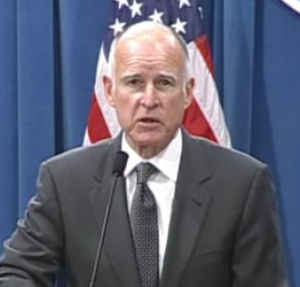

Governor Jerry Brown delivered the first State of the State Address of his new tenure as California’s Governor, and he called on both Democrats and Republicans to do things that they do not want to do.

Governor Jerry Brown delivered the first State of the State Address of his new tenure as California’s Governor, and he called on both Democrats and Republicans to do things that they do not want to do.

“This is not a time for politics as usual,” he said in a line that is usually reserved more for rhetoric than substance. However, this time it is different.

In his address he said, “Things are different this time. In fact, the people are telling us–in their own way–that they sense that something is profoundly wrong. They see that their leaders are divided when they should be decisive and acting with clear purpose.”

He continued, “If you are a Democrat who doesn’t want to make budget reductions in programs you fought for and deeply believe in, I understand that. If you are a Republican who has taken a stand against taxes, I understand where you are coming from.”

He then called out to Republicans and Democrats alike saying, “From the time I first proposed what I believe to be a balanced approach to our budget deficit – both cuts and a temporary extension of current taxes – dozens of groups affected by one or another of the proposed cuts have said we should cut somewhere else instead. Still others say we should not extend the current taxes but let them them go away. So far, however, these same people have failed to offer even one alternative solution.”

Here he criticized Republicans, who have sworn to block any vote on a tax extension by the voters.

“My plan to rebuild California requires a vote of the people, and frankly I believe it would be irresponsible for us to exclude the people from this process. They have a right to vote on this plan.” He added, “When democratic ideals and calls for the right to vote are stirring the imagination of young people in Egypt and Tunisia and other parts of the world, we in California can’t say now is the time to block a vote of the people.”

At the same time, he also criticized Democrats who have come forward, criticizing them for opposing spending cuts on their programs again without providing alternatives for balancing the budget.

The Governor has to this point been reluctant to detail which programs would be cut if his tax measure fails, as he has not wanted to seem to threaten voters.

However on Monday, those gloves came off.

“At this moment of extreme difficulty, it behooves us to turn to the people and get a clear mandate on how we should proceed: either to extend the taxes as I fervently believe or cut deeply into the programs from which–under federal law–we can still extract the sums required,” he said and then listed out programs that could be cut if we do not act. “Unfortunately, these would most probably include: elementary, middle and high schools, the University of California, the California State University system, prisons and local public safety funding, and vital health programs.”

Naturally Republicans were dismissive of his plan. “Republicans stand united as the only line of defense for California taxpayers,” Assembly Republican leader Connie Conway responded in a record message. The general message was that Governor’s Brown plan to put taxes on the ballot had no Republican votes.

Republican Senate Leader Sam Blakeslee took exception to the Governor’s comparison to Egypt, “Trying to create a moral equivalency between supporting his plan and freeing oppressed masses in the Middle East I thought was a bit of a stretch. There may be, in fact, a third way that talks about some of the issues that are more uncomfortable for him, including pension reform, tax reform and regulatory reforms that have some teeth.”

Ron Nehring, chairman, California Republican Party added, “Instead of using his considerable political capital to propose bold and serious reforms to collective bargaining and California’s unsustainable pension system, Jerry Brown will blow it all by campaigning for a tax increase the voters rejected just two years ago.”

Columnist Dan Walters wrote this morning in his column that Governor Brown’s plan still faces big hurdles.

First, within his own legislature he faces a huge problem that neither side is completely supportive of his plan while there are elements both sides outright oppose.

Writes Mr. Walters, “One is a Legislature dominated by very liberal Democrats and very conservative Republicans. The former are feeling heat from advocates for the poor, elderly and disabled who oppose the billions of dollars in permanent “safety net” spending cuts Brown wants, while the latter are being pressed by anti-tax groups to oppose tax extensions.”

Nothing he said during his address changed any minds either, as Republicans continued to maintain.

Moreover, even if Republicans could be moved, he would face “a tough, perhaps uphill, battle to win their approval,” Dan Walters added.

Assembly Speaker John Perez released a statement saying, “Governor Brown’s state of the state was refreshing in its candor. His budget proposal contains many difficult choices, but his proposal is balanced and is worthy of serious consideration by every member of the Legislature. I think he made a very strong argument today, and I’m hopeful his speech will help us build the consensus we need to move forward in terms of getting our finances under control and making the right investments to create quality jobs in California.”

