Given that voting on the rates on this water project begins in just over two weeks, it is perhaps surprising that we have so few answers as we do to still very critical questions. But there we were on Tuesday night, on the eve of sending out the Prop 218 rate notices, and the Davis City Council suddenly made the decision to switch from a partially-debt funded financing process to an all-debt funded financing process.

Given that voting on the rates on this water project begins in just over two weeks, it is perhaps surprising that we have so few answers as we do to still very critical questions. But there we were on Tuesday night, on the eve of sending out the Prop 218 rate notices, and the Davis City Council suddenly made the decision to switch from a partially-debt funded financing process to an all-debt funded financing process.

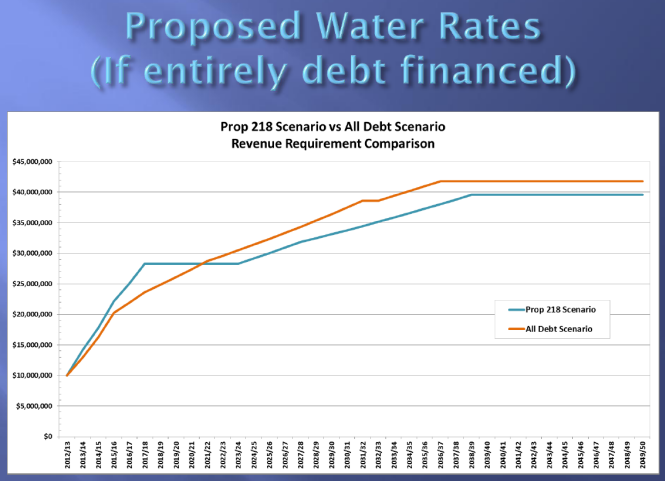

In the process of that discussion, Herb Niederberger, the City’s General Manager of Utilities, presented the council with a graph comparing the revenues needed in both options.

The city, much to our frustration, has been dragging its feet on getting critical data to the public on the overall cost of the project – and also the cost of no project. The proponents of Measure I have argued that, because we have borrowed for the JPA and have put off much-needed infrastructure improvements, the cost of not doing the project will be considerable.

The problem is that we do not know how much the no-project option will cost us, and how much our rates may go up anyway because of it.

At the same time, the graph affords us a rough approximation of how much revenue the rate increases will produce. One of the points that the opposition made in our interview is that the project is going to cost considerably more than they are letting on, with the financing and other cost increases. There have been suggestions about hiding the ball and hidden costs.

Again, because the city has been dragging its feet on getting this data out to the public, and has been preoccupied with preparation of the Prop 218 mailing (rightly so), we have no way of answering some of these critical questions.

But the graph allows us, for the first time, to estimate the costs.

We start with the baseline of $10,000,000 which is the projected revenue for this year, some of which may be produced with increased rates following the Prop 218 process and the Measure I election.

We will limit our analysis to a 30-year period from 2013 to 2042.

Assuming that $10 million baseline over the period stays constant (which is absurd, but we are using it as a point of comparison), we see that the city generates $300 million in revenue.

We then take a more realistic assumption of 3% annual inflation – figuring that if the costs of water stay constant with the costs of inflation, we are looking at about $475 million in revenue over the 30-year period.

The projected revenue for the chart, however, is far greater. For the purposes of this analysis, we use the blue line rather than the orange line as our comparison point. That was the estimated cost of the project as originally conceived. With the fully-debt financed project, this number will be somewhat higher.

Over the next 30-year period, we see that the rate increases will produce $937 million in revenue, $461 more than the inflation-adjusted baseline revenue.

That figure, of course, leaves out population increase estimates, but we do so for the reason that we are looking at revenue projections, not rate estimates.

One of the key questions that the city needs to address is why we need that much revenue for what is a $113 million project. Even if we estimate the debt financing at 2.5 times that amount, we still end up at about $282 million.

Some of that answer is going to be capital upgrades that have nothing to do with the project itself. For instance, the Vanguard was told that we will need a third water tank sometime in the future, regardless of whether we use surface water or groundwater.

But even the blue line is ultimately generating revenues somewhere around $40 million per year toward the end of the 30-year project. Moreover, even after the 30 years ends, it appears those revenues are not projected to go down.

This seems to be a critical question that the council, preoccupied in the debt financing issue, never bothered to ask on Tuesday night. But we have no public accounting for what is going into this revenue assumption, and why we need this level of revenue to finance this project.

