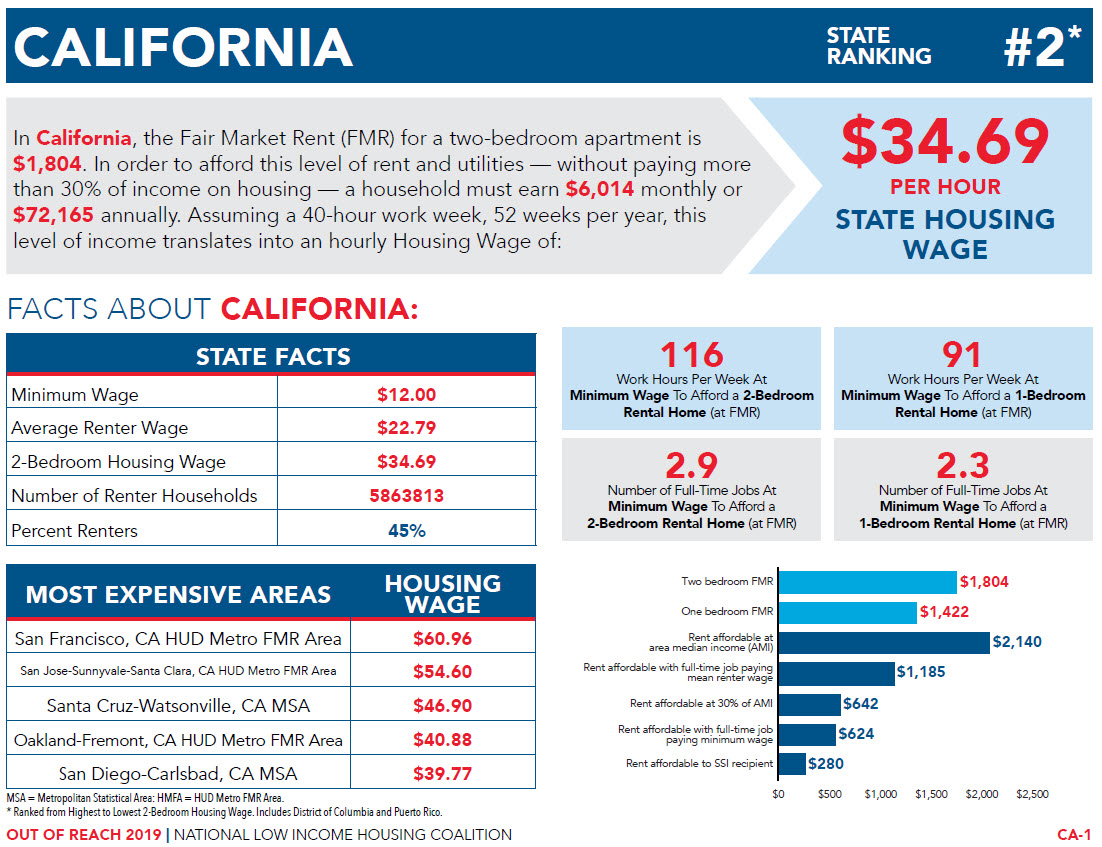

A new report by the National Low Income Housing Coalition finds that the Fair Market Rent (FMR) for a two-bedroom apartment is $1804 in California. According to their findings, “In order to afford this level of rent and utilities — without paying more than 30% of income on housing — a household must earn $6,014 monthly or $72,165 annually.”

The report ranked California second in the hourly wages required to be able to afford rent in a two-bedroom home. Hawaii was ranked number one.

Yolo County according to the data was below the state average, with the average two-bedroom costing $1342 requiring an hourly wage of $1342 and an annual income of $53,680. However, according to the latest UC Davis rental survey, the average monthly rent in Davis was $1815 or right about the state average.

“In my district, the Massachusetts 7th, one of the most diverse and unequal districts in our nation, we are distinctly aware of the interconnectedness between housing and economic opportunity,” Congresswoman Ayanna Pressley of Massachusetts explained in the report. “The lack of affordable housing is perhaps the greatest challenge to successfully ending homelessness and lifting millions of people out of poverty.”

“Much has changed in the past 30 years. New data sources and the internet have fundamentally changed how people access and disseminate housing data,” said NLIHC President and CEO Diane Yentel. “What has not changed is that the U.S. has a deep and pervasive housing crisis affecting millions of renters and a pressing need to educate and  mobilize people to end it.

mobilize people to end it.

“Our rental housing needs have worsened considerably over the past 30 years,” she said. Back in the late 1980s, housing assistance reached only 1 in 3 eligible households. She said, “Today, housing assistance reaches fewer than 1 in 4. The private market has lost more than 2.5 million low-cost rental units since 1990, and rent increases have significantly outpaced income growth and price increases for necessities like food and transportation. Wage inequality has worsened between black and white workers at all wage levels, exacerbating the racial housing inequities that have long plagued the nation. Affordable rental housing for low-income people is significantly further out of reach now than in 1989, despite a massive increase in wealth for higher-income households.”

