By Susan Bassi and Fred Johnson

More than eighty women, elderly donors and local real estate professionals have joined forces to expose an illicit attorney referral scheme benefiting prominent Silicon Valley law firms. The scheme, primarily operating through the Los Altos-based nonprofit WomenSV, uses misinformation, NDAs, binding arbitration agreements, unfair business practices and swanky fundraisers to attract vulnerable victims of domestic violence and prospective donors from wealthy communities.

As part of the scheme, vulnerable women from affluent areas alleging to be victims of domestic violence and headed for divorce, are targeted, and recruited to the WomenSV  network. Once captured by the nonprofit, these vulnerable women are referred to divorce lawyers involved in the scheme.

network. Once captured by the nonprofit, these vulnerable women are referred to divorce lawyers involved in the scheme.

Lawyers benefitting from the scheme provide kickbacks to the nonprofit’s founder, Ruth Patrick. As alleged in court documents, these kickbacks are seen in the form of tax-deductible donations which pay Patrick’s salary and expenses. The scheme has created intricate quid pro quo arrangements that have managed to elude scrutiny from law enforcement, the state bar, and taxing authorities for a decade.

Victims of this scheme were disheartened to learn that a lawsuit filed against the Hoover Krepelka law firm promising to expose the scheme in open court was moved into arbitration. The move, based on the orders of Santa Clara County Superior Court Judge Socrates Manoukian, will keep the matter out of the public eye.

Hometown Judge in Los Altos

Los Altos is known for its upscale neighborhoods, swanky philanthropic events, exclusive membership clubs and pricy real estate. The closely knit community is home to prominent residents who include Silicon Valley business leaders, investors, celebrity athletes, prominent politicians, and judges. Los Altos was recently ranked as the wealthiest small city in the country.

Judge Manoukian and his family have resided in Los Altos for four decades.

Cozy Courtrooms

On January 9, 2024, Judge Manoukian held short “law and motion” hearings in multiple civil lawsuits assigned to his courtroom. The hearings allowed those involved in the lawsuits to be heard on matters addressed in preliminary rulings.

During a hearing in a conservatorship case, Judge Manoukian noted he recognized the witness, Shelly Sutton. The judge said he knew Ms. Sutton as Shelly Potvin from the Los Altos Town Crier, a newspaper that serves the Los Altos community where Judge Manoukian is a long-time resident.

According to her online profile, Shelly Potvin is a top producing real estate agent based in Los Altos. On LinkedIn she is connected to Santa Clara County Supervisor Joe Simitian and Bruce Barton, longtime Editor-in-Chief for the Los Altos Town Crier.

When the lawsuit brought against James Hoover and the Hoover Krepelka law firm was called to order, Judge Manoukian quickly denied the Vanguard’s media request to photograph or record the hearing.

Out-of-Area Attorney Flushes out WomenSV Scheme in Open Court

Orange County real estate attorney Pat Evans represented Hoover’s former client in the hearing.

Evans argued against Judge Manoukian’s preliminary ruling, claiming the mandatory arbitration clause contained in the Hoover Krepelka (HK) retainer agreement was not only unclear but unfair as it failed to provide a non-attorney arbitrator option for his client. Judge Manoukian was not persuaded and requested Evans move on to argue the unfair business practices allegations at the center of the lawsuit.

Evans likened the scheme Hoover was engaged in with nonprofit WomenSV to that of an ambulance chasing scheme. Evans claimed attorneys with the Hoover Krepelka law firm used nonprofits claiming to assist victims of domestic violence to attract clients HK could overbill for substandard legal services. The lawsuit alleges WomenSV operated an illegal unlicensed attorney referral business, not a therapy or support group as they claimed when collecting $2 million in private and public tax-exempt donations.

Further, Evans noted the quid pro quo (something for something) at the center of the illicit scheme included Hoover getting business referrals in exchange for kicking back donations through WomenSV. Donations paid the salary of WomenSV founder, Ruth Patrick. Judge Manoukian called the scheme “networking,” labeling it good business practices for a law firm.