What the voters need to fully understand, in addition to that question, is what the costs are going to be for no project. Herb Niederberger, back in November, suggested a 62% rate increase even without this project. But some have suggested that the real number will be far higher than that.

At the Vanguard‘s interview, Elaine Roberts Musser, who chaired the Water Advisory Committee, also noted the difficulty of coming up with a realistic estimate. After all, she reasoned, we cannot predict if a well will fail, how many wells will fail, and the cost for replacing those failed wells.

However, we do have known expenditures for the JPA, we do have known capital upgrade costs irrespective of the project, and we can anticipate what it would take to maintain the current system into the future. We should be able to approximate a rate structure, in the absence of the project.

It is, in fact, one of the more critical questions that we face. After all, if we end up tripling the water rates under the project, that is a shockingly large increase, as the business community attested to on Tuesday night.

However, if the alternative is doubling the rates for the same water system, then perhaps that is a more manageable rate increase for the typical person. Without a full and proper public accounting, we are stuck in guesswork and hunches, just weeks before voters will cast their ballot for a water project.

—David M. Greenwald reporting

Exactly right: we are stuck with guess work and hunchs. Staff produced at the 11th hour a small page with two tables on it. It was handed to CC, and was put up on the screen. THe numbers were faint and too small to read. It was not given out to the public in the room, but I have a feeling some insiders had it.

There was no analysis of overall increase in financing costs, no analysis that by eliminating “pay as you go” for some components there was a lot of debt being pushed back past the 5 year cycle of this rate notice. Meaning: in 5 years, when they go out with another Prop 218 notice and fresh bonds, the interest rates could be far higher.

There was no analysis of what the interest rate on the bonds will be, but it surely will be a lot higher due to the elimination of the “pay as you go.” We all know what it does to the terms of the mortgage if we put down 20% of the purchase price, versus 0 down. Our CC, spending most of its time over the last 3 years dealing with the aftermath of previous CC contracting for high city employee salaries and benefits that were never properly funded, this week instructed staff to eliminate any “pay as you go,” which introduces higher financing costs for the project, and huge uncertainty and exposure for when the City has to go back into the market to sell bonds later.

I sat there in CC chambers this week and watched the worst, most disorganized, most last minute, and most opaque vote that can and will lead to uncertain fiscal consequences for the city. In my 13+ years of civic political involvement, it was the most bogus vote ever.

And they all did it in order to tell the voters that their water bills wont have such a steep hike.

It’s like Home Depot: open a charge account for that home remodel, same as cash, no financing costs for 6 months. But: when you get to that 6 months, any balance left is at 18 or more percent.

There were good reasons for the “pay as you go” portion of the costs of the project, and Steve Pinkerton tried to stand up for that policy, but he was pushed down by comments from Brett Lee and Rochelle Swanson. The other three CC members then went along for the ride.

It was clear the CC put raw politics, and their desire to win Meausre I in a few weeks, above a fiscally conservative approach that staff had good reasons to take.

None of that being the point of this article. The question I have is why didn’t council think to question where those numbers were coming from. I’m alright with the rate smoothing its not the objective issue that Harrington would like you to believe.

Mike wants it both ways, he wants to put the measure to a vote but apparently the council not to craft a policy that the voters with support.

David wrote:

> Why is this Project Costing So Much?

Same reason that all recent government construction projects “cost so much”. The game is rigged so only big union construction firms that overcharge and kick campaign cash back to elected officials (of both major parties) get the work. Like almost all projects I expect that it will cost even more than they are projecting today (requiring even higher water rates to cover the cost) by the time it is done…

I wonder what their labor projections are

Bob Dunning’s piece of 1/13/13 deserves a PhD in Wateromics. He was able to wade through the staff report of 1/15/13, Water Rate Recommendations to City Council and expose the huge rate increases proposed therein for the $113 million-12 mgd [million gallons/day] facility to be funded by Davis water users!

He used the smallish amount of 10 ccf in winter and 20 ccf in the six summer months to calculate that this modest user would owe $118.74 per month in Jan./2018. Under our current rate structure this user’s bill averages close to 34.40/mo. Bob does not finish the math but this ratio is a rate increase by a factor of 3.45 over 5 years!

For large lots such as Willowbanks 1/2 acre lots, estimated costs will be ~ $350/mo for Jan./2018 and on. Council is considering that these large rate increases may be stretched over 7 years, but they keep going up from there! Clearly, Davis needs to learn to go from green to dry and brown landscaping, and forget or reduce most of the flower and veggie gardens!