Senate President Pro Tem Darrell Steinberg strongly supported the Governor’s tax plan, “The Governor’s speech was quintessential Jerry Brown – no frills and pointedly honest with Californians about what needs to be done. Democrats are willing to step up and make the level of cuts he proposes, but I don’t think anyone really wants a budget of $25 billion in all cuts. Let the people decide. Giving people the right to vote is about as American as John Adams and apple pie. Democracy doesn’t get more basic than that. Let’s work together, get this fiscal crisis behind us and start rebuilding California.”

Senator Mark Leno added, “Over the coming weeks we will examine and debate the governor’s budget proposals in Committee and in the public domain. It will also be critical to get voter input on our negotiated solutions. When so much is at stake, it is indefensible to silence voters by denying them a say in California’s future.”

Locally Assemblymember Mariko Yamada issued her own response.

“Governor Brown’s fiscal message is similar to the difficult budget outlook of years past, but the messenger couldn’t be more different. Brown’s statements come from a position of shared and honest sacrifice. No more gimmicks, no more budget sorcery–just the truth with a focus on hope,” the Assemblymember said.

“Governor Brown’s back-to-basics tone matches these somber times,” she added. “I commend him for leading by example in reducing spending and calling on the Legislature to let the people decide.”

However, even in that support we see the problem that the Governor faces. Assemblymember Yamada said, “At the same time, however, I believe that the cuts we do make should be based on certain core principles, including keeping reductions furthest away from the poorest and most vulnerable, avoiding ‘one-size-fits-all’ and ‘across-the-board’ cuts, and preventing cost-shifts that leave federal monies on the table. We must also stand against wholesale elimination of programs that we all know will ultimately save California money.”

Senator Wolk was more supportive in general stating, “I was pleased the Governor remained focused on the budget, and on how any long-term budget solution will require making government more efficient and accountable. It will require both vision and discipline. Ultimately, our path forward to a more prosperous state depends on a new approach that rewards innovation. He gets that. As tough as this budget is, it is also our best opportunity ever to repair a broken and outdated system of governance to provide services to the taxpayer at a better value.”

Governor Brown’s plan will not come easy. It will be difficult. But it is probably the right thing to do and that makes it all the more difficult to address.

—David M. Greenwald reporting

The Guv came into office saying the budget would go to a vote of the people. What part of that clear, concise statement do members of the legislature not understand? Already superfluous to the process, some of them still insist they have relevance. I don’t see it.

What surprises me is Brown’s continued unwillingness to engage on the issue of pension reform. It is clear that is what is troubling most cities and the state, and what could budge some opponents of his budget plan into a more supportive attitude. Yet Brown still stubbornly refuses to discuss the issue of pension reform, the single most needed problem in search of solid solutions. Forgive me if I sound cynical, but I think too many distrust Brown’s sincerity in terms of solving the budget crisis if he is not willing to take on pension reform at the same time he is asking for “shared sacrifice” from voters in the form of more taxes, and cuts in services.

I did some amateur boxing in my youth, and on one occasion was struck by a stiff right jab just seconds into the first round and though able to stay on my feet, I spent much of the remainder of that round just covering up and the next trying to dodge and counter punch In the final round I knew what I was up against and mounted an offense. What we know is that arguing about who’s most righteous doesn’t work. The governor has presented a clear choice,”At this moment of extreme difficulty, it behooves us to turn to the people and get a clear mandate on how we should proceed: either to extend the taxes as I fervently believe or cut deeply into the programs from which–under federal law–we can still extract the sums required,”

I fear that the voters of the state will take the short sighted route, but in either event, all parties must bloody their hands and accept responsibility for the choices made.

“Brown’s continued unwillingness to engage on the issue of pension reform.”

What makes you think he is unwilling to engage on the issue of pension reform? No proposal for pension reform would have any impact on the current budget, which is what he is dealing with now. He has said he is going to make pension reform proposals.

What surprises me is Brown’s continued unwillingness to engage on the issue of pension reform.

To me the Republican argument on pension reform is sort of like refusing to put out the fire until the fire codes have been vetted and rewritten in an acceptable way.

The Republicans could focus issue on pension reform immediately by allowing the tax vote to take place (“let the people speak”), and then leverage opposition to the proposal by saying that pensions oughta be reformed first. If the tax measure fails, the Republicans should have little trouble in pushing the point further. Jerry Brown is the kind of politician who would cede to that kind of political reality.