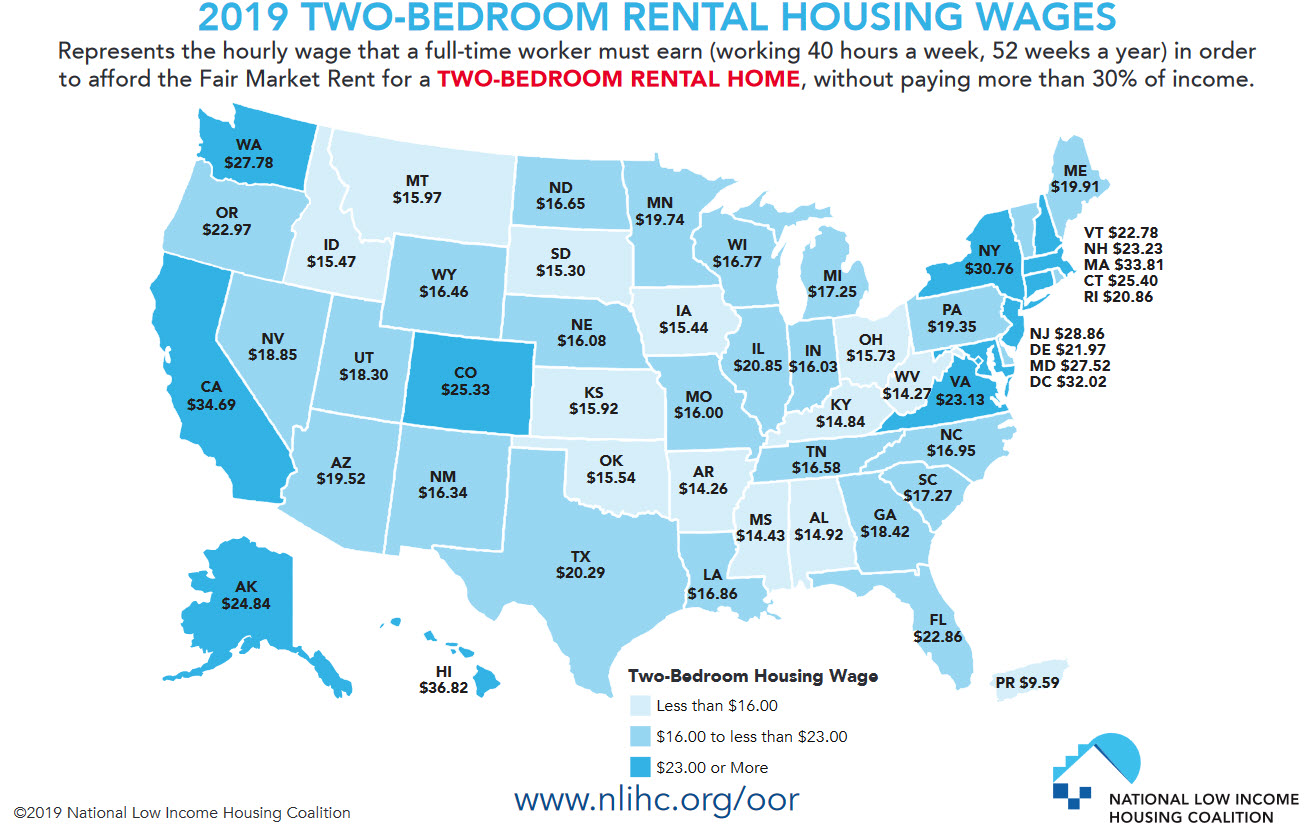

The report found, in 2018, the National Housing Wage was $22.96 “for a modest two-bedroom rental home” and $18.65 for a modest one-bedroom rental home.

That means, “A worker earning the federal minimum wage of $7.25 per hour must work nearly 127 hours per week (more than 3 full-time jobs) to afford a two-bedroom rental home or 103 hours per week (more than 2.5 full-time jobs) to afford a one-bedroom rental home at the national average fair market rent.

“The struggle to afford rental housing is not confined to minimum-wage workers,” the report continues. “The average renter’s hourly wage is $5.39 less than the national two-bedroom Housing Wage and $1.08 less than the one-bedroom Housing Wage.”

The result of this is that an average renter must work 52 hours per week to afford a modest two-bedroom apartment of his or her own. The report notes that is a task that “is even more difficult for a single parent of a young child or a person with a disability.”