Are the rates/costs realistic? I talked to Fidelity bond experts. They estimated that Davis could finance the $113 million facility with a 30 yr water-revenue bond costing about $228 million or $7.6 million/yr in interest and principal payments. Conaway water costs add about 1.65 million/yr for 24 years. These total ~$9.3 million a year. Current water revenues are near $12 million/yr, so one only requires a factor of 1.8 increase in rates to pay for the facility, not the 3.5 recommended to Council! It appears there is almost 100% pork in these recommended rates!

In addition, there will be several million dollars in savings each year from the planned shut-down of intermediate wells, those having high Se and nitrate levels, and from the reduced pumping of other wells. These savings can be used to fund or finance system upgrades as needed. For these there is no need for this amount [~100%] of pork to be built into the rates now[!], taking them from a factor of 1.8 to a [huge] factor of 3.5 rate increase – nearly a double!

Paul Brady – sorry this comment is so long – trying to be clear! PB

pbradyus said . . .

[i]”Bob Dunning’s piece of 1/13/13 deserves a PhD in Wateromics. He was able to wade through the staff report of 1/15/13, Water Rate Recommendations to City Council and expose the huge rate increases proposed therein for the $113 million-12 mgd [million gallons/day] facility to be funded by Davis water users!

He used the smallish amount of 10 ccf in winter and 20 ccf in the six summer months to calculate that this modest user would owe $118.74 per month in Jan./2018. Under our current rate structure this user’s bill averages close to 34.40/mo. Bob does not finish the math but this ratio is a rate increase by a factor of 3.45 over 5 years!”[/i]

Paul, what is the basis that Bob and you use for justifying the 10 ccf and 20 ccf example as representative? Is it supported by the data about water use in Davis?

A 10/20 account means a “peaking factor” of 1.33 (20 divided by the average annual usage of 15). How does that 1.33 value compare to the actual Davis peaking factor numbers for a Tier 1 account using 15 ccf per month? Does a Tier 1 account use twice as much water outdoors as indoors?

But even setting that issue aside, lets look at Bob’s numbers. The monthly Distribution Charge in January 2018 is $15.54 per month. The average of 15 ccf per month at $1.50 per ccf yields a monthly Use Charge of $22.50. If we use Bob’s 20 ccf monthly summer peak load on the system that means 120 ccf of peak consumption for the 6-month period. Multiply 120 times $0.61 you get $73.20 per month as your Supply Charge. Add $15.54, $22.50 and $73.20 together and you get $111.24, not $118.74.

Of course Bob hasn’t factored in any conservation in the account’s usage through 2018, or for that matter any effort to save money because prices are going up. Are you going to use less water in the coming years than you have up until now? At 19 ccf in the summer (a 5% decrease in consumption) the $111.24 goes down $4.41. How does a 5% decrease in consumption compare to the Davis consumption data over the past 4 years? We have gone down an average of 6.2% [u]per year[/u] from 197 gpcd in 2007 to 152 gpcd in 2011.

What is the reasonable expectation of gpcd in 2018? The Natural Resources Commission has set a goal of 134 gpcd by 2020. factoring out 2020 and 2019 from that 134 number, their goal for Davis is 138 in 2018. That is a 9.3% decrease from the 2011 baseline. And at 9.3% the 20 ccf summer usage goes down to 18 ccf and the $111.24 comes down by $8.82

Bottom-line, each of us has plenty of opportunity to use our water wisely and impact our own bill.

I realize that you don’t want this project to go forward, but please try not to cherry pick only the numbers that resonate for you, and please also be sure the numbers you do use are correct.

The toal of $

paulbradyus said . . .

[i]”Current water revenues are near $12 million/yr, so one only requires a factor of 1.8 increase in rates to pay for the facility, not the 3.5 recommended to Council! It appears there is almost 100% pork in these recommended rates!”[/i]

Paul, here too the information you are providing is inaccurate. The data provided to the WAC by Bartle Wells on 4/2/2012 verified the fact that annual Water Revenues to the City were $9,978,000. On the other hand, annual Costs (excluding any JPA contributions) were $12,956,163. The result was a $3 million draw down of the Water Enterprise Fund’s reserves.