Finally, Evans alleged Hoover ran a similar scheme in connection with local real estate agents and brokers. However, before Evans finished his argument, Judge Manoukian noted he stood by his ruling and was moving the case into arbitration.

Employers and attorneys often use arbitration to keep cases out of public court. and out of the public eye,

Misinformation on WomenSV Spread By Local News

For over a decade, the Los Altos Town Crier newspaper supported WomenSV and the nonprofit’s founder, Ruth Patrick. The newspaper published news articles, commentary, community postings and opinion pieces promoting WomenSV and Ruth Patrick. The publication elevated Ruth Patrick in the Los Altos community as the foremost expert on domestic violence, despite the fact she was not a licensed therapist or attorney.

Recently, the Town Crier published articles soliciting donations for WomenSV, supporting Ruth Patrick giving a presentation and promoting a book she claimed will be published in 2024.

“We don’t need book bans in our libraries and schools, we need a ban on any book Ruth Patrick writes as it will be actually dangerous to women and young girls all over the world”- Jane Doe74 said.

Los Altos Town Crier’s Role in Nonprofit WomenSV Scheme

The Los Altos Town Crier was founded in 1947 and is one of Silicon Valley’s last remaining independent local newspapers.

For over a decade the Los Altos Town Crier published hundreds of articles, editorials and announcements promoting WomenSV and its founder Ruth Patrick. The information published by the Town Crier was presented to readers as news and was not designated as opinion or advertisement, a violation of ethical journalism practices. Further, the articles failed to reveal Town Crier publishers sat on the WomenSV board.

Misleading information published by the Town Crier was designed to lead readers to believe WomenSV was operating legitimate support groups for victims of domestic violence. Yet Ruth Patrick had no formal training or experience as a licensed therapist.

The Town Crier played an active role in attracting vulnerable women and donors to WomenSV and was responsible for creating a false image of the nonprofit’s founder, Ruth Patrick.

Nonprofit Taxing Troubles

Nonprofit Taxing Troubles

Despite receiving $2 million in private and local government funding to run WomenSV, and provide support for local victims of domestic violence, the nonprofit’s founder began to plan her move to Hawaii.

In May 2023, Ruth Patrick purchased a home in Hawaii.

