By David M. Greenwald

Executive Editor

Sacramento, CA – A report this week released by the Greater Sacramento Economic Council and Newmark, found that the “region is one of the fastest growing in California and one of the most diverse in the country. Just 88 miles from the Bay Area, the region’s talent pool is unmatched and investors are taking note. Over $13 billion was invested in Greater Sacramento over the last five years – with roughly $4 billion invested just in 2021.”

Indeed, “With all this activity, business relocation and expansion projects in the region jumped 19% in the past year alone.”

Overall the White Paper found “the Greater Sacramento region is on a major growth trajectory as investment, population increase and expanding opportunities for talent and education go into overdrive.”

Among the key findings, “Venture capital activity jumped significantly in the past year, including multiple IPOs, a $1.8 billion SPAC merger and an $800 million venture raise. The region has also seen interest for  business relocation and expansion jump about 19%, while year-over-year net migration soared 56% in 2020.””

business relocation and expansion jump about 19%, while year-over-year net migration soared 56% in 2020.””

It also found this was a highly educated and diverse workforce.

“About 734,000 students are enrolled in two- and four-year institutions within 100 miles of Greater Sacramento, and the region ranks third in the nation for diversity in both tech and STEM,” much of that of course due to the presence of UC Davis.

“Greater Sacramento has seen incredible market momentum over the past five years,” said GSEC President & CEO Barry Broome. “There’s been a real shift in how executives across the country and world view our region. These leaders recognize that Greater Sacramento is the place to do business in California.”

While areas of California and the nation have struggled, “Greater Sacramento’s regional economy showed incredible resilience during and after the pandemic as it continued to attract investments and make progress on significant projects”

Folsom’s PowerSchool, for example, saw its valuation rise to $3.5 billion following its IPO in 2021. UC Davis broke ground on Aggie Square, a $1.1 billion, 1.2 million-square-foot life science research park at its Sacramento campus, developed by Wexford Science & Technology.

In a release, GSEC noted, “To spotlight this growth and further entice others to the region, GSEC is launching the Capital Momentum campaign, an initiative that will highlight groundbreaking developments and opportunities within California’s capital region. The campaign will be geared toward decision-makers and national site selectors for major companies.”

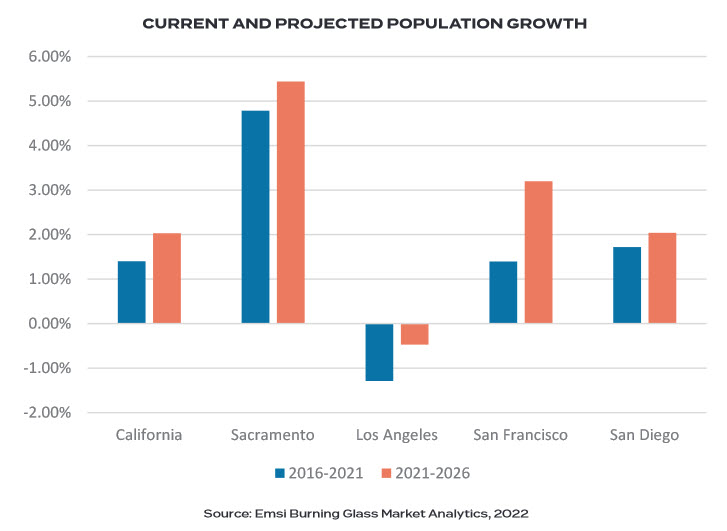

Unlike other areas of California the Greater Sacramento Region has grown over the past five years and “is expected to grow even more over the next five.”

They found, “The region is growing faster than all major California markets and the state as a whole. Greater Sacramento has grown by about 5% since 2016, adding 117,783 net new residents. Greater Sacramento’s growth is expected to accelerate over the next five years, increasing the population by 5.4%.”

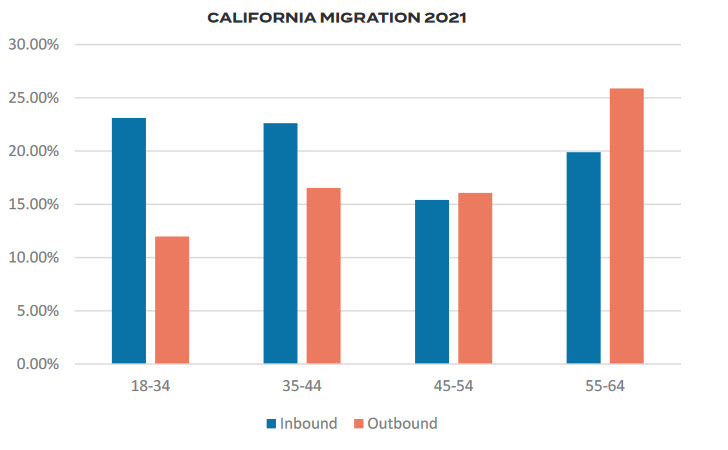

Moreover, it continues to be a draw for young talent.