If one looks at the $28.2 million revenue requirement in 2018 in the “blue line” rate scenario, the $12.9 million base costs for the existing system when a 4% CPI is applied to them rise to $15.7 million. Add to that figure the your 2018 annual Debt Service number of $7.6 million and you are at $23.3 million. Add in your $1.65 million for the CPG water purchase and you are at $25.0 million (rounded). Now add the annual SWTP M&O of $2.75 million and you are at a $27.75 million total. Again, the revenue requirement that the rates use is $28.2 million. Where is the pork? That 0.45 million difference exists because your interest rate [u]assumption[/u] is less conservative than the City’s. Until we have actual rates we are all making some assumptions.

So please, try and use correct numbers and perhaps a bit less hyperbole.

Joe Friday . . . over and out.

Okay… so now I am confused (seriously).

David writes: “Without a full and proper public accounting, we are stuck in guesswork and hunches, just weeks before voters will cast their ballot for a water project.”

Michael adds: “..we are stuck with guess work and hunchs” (sic)

pbradyus says: “It appears there is almost 100% pork in these recommended rates!”

And then in one comment (and not a long one) Matt Williams seems to lay out the entire picture. What am I missing here?

I am confused too. I am sure I do not only speak for myself when I say people want to understand what they are paying for and why rates would be as stated if they are going to approve this, duh. I do understand that exact amounts are unknown but the estimates have to have some logic and backing, they can’t be off by 100% (one estimate double another) and be considered credible and justified.

“…people want to understand what they are paying for…”

They are paying for water with improved quality and they are paying to pollute the Delta less to be good environmental stewards.

Sorry, poor wording. I want to know if HOW MUCH I am paying for it is justified by at least reasonable estimates. Of course removing water from the river also has an impact on the delta, it is not a simple equation.

dlemongello said . . .

“I am confused too. I am sure I do not only speak for myself when I say[b] people want to understand what they are paying for and why rates would be as stated if they are going to approve this[/b], duh. I do understand that exact amounts are unknown but the estimates have to have some logic and backing, they can’t be off by 100% (one estimate double another) and be considered credible and justified.”

Actually Donna your question illuminates one of the great strengths of the CBFR rate structure. Specifically, all the costs of the Surface Water plant in one transparent spot on everyone’s monthly water bill . . . in the Supply Charge.

Using Bob’s example account, the monthly cost of the Surface Water Plant from 1/1/2018 through 12/31/2018 is $73.20 per month.

Fire Protection and other costs that are not related to consumption have a monthly cost of $15.54 per month from 1/1/2018 through 12/31/2018.

Monthly charges for actual water used will average $22.50 per month (one third lower in winter and one third higher in summer).

If you are able to achieve water conservation, both your $73.20 per month cost for the plant and your $22.50 per month cost for water used will come down.

Is that still confusing?

Everyone, Bob Dunning and I are in a very heated e-mail discussion of mathematics and the intent of my comments.

If my numbers are wrong I [u]ABSOLUTELY WILL CORRECT[/u] them . . . and then eat a murder of crows . . . and then fall on my sword . . . and then not post here in the Vanguard for a full month.

Stay tuned.

Bob Dunning e-mail update . . .

For the most part Bob’s article in the Enterprise focused on a single month July, and from that single month perspective $118.74 per month is correct. So for anyone out there who thinks that Bob is not a good mathematician, you are wrong. He was simply laser focused on the summer rates. He also acknowledged seasonality in his final paragraph when he said [i]”Under our current rate structure, using identical comparisons (20 ccf in summer, 10 ccf in winter), the monthly summer bill would be $42.30, dropping to $26.50 in winter.”[/i]

paulbradyus did not carry forward Bob’s one month focus in his comment, [i]”Under our current rate structure this user’s bill averages close to 34.40/mo. Bob does not finish the math but this ratio is a rate increase by a factor of 3.45 over 5 years!” [/i]

So to paraphrase Bob’s own comment, “Under the 2018 rate structure, using identical comparisons (20 ccf in summer, 10 ccf in winter), the monthly summer bill would be $118.70, dropping to $103.74 in winter.”

So bring on that murder of crows and sword for me to fall on.

Matt, I appreciate your hard work and trying to help, but yes there are so many scenarios being tossed around I am still confused. Will you do one thing for me? Post as you currently see it, how much it will all cost adding debt and all, include everything and then how much would be (estimated of course) collected under the proposed rates. Maybe itemize it in 5 year chunks or something, as in cost the first 5 years and money projected to be collected the first 5 years, then the next 5 years, etc. Thank you in advance, because you seem to understand this better than anyone.

“Same reason that all recent government construction projects cost so much. The game is rigged so only big union construction firms that overcharge and kick campaign cash back to elected officials (of both major parties) get the work.”