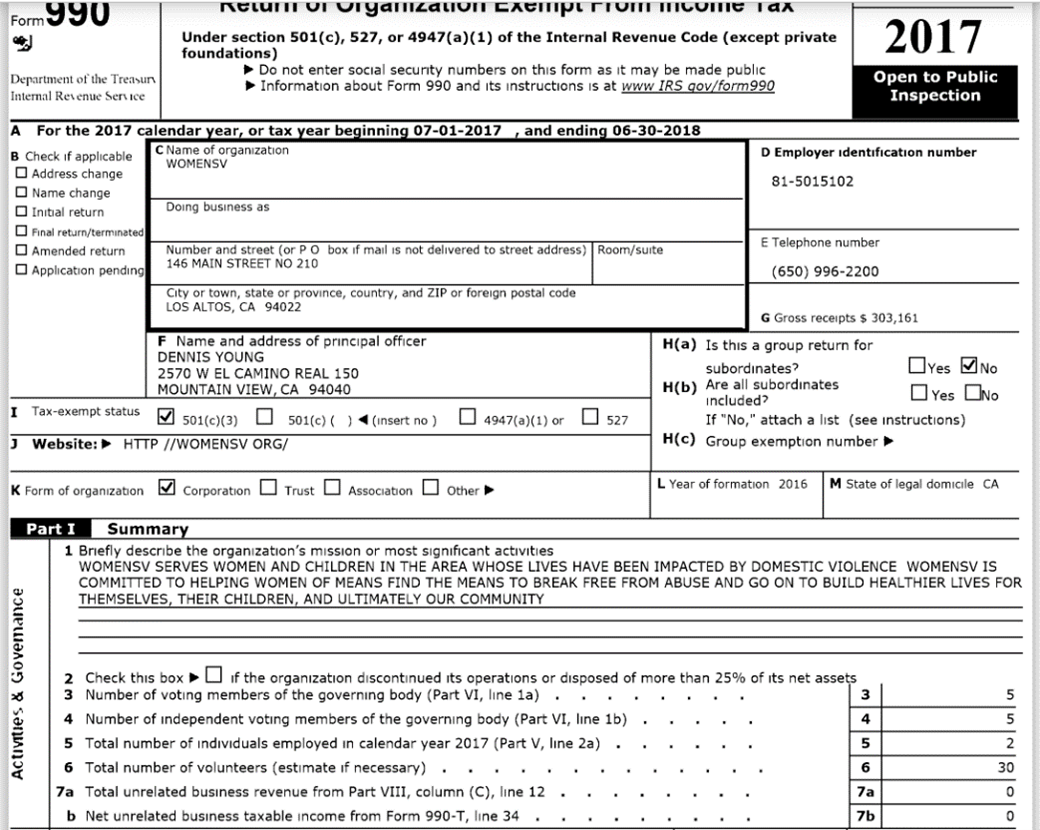

That same month, Dennis Young, a WomenSV board member and CPA who prepared the WomenSV tax returns, sold his accounting firm to MGO, one of the largest accounting firms in the state.

When the Vanguard reached out to MGO in 2023 to inquire about the WomenSV tax returns, a spokesperson from MGO was uncertain if the business had retained WomenSV as a client.

Recently the Vanguard reached out to MGO representatives to request the WomenSV tax records for a second time, but did not get a response.

Math and Taxes for Domestic Violence Nonprofits

The Violence Against Women Act (VAWA) was signed in 1994 to provide support to victims of domestic violence, sexual violence and stalking. The VAWA has sent billions of dollars in state and federal funds to nonprofits such as WomenSV and government agencies.

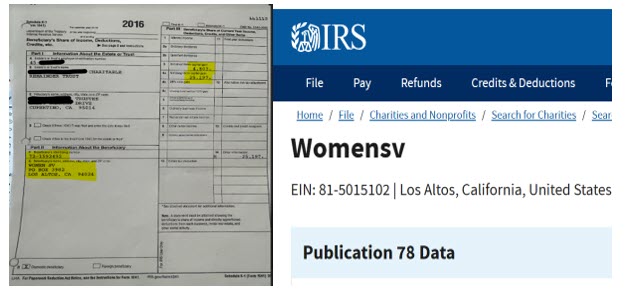

In 2023, Vanguard obtained private K1 tax documents from WomenSV donors. The documents show WomenSV collected donations and shipped the funds to nonprofit Domestic Violence Interference Coalition (DVIC) from 2016 to 2019 when Dennis Young prepared the WomenSV tax returns.

Dennis Young has repeatedly ignored the Vanguard’s request for comment and records related to WomenSV’s tax filings.

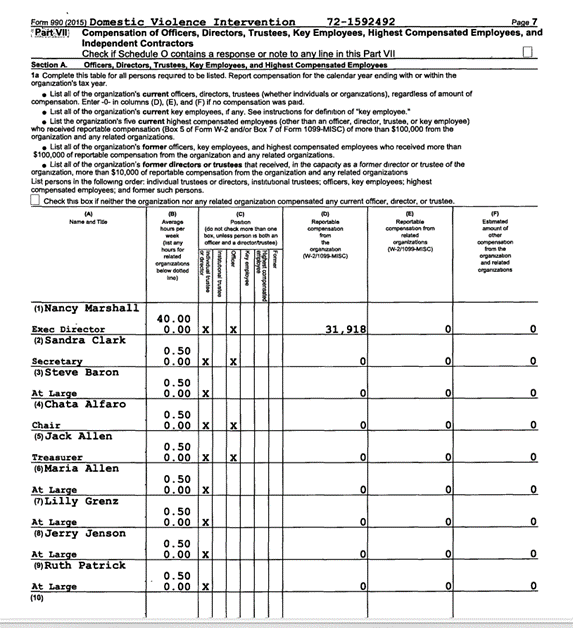

As previously reported, Ruth Patrick was a DVIC board member prior to obtaining tax exempt status to operate WomenSV in 2017.