Indeed, the report finds, “In only 10% of U.S. counties can a full-time worker earning the average renter’s wage afford a modest two-bedroom rental home at fair market rent, working a standard 40-hour work week. The same worker could afford a modest one-bedroom apartment in 41% of U.S. counties.”

Here are some figures for California…

While Yolo County is better than state average, Davis is right at state average. Sacramento is also more affordable compared to the state average.

While Yolo County is better than state average, Davis is right at state average. Sacramento is also more affordable compared to the state average.

In Sacramento, a two-bedroom apartment requires an hourly wage of $23.46. That means someone working for minimum wage would have to work at least two full-time jobs. The average renter in Sacramento makes $17.02 hourly and at that amount would have to work 56 hours a week.

On the other hand, Marin County required the highest income in California, according to the study, where residents would have to make $60.96 an hour to afford a two-bedroom home. A person who makes minimum wage would have to work at least five full-time jobs to afford it.

Modoc County required the lowest income, according to the study, where residents would have to make $13.46 an hour. A person renting there would have to work 44 hours a week for the rent to be 30 percent of their income.

—David M. Greenwald reporting

All of the above, as to “rental wage” appears to assume 1 wage-earner per unit.

It also mixes “apartment unit” with “house unit”.

Or share a two-bedroom apartment with a second wage earner.

As noted by Bill, there seems to be an underlying premise of this whole analysis that a single wage earner is going to be living in a two-bedroom apartment. I suspect that is barely relevant to the Davis housing and job market. It probably isn’t actually relevant to most job and housing markets.

I agree with that point but you’re missing another. Single mothers with children.

I didn’t miss that “point”…

That is an issue unrelated to general “housing crisis”… to use that “point” to generalize to all housing costs is spurious, at best.

It begs questions as to why is a mother (or father, there are those, too, or do you believe that mothers are single,with children… I know a bunch of folk where that is true… or playing a “sympathy card”?) is single, with children. With no alimony and/or child support.

Now, if the piece was about “Problems Single Women with Children Face as to Finding Affordable Housing”, that would be different. But the main points of the article is not about that.

I disagree. The housing crisis such that under the best of conditions, it affordability is in grasp, but it’s a reach and strain. Anything that goes wrong, and you have a problem.

You are correct. We disagree.

No kidding Sherlock… I beg your pardon, society cannot promise everyone a rose garden…

BTW… housing affordability was critical for me about 12 years of my adult life… if anything had gone wrong, we’d have been screwed… but, it didn’t, but for sure there was anxiety on my part… I was the responsible party. I have that T-shirt.

Today, no financial anxiety. Replaced by others.

They are – in Secret Land.

Single parents are good candidates for income assistance.

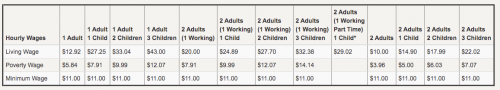

Per the MIT living wage calculator for Yolo County, a single person’s Living Wage is $12.92/hour. Once that person has a child, their Living Wage becomes $27.25/hour. But if two adults have one child, their Living Wage is $14.90/hour (each).

Having a child is very expensive. I don’t think we can efficiently tailor housing policies to the needs of that specific demographic. Income assistance as in housing vouchers or direct subsidies will be much more efficient use of tax dollars.

Yep. I affirm.

An individual who makes 13.50 – 15.00 per hour, using the standard of housing costing 30 – 35% of their income, would be seeking to rent a place where their share of the rent would be from $725 up to about $945 per month.

So they would be looking at units in the 2 br @ $1450, up to 3 br @ as much as $2835 per month.

Those would definitely be at the low end of the rent spectrum in Davis. More to the point, they barely exist here.

I am acquainted with an individual who applied to 9 apartments, each with a $45 non-refundable application fee, before finding one that would rent to them. They had decided they would pay a higher percentage of their income than the 30 – 35% norm, but that was not acceptable to the apartment managers. With a very low apartment vacancy rate, the landlords can afford to be strict about the income limit.

Consideration of out-of-town rentals included the daily cost of commute, which is about $5 a day.

Those are the relevant statistics for the Davis market. I think the National Low Income Housing Coalition is focused on family units. The majority of Davis renters are fully prepared to share housing with at least one other wage earner.

Right arm, Don!

And, now that apartments in Davis are trending to rent by bed/bedroom… (and those are two different things, as well)…

As a UCD student I and future spouse lived in two bedroom apartments, with two beds/room. We paid by the dwelling unit.

The rental/utility costs were split 4 ways..

So 90% of workers are homeless?

Note that “home” is not clear as to SF or MF.

Alan, “figures don’t lie, but liars can figure”. Suspect strongly you know that adage.

Many statisticians ask their client, “what answer would you like? I can come up with the numbers…”… same for accountants, auditors, and attorneys… (the 3 A’s… double entendre intended)

A pinch of salt is good for body and mind.