Pension reform’s not the key issue–the key issue is the wealthy of California not paying enough in taxes. The Yacht club (and their constituents) can afford the tax increases. Capital gains, especially, should be on the table, at state and national levels. The teabagger sorts forget that current cap. gain levels are hardly different than Reagan era–an increase of 10% or so on a Google exec’s stock profits would probably save a few dozen schools.

[i]”Pension reform’s not the key issue–the key issue is the wealthy of California not paying enough in taxes. The Yacht club (and their constituents) can afford the tax increases. Capital gains, especially, should be on the table …”[/i]

California has one of the highest marginal tax rates on the rich of the 50 states, 10.55%. Also, we tax capital gains in California the same as we tax earned income.

What would make a lot more sense to me is if we [i]lowered[/i] the income tax rates on the wealthy and raised the property tax rates on their expensive properties, including income producing commercial properties. (To do so, the people would have to alter Prop 13.) The reason I favor that approach is because it is very easy for most wealthy people to move their income out of California for tax purposes. What is hard is avoiding paying property tax on a skyscraper in San Francisco or an estate in Bel Aire.

[i]”an increase of 10% or so on a Google exec’s stock profits would probably save a few dozen schools.”[/i]

No. It wouldn’t raise any money at all. It would just entice the Google exec to make his stock profits in another state or overseas. Trust me on this. Your notion will have (on a state level) a Laffer effect.

“What surprises me is Brown’s continued unwillingness to engage on the issue of pension reform.”

It does not surprise me for three reasons:

1) Brown obviously made closed-door agreements with the unions that purchased his political victory.

2) He is past retirement age and so more concerned about retiree standard of living than he is the dismal future of our children having to pay for it.

3) He would get political pain but no immediate political gratification for balancing the budget.

”The Yacht club (and their constituents) can afford the tax increases.”

The problem with this thinking can be explained by just looking at billionaire Tiger Woods. He was born and raised in California. He went to college in California. He moved to Florida and California is out the tax revenue he would otherwise provide the state.

States compete with each other for a percentage of wealthy taxpayers and businesses. Raise taxes and the Laffer effect is accelerated to mean less tax revenue. Think of it this way (a simplistic explanation), if you make $100M, and your tax bill is raised 1% you get to write a check for an additional $1M. Or, instead you pick up and move to a state where the tax rate is 5% lower, and then you pocket $5M. Not a bad haul for even a multi-millionaire… then consider the value of this move over 10 years… $50M… and that does not include the present value given the fact that wealthy can generate greater than average returns on their investment capital.

In both cases that I can think of when federal taxes were cut in significant ways, especially in the higher income brackets — the Reagan adminstration and the GW Bush adminstration — then the federal budget started going out of whack. It makes me think that supply side economics doesn’t work well in practice when it comes to balancing a government budget. What am I missing?

On the other hand, the Clinton administration used a combination of tax increases (that George HW Bush should get some credit for) and spending cuts and achieved a balanced budget.

[i]”It makes me think that supply side economics doesn’t work well in practice when it comes to balancing a government budget. What am I missing?”[/i]

I don’t believe in supply side or demand side economics. I think the government policy should be neutral.

What are you missing? How about the spending side of the equation. During the Reagan years, the revenues kept increasing. But spending–especially on defense, Social Security and Medicare–grew even faster.

It is true, of course, that the Congress during the Reagan Administration greatly cut the top income tax rates. But it’s also true that FICA taxes were increased substantially in that period.

Both, as it happens, increased revenues to the Treasury, once the economy rebounded in late 1983 and early 1984.

If you look at the chart below–revenues are in blue; expenses are in red–you will see that the rise and fall of federal tax revenues correllates far more with the health of our economy than it does with the actual tax rates.

[img]http://www.pickinglosers.com/files/u2/us_tax_outlays_40-14.png[/img]

What that suggests then is that, if want the government to have ample tax revenues, you should not pursue policies (like high taxes on business or regulations which discourage investment) which harm the health of the economy.

[quote]What surprises me is Brown’s continued unwillingness to engage on the issue of pension reform.[/quote]

Others have already commented but I will ad my two cents. First things first. Jerry has his hands full on the immediate budget. The public has ADHD and cannot focus on more than one thing at a time–if that.