One finding is a “a net positive migration to California of individuals between 18 and 44 years old.” Furthermore, “millennials (ages 25-39) make up the largest share of the region’s population. The region has 543,534 millennials, more than the national average of 525,754 for a similar sized market.”

Diversity has also increased. “Sacramento is the second most diverse city in the United States (2020 U.S. Census). There are 1.26 million racially diverse people in Greater Sacramento, 22% higher than the national average of 1.03 million for a similar sized market.”

Furthermore, its location near a huge center for universities makes Greater Sacramento “an increasing attractive market for companies seeking educated, young professionals.” The report notes, “The region is home to a strong higher education system and is just 90 miles away from the San Francisco Bay Area, which boasts some of the best universities and talent in the world.”

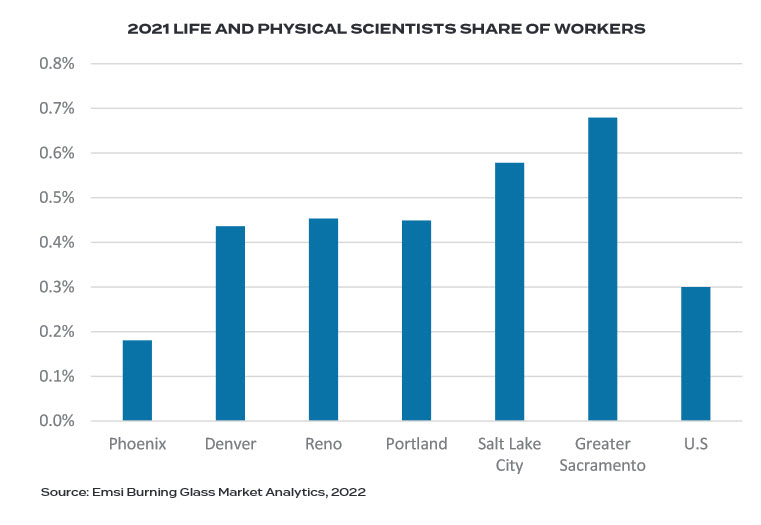

Greater Sacramento also has a strong STEM base, with “nearly 2x more STEM degree completions within 100 miles than Phoenix and Austin.”

The region also boasts a large share of life scientists—most among peer groups and twice the national average.

Greater Sacramento’s growing innovation infrastructure supplies entrepreneurial resources, financing and collaboration for start-ups and businesses to grow and thrive.

Bayer CoLaborator: A shared lab space for biotech startups located at the global headquarters of Bayer Cropscience Biologics group

Black Star Fund: Invests in Black founders

FourthWave: Supports women-led tech

Folsom Innovation District: Innovation network that connects startups to accelerators, funding, co-working spaces and partnerships

Growth Factory: Regional accelerator for early-stage startups

Carlsen Center for Innovation and Entrepreneurship: Platform for entrepreneurial education, community and support hosted by Sacramento State

Lab@AgStart: The only integrated wet lab and food lab in Northern California, featuring 4,800 square feet of shared wet lab, food lab and coworking space

Inventopia: A life science and engineering incubator with wet lab, coworking and engineering prototyping spaces

Regional fintech consortium: Composed of state regulators, venture capitalists, financial institutions and fintech firms, the consortium funds and fuels efforts to recruit, retain and attract fintech firms and jobs across the regional ecosystem

The report found overall that the “office market remained stable over the last few years, in spite of the COVID-19 pandemic. The vacancy rate was 12.1% in the first quarter of 2022. Over the past two years, the office vacancy rate fluctuated between 10.1% to 12.1% but the quarterly vacancy changes were minimal.”

Moreover, the “industrial market not only survived the pandemic but thrived during it. Among the various sectors of commercial real estate, industrial real estate is uniquely positioned for success in the wake of the pandemic.”

It found, “Strong rent growth, strong leasing demand, limited available land and relatively low interest rates created a red-hot sellers’ market for existing industrial buildings in Greater Sacramento. This momentum is expected to continue.”

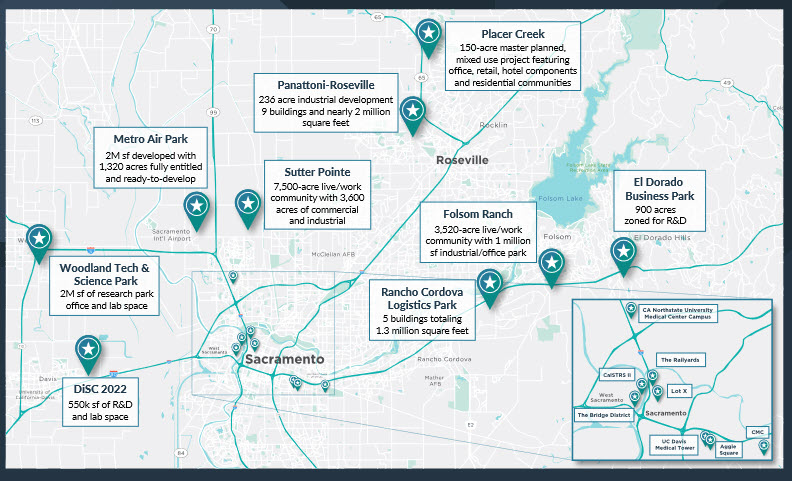

Finally the report found: “Momentum in Greater Sacramento’s population growth and industry advancements is driving the creation of new developments that will change the economic landscape of the region”

The report concludes: “The region continues to attract diverse talent and offers access to one of the strongest labor markets in the nation, with more than 730,000 students within a 100-mile radius and high STEM degree completions. As more people are drawn into the region, companies and investment will continue to grow.