Constance Carpenter, an attorney who has worked for the Hoover Krepelka law firm since early 2023, was appointed to the DVIC board in 2018. Carpenter was on the DVIC board when WomenSV sent donor funds to DVIC through the mislabeling of EIN numbers.

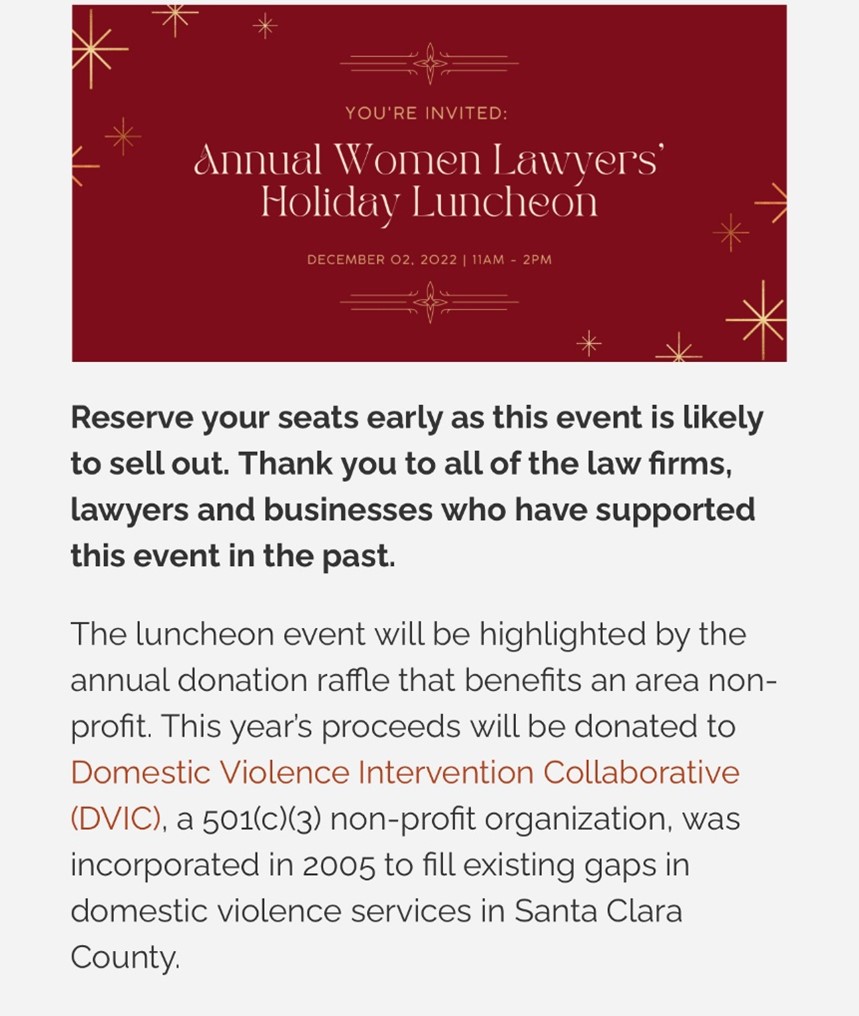

Carpenter used her standing at the local bar to raise money for DVIC through the Women’s Lawyer Section.

In early 2023, Carpenter left her longstanding partnership with criminal defense attorney partner, Dan Mayfield, and went to work for the Hoover Krepelka law firm.