[quote]What would make a lot more sense to me is if we lowered the income tax rates on the wealthy and raised the property tax rates on their expensive properties, including income producing commercial properties. (To do so, the people would have to alter Prop 13.) The reason I favor that approach is because it is very easy for most wealthy people to move their income out of California for tax purposes. What is hard is avoiding paying property tax on a skyscraper in San Francisco or an estate in Bel Aire. [/quote]

I generally agree with Mr. Rifkin here though I think taxing internet sales should be one of the first oredrs of business. I know many people who have houses in California and Las Vegas and claim Las Vegas as a residence even though they actually spend more time in California (and yes their CA property taxes are minimal thanks to Prop 13). The rich are indeed different.

[i]” I think taxing internet sales should be one of the first oredrs of business.”[/i]

I agree with this. However, I think the main issue is one of fairness, rather than revenue collection.

It’s unfair to local stores which are forced to charge sales tax on merchandise that online competitors do not have to charge. If you buy, say, an $800 computer from a local merchant, you have to pay $70 in sales tax. If you buy the same computer online for the same price* and can avoid that tax, you are usually better off not buying locally, even if the online seller charges S&H.

For inexpensive items, the shipping costs will usually cancel out the difference.

*Of course, the main competitive edge online sellers have is price. Not paying sales tax just compounds that.

States compete with each other for a percentage of wealthy taxpayers and businesses. Raise taxes and the Laffer effect is accelerated to mean less tax revenue

That could be an issue though …I doubt as significant as you claim–the wealthy probably would still prefer Cal. coastside, over Vegas chateaus, however massive. Scrapping Prop 13’s another solution– though prop. taxes go to cities and counties, and the bureaucrats would have to work out some new regs to get the revenues to the State, or something. But the Demos as usual are playing compromise-ball with the GOP…or for that matter with Dem members of the CA Yacht Club (it’s not like all the ostentatiously wealthy of CA are GOP). Mention reforming Prop 13 and many Californians, whether Yacht club…or Evinrude Club would start frothing at the mouth.

[i]”Scrapping Prop 13’s another solution — though prop. taxes go to cities and counties, and the bureaucrats would have to work out some new regs to get the revenues to the State, or something.”[/i]

This is the distribution ([url]http://www.californiacityfinance.com/PropTaxShares.pdf[/url]) of the property tax:

Cities 11%

Counties 19%

Redevelopment 8%

Special Districts 9%

Schools 52%

Prop 98 guarantees that the K-14 schools get a minimum of 39% of the state budget ([url]http://www.lao.ca.gov/2005/prop_98_primer/prop_98_primer_020805.htm[/url]).

I presume–but don’t really know–that all of the property tax monies ([url]http://www.ebudget.ca.gov/pdf/BudgetSummary/SummaryCharts.pdf[/url]) which fund the schools count toward that 39% minimum.

As such, it seems wrong to me to say [i]the state does not receive property tax money.[/i] (Correct me if you think I am off-base.) If Prop 13 were modified and we collected more money from high-revenue commercial properties and more money from expensive residential properties (by taxing them at their actual market value), then the property tax revenues to the state (52%) would increase, and that would free up other revenues which are now going to pay for other general fund expenses, such as higher education and HHS.

Raising taxes sounds like a reasonable idea but I want to know where and how the state budget is going to be axed. I want to see what programs Moonbeam is going to give back to the cities and counties. How much money is Moonbeam going to allocate in order to fund all these programs?

First things first, we need full disclosure! I don’t know about everyone else, but I need to know the nitty gritty before I vote. I want to see 12.5 billion dollars worth of pain BEFORE these village idiots get one red cent. Ya never know, our local governments might need the tax money far more than the state.

wdf1: “makes me think that supply side economics doesn’t work well in practice when it comes to balancing a government budget.”

No matter how much revenue you bring in, overspending will cause your budget to be unbalanced. The challenge with either top-down or bottom-up spending is the creation of long-term entitlements that corrupt the system. Farmers have been corrupted with entitlements; generations of families have been corrupted by welfare entitlements; PEU employees have been corrupted by too generous pension benefit entitlements. Putting entitlement cats back in the bag is nasty work. People hate it when you take something from them. The best way to prevent the fight is to not give them so much in the first place.

I remember UCD football coach, and Zen Master, Jim Sochor giving a presentation at a company I worked for… telling all of us manage-by-objective execs to stop fretting about outcomes and just focus on the process. The room looked at him like he had just sprouted pink hair. They missed the point that the good coach was making… that focusing on results might win a season, but probably will not create a winning program.