“Venture capital activity was at an all-time high in 2021 and business relocation and expansion projects jumped 19%. These trends are expected to continue in the coming years and are fueling additional investment.”

Finally, “As key developments become available, the region is set for an unprecedented economic shift.”

California lost population, for the second year in a row.

Anecdotally, I can tell you that there’s a disconnect between how this is viewed by officials/media, vs. residents (e.g., in places like San Francisco). You can see it in the comment sections of local media (such as The Chronicle), as well as alternative publications such as 48 Hills.

Note the word “blame“, here (from the NY Times), for example:

https://www.nytimes.com/2022/05/04/us/california-population-decline.html#:~:text=For%20the%20second%20time%20in,sharp%20drop%20in%20foreign%20immigration.

In any case, if the Sacramento region is growing, that’s only because it’s pursued (via sprawl), and is still much cheaper than the Bay Area. Is that cause for “celebration”?

[edited]

Just came across this, as well:

https://www.msn.com/en-us/money/realestate/housing-affordability-plummets-in-california-sacramento-region-where-it-s-the-worst/ar-AAWTAEE

That’s an erroneous conclusion. Kind of a cart before the horse type of reasoning. The region is growing because of previously existing relative affordability and growing industries in the region. The sprawl is a RESULT of those factors creating demand for housing and pushing sprawl in the region.

Your problem is that you see it as a completely black or white scenario. Secondly you’re essentially complaining about the weather….something that just happens and you can’t do much about except mitigate it’s effects. Your problem is that you’re under the delusion that you can control the effects of regional and local growth through anti- growth measures. Growth in the region will bring economic prosperity to the region. That’s a good thing. Will the growth sprawl outward? Unfortunately Yes. To what degree and under what conditions? That we can try to mitigate to varying degrees.

No the developers are not in full control of the region. If they were, they’d be building more houses. I’ve said before that builders control the supply of houses as to not effect the optimal returns on their investments. But constraining the supply happens more during a downturn so they won’t flood the market with homes when prices are low. They’re not going do anything to lower prices. But when the market is hot; they’re going to want to pump out as many houses as they can. Builders are under supply, manpower, political and land/infrastructure constraints.

Your implication is one of blame of Biden. That’s galactically moronic. The blame goes to the last couple of years of the Obama administration who should have cooled the economy after the growth stimulus it enacted after the Great Recession. But it’s hard to start cooling the economy when you want your political successor to win an election. Then the Trump administration and his lot were financial crackheads addicted to cheap capital used to inflate economic (and personal financial) growth. The Trump administration should have slammed the brakes on the economy in his first couple of years in the office. But that would be like telling an addict to quit cold turkey. By the end of the Trump administration and the beginning of the Biden administration Covid hit the country so an economic stimulus had to be applied to an already overly inflated economy. That’s hardly Biden’s fault. The alternative would to have let economy freeze during Covid; then you’d have really seen everything crash. Instead he had to keep inflating a leaky already overinflated balloon.

You’re kidding, right? Developers are in full control of this region. This is a decision that is made by local politicians whom the developers support in the first place. The same is true regarding the pursuit of “growing industries”, though much of the residential growth would be pursued regardless (e.g., in places like Folsom, which is probably attracting retirees from the Bay Area).

Not to mention those who commute to the Bay Area.

By the way, how long has the railyard development been going on for? Or, the ARCO arena re-use?

“can’t do much about”. Uhm, you’ve heard of urban growth boundaries, right? You’ve heard of Measure J? You’ve heard of slow-growth candidates for councils, right? (Well, not too many of the latter in this region, if any.)

They are.

They’ll “catch up” right around the time that the housing crash is fully-underway.

Talk with Trevor Noah about that. 🙂

Tell you what, if you don’t respond further, neither will I (to you). How about if we not waste our time with this, today?

Given that your first response was one of pure ignorance and conspiracy garbage…..yeah let’s not talk too much more. Well…duh! Developers are in league with local politicians….stuff doesn’t built otherwise. That doesn’t mean there’s a conspiracy by builders to constrain supply during boom times. That’s just flies in the face of all rational thought…which is builders (and politicians) are in it to make money. Builders make money by building stuff. Constraining supply during a boom time does not make them money. I’ll tell ya what…you give me the name of the builders that you’ve talked to that say they’re actively trying to not build during this boom time and I’ll agree with you.