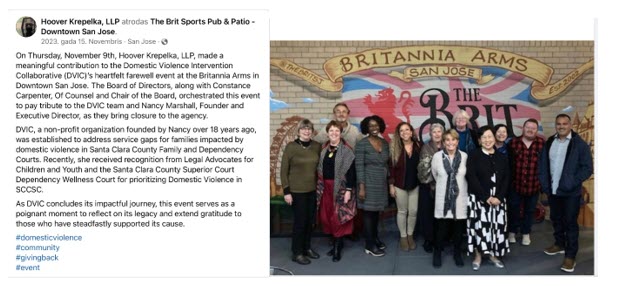

In the fall of 2023 Hoover Krepelka promoted the “good work” of DVIC and its founder, MFT Nancy Marshall on their Facebook and other social media platforms.

When the Vanguard requested records from WomenSV and DVIC in late December 2023, they were ignored.

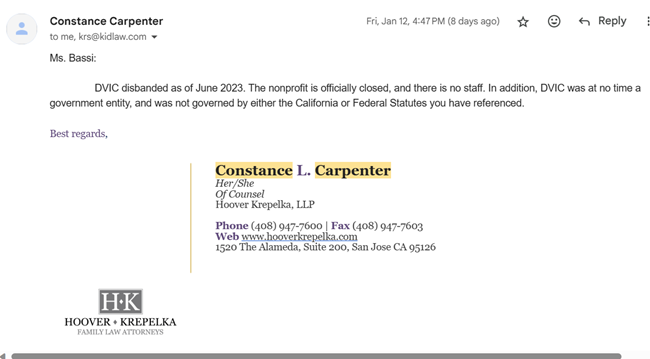

On January 12, 2024, three days after the Hoover malpractice lawsuit slid into arbitration, in response to the Vanguard’s December 2023 request for records, Carpenter told the Vanguard DVIC had been shuttered in June 2023, and had no obligation to produce records.

IRS Requires Nonprofits to Produce Tax Records to the Public and Press

In return for being tax exempt and receiving tax deductible contributions, nonprofits are required to disclose records as follows:

Tax returns for three years after the due date. This includes:

- All Form 990 schedules (except portions of Schedule B), attachments and supporting documents, including amended returns.

- IRS exemption application and all supporting documents, including Form 1023.

- Determination letter from the IRS that shows the organization has tax-exempt status.

A nonprofit is also required to prepare and provide tax documents related to donations and fundraising, and quid pro quo (something for something) donations which could include office space, legal services, or advertising in a newspaper.

Penalties for Concealing Records from the Public and Press

Penalties for Concealing Records from the Public and Press

Several women who reached out to WomenSV for support claimed they were pressured to donate or attend costly fundraisers at the Los Altos County Club. They further allege they were not provided proper tax documents in connection with the donations they made.

Additionally, donors who gave more than $50,000 to WomenSV from 2016 to 2019 report the funds were solicited for WomenSV but given to the DVIC through a deceptive bait and switch with the nonprofit tax EIN numbers.

WomenSV Ignores Requests for Tax Records

Ruth Patrick was known to solicit quid pro quo donations for WomenSV that included office space at the Los Altos Masonic Lodge, legal services, vacation properties and private jet trips that were auctioned off during the nonprofit’s annual Gilded Cage Fundraiser. It is unclear if the nonprofit properly reported these quid pro quo donations.

Contrary to Constance Carpenter’s email, the IRS requires nonprofits to produce records upon request. If the nonprofit claims to not have an office where records can be physically produced, as WomenSV now claims, they are allowed to ask for a small fee for mailing, but records must be provided within two weeks.

To assure proper compliance with tax document requests and obligations, the IRS assigns fees, and penalties when a nonprofit such WomenSV or the DVIC fails to comply. Those penalties include fines of $20 for each day records are not produced, up to $10,000.

If the noncompliance is found to be willful, the nonprofit could be on the hook for $5,000 for each form or application withheld.

Further, nonprofits could face fines and penalties for failing to provide donors with the proper tax records in association with the nonprofit’s fundraisers and donation drives.