opinion)