It’s not “rigged”, it’s a legal requirement pursuant to the Davis Bacon Act. Government construction projects, or projects with government subsidies/support are required to pay “prevailing wages”. Prevailing wages generally result in a project cost increase of 20-30%. It’s the case with any City let contract And it’s not new. The Davis Bacon act was passed in 1931. Every freeway, road, bridge, waste water plant, airport, harbor, school, RDA funded project has 20-30% pork.

-Michael Bisch

Matt thank you very much for taking the time to do that. Yes it helped. Now no falling on your sword, we need you.

Donna, I haven’t seen the reworked “all debt” numbers, so I will answer you from the “pay as you go” numbers.

Baseline Expenses w/o Surface Water Project (including Labor – Salaries/Wages, Other Baseline Expenses, East Area Tank M&O, Well 32 M&O, Well 34 M&O, Local R&R Projects (not incl Water Main Replacements), Water Main Replacements from Brown and Caldwell 2011 Assessment, Existing Debt Service, Water Meter Replacement Program and Billing Administration

FY 2013/14 FY 2014/15 FY 2015/16 FY 2016/17 FY 2017/18 FY 2018/19

$15.0 M __ $14.5 M ____ $14.6 M ___ $15.2 M ___ $16.4 M ___ $24.2 M

The above numbers include $31 M of “pay as you go” repair and replacement “events” that are outlined in the 2011 analysis of the current water delivery system.

The annual costs of the CPG Water Purchase and the Surface Water Plant M&O are:

FY 2013/14 FY 2014/15 FY 2015/16 FY 2016/17 FY 2017/18 FY 2018/19

$1.6 M ____ $1.6 M _____ $2.8 M ____ $3.5 M ____ $4.0 M ____ $4.1 M

The annual Debt Service costs for the Surface Water Plant are:

FY 2013/14 FY 2014/15 FY 2015/16 FY 2016/17 FY 2017/18 FY 2018/19

$0.9 M ____ $2.4 M _____ $5.0 M ____ $7.9 M ____ $8.7 M ____ $8.7 M

Add those three numbers up and you get the following total annual costs (subject to finalization of debt interest rates and finalization of construction bids for the surface water plant)

FY 2013/14 FY 2014/15 FY 2015/16 FY 2016/17 FY 2017/18 FY 2018/19

$16.6 M __ $17.5 M ____ $20.2 M ___ $24.3 M ___ $26.8 M ___ $34.7 M

The annual revenue requirement numbers built into the rate structure are:

FY 2013/14 FY 2014/15 FY 2015/16 FY 2016/17 FY 2017/18 FY 2018/19

$14.1 M __ $17.7 M ____ $22.1 M ___ $25.0 M ___ $28.2 M ___ $28.2 M

Those year-by-year variances represent some flexibility in scheduling and completing the “pay as you go” R&R projects.

Hope that helps.

Donna, the falling on sword is because Bob Dunning in one of his patented e-mail flurries said to me,

[i]”I realize one of your current goals is to make me out a liar, but you should know that before I ran last Sunday’s column, I triple checked every single number and calculation in that column with Dianna Jensen and she agreed that every number and every calculation were exactly correct to the penny. You know it and I know it. Lying about what I wrote and trying to convince others I was lying is unbecoming. We can disagree on a lot of things, but facts are facts. My numbers were correct, as much as you might not like them.”[/i]

As I pointed out to Bob, I didn’t call him or even infer that he was a liar. I simply used his 20 ccf and 10 ccf numbers to step through the calculations. The result was a different number than his. The reason was that he was only looking at one month, July. I was looking at a whole annual period.

Unfortunately for both Bob and me, Paul Brady pounced on Bob’s July-only number and compared it to an annual number. As a result Bob is summing up his current low opinion of me as follows, [i]”If you were only writing about your own numbers why did you even bother to mention mine. You said the correct number was your number and SPECIFICALLY said it wasn’t my number. Have someone with a brain read your comments and ask them neutrally if you were hinting, indicating, implying – anything you wish to use – that my numbers were wrong.” [/i]

Bob has every right to express his concern, and in this case I’m going to get up close and personal with a murder of crows and I’ve suggested that he have a heart to heart talk with Queen Gertrude.

Hoping things are not too rotten in Davis. But one is not going to get much of a full picture looking at one month. And it is a good thing the affect of conservation is already considered in the rate structure because there assuredly will be some.