Like Rich, I am no fan of either supply-side or consumption-side spending. I am in support of balanced infrastructure spending. That is fully funded spending that helps develop and improve opportunity for individuals and enterprises to stand on their own and prosper. I want my government to focus their efforts on the process of good governance and stop trying to legislate outcomes. I want the government to delegate more expectations for results to the amazing and fantastic American people… the people that have proven time and again they own the most profound spirit of hard work and ingenuity. I don’t mind government spending that supports the process of people and businesses being able to take care of themselves… but not long term spending that props them up and trains them to be entitled.

Our roads and transportation systems are crumbling; we are falling behind the rest of the world on communications technology; our public schools are the joke of the industrialized world; and even our much lauded institutions of higher learning are losing their appeal. Our banks have stopped making loans to real businesses, and instead gamble their capital in various investment schemes. Young people are choosing to not get married and not have kids; thereby eliminating family support structures. These are all infrastructure issues: economic, social, cultural. It is time to take away the entitlements and use the proceeds to invest in infrastructure improvements that support the process of free enterprise and promotes self-determination. No kid should grow up thinking that their government should take care of them. However, I think the growth of this mindset must correlate with our growing budget deficits. Instead, kids should grow up thinking that their government will help provide the infrastructure that maximizes their opportunity to make something of themselves as long as they strive.

From the California GOP website…..

[quote]While those of us with offices in Sacramento are tuned in to exactly what Jerry Brown and the Democrats are up to, regular folks will focus on a tax hike if and when it ever makes it to the ballot – something we’re determined to prevent. [/quote]

So much for their belief in democracy. I guess we are all just too stupid to realize that public schools, safe neighborhoods, good universities, a marginally clean environment, roads that you can drive on, and basic medical care for the frail are just luxuries that are just not worth paying for.

[i]”I want to know where and how the state budget is going to be axed.”[/i]

You should read the governor’s budget summary ([url]http://www.ebudget.ca.gov/pdf/BudgetSummary/FullBudgetSummary.pdf[/url]). (It’s not short.) It answers your questions.

Here is a quote from it: [quote]The Budget reduces spending by $12.5 billion. It includes substantial cuts to most major programs, such as $1.7 billion to Medi‑Cal, $1.5 billion to California’s welfare‑to‑work program, $1 billion to the University of California and California State University, $750 million to the Department of Developmental Services, and $580 million to state operations and employee compensation.[/quote]

Brown’s doing the typical Democrat double-speak. Pension reform should be upfront and on the table now at the same time that we might be voting on raising our taxes. Brown’s just using the “first things first” to get out of what should be done. Nothing will happen with the pensions as Brown can’t alienate his base, the unions. Are you Democrats going to hold his feet to the fire, I doubt it, and Brown knows it.

[i]”Nothing will happen with the pensions as Brown can’t alienate his base, the unions.”[/i]

It’s not really a question of what Jerry Brown wants, what the unions want or what anyone in the general public wants with regard to the pensions of state workers (public safety and miscellaneous). It’s reality staring them in the face. Reality will trump anyone’s wishes. The state does not have the option of declaring bankruptcy. They will slash the amounts they pay for pensions by slashing salaries of state workers and cutting the formulas for new hires. There is no choice.

If you followed the Jan. 18 meeting of the Davis City Council, you know that in the next 3 years, the employer rates to fund CalPERS pensions are now scheduled to go up from 13.495% misc. and from 22.846% safety to 21.2% and 30.3% respectively.* The state cannot afford that increase in costs. These increases can only be covered by steep reductions in salaries or other benefits. It doesn’t matter what the unions want. That is reality.

But those increases in funding costs don’t tell the whole story. As soon as CalPERS announces that it is changing its assumed investment return from 7.75% per year to 7.25%, Paul Navazio suggested the employer rates will climb to 26% for misc. and to 38.3% for safety. That means that in less than 3 years, all else held equal, it will cost almost twice as much per worker to fund the employer portion for misc. state workers and 167% as much for state safety workers.

Again, our state cannot function at those rates.

My guess is that all of the unions will agree to some serious reforms. However, it would not surprise me if an initiative reaches our ballot. There are a bunch of them out there. Not one has yet qualified for a vote. But if one does, it will likely change the state law in dramatic ways–seriously cutting back the formulas for current and future public employees; and requiring all workers to pay a much larger share of their pensions’ funding costs.

*I address this in my column which will be published in tomorrow’s Davis Enterprise.

[quote]You should read the governor’s budget summary. (It’s not short.) It answers your questions.

[/quote]

266 pages? Gee, I think it’s going to take more than a few adult beverages to plow through this endeavor!!!

Thank You

CALPERs consists of 31% state employee members, 38% misc school employee members, and 31% local public agency employee members. So in reality the governor cannot negotiate pension reform on behalf of the local school districts or local county and city governments which is 69% of the pension pie. As a state employee I have seen my pension contribution go from 5% to 9% of my salary. I suspect Davis is like many localities where local government employees have just recently started contributing a measly 2% toward their retirement. The same can be said for school misc employees, and that is 69% of the problem.

A lot of good food for thought:

1)”Raising taxes sounds like a reasonable idea but I want to know where and how the state budget is going to be axed. I want to see what programs Moonbeam is going to give back to the cities and counties. How much money is Moonbeam going to allocate in order to fund all these programs?”

2) “Brown’s doing the typical Democrat double-speak. Pension reform should be upfront and on the table now at the same time that we might be voting on raising our taxes. Brown’s just using the “first things first” to get out of what should be done. Nothing will happen with the pensions as Brown can’t alienate his base, the unions.

3) “These are all infrastructure issues: economic, social, cultural. It is time to take away the entitlements and use the proceeds to invest in infrastructure improvements that support the process of free enterprise and promotes self-determination.”

4)”No. It wouldn’t raise any money at all. It would just entice the Google exec to make his stock profits in another state or overseas.”

5) “Mention reforming Prop 13 and many Californians, whether Yacht club…or Evinrude Club would start frothing at the mouth.”

Brown has a difficult task, to be sure. But it feels too much like he is punting: let the people decide whether to extend taxes; let the cities and counties take on state responsibilities; let’s not talk about pension reform just yet…

Rifkin: I presume–but don’t really know–that all of the property tax monies which fund the schools count toward that 39% minimum.

It doesn’t. I think property taxes are collected by the counties and distributed to the school districts. The state supplements property tax money up to a set amount as “revenue limit” money. Districts that bring in enough property tax to reach that set limit without any state money are “basic aid” districts that are mostly unaffected by state budget cuts.

One reason for the high budget deficit is that property values have fallen statewide, and correspondingly so has property tax. It requires the state to backfill more money to reach the revenue limit.

If more property tax revenues came in, then it would free up more money in the state budget.

WES: [i]”As a state employee I have seen my pension contribution go from 5% to 9% of my salary.”[/i]

If you pay in 9%, then you are on 3% at 50 (or less likely, 3% at 55). That means you are in a public safety position. (As you know, a lot of “public safety” people are not doing jobs with any danger factor. For example, administrators of the CYA get these lucrative pensions, too.)

When you were paying only 5%, the taxpayers were funding the other 4% of the employee share, and paying the full 22.846% employer share. So if you made $100,000 a year and got no overtime, you cost the taxpayers $126,846 + your current benefits package + Medicare and other costs + worker’s comp + roughly $20,000 per year (unfunded) for retiree medical. Altogether, it’s likely the people spend around $180,000 to keep you employed (if you happen to make around $100,000 in base salary).

[i]”I suspect Davis is like many localities where local government employees have just recently started contributing a measly 2% toward their retirement.”[/i]

Yes and no. Since Davis moved all of its safety employees into 3% at 50, they have always paid the full share, 9%, of the employee share. However, it should be noted that the city gave them a big raise at that time to make it neutral to them on a take-home pay basis.

By contrast, the miscellaneous employees have paid 0% of their 8% employee share from the beginning. Though as you suspected, just recently (meaning beginning July 1, 2010), some began paying a small portion of that. I think they will eventually get to 2%, but no one is there yet among them.

[i]”The same can be said for school misc employees, and that is 69% of the problem.”[/i]

It’s not really the problem. The number one problem is that CalPERS cannot make 7.75% returns on investement or better. On a market valuation basis, Davis is about 57% funded. When PERS was doing better in the stock market, Davis was closer to 100% funded.

Because of its unrealistic market return projections and its real losses on its investments, PERS has had to greatly increase the rates it charges its agencies, including the state and the locals. But even if all employees paid all of their employee shares, the rising employer contribution rates would still make their pension expenses nearly double what they have been for miscellaneous and well more than 50 percent higher than they have been for safety.

The only way this gets solved is some combination of: 1) greatly reduced salaries; 2) greatly reduced benefits; and 3) a change in state law which allows the lucrative pension plans like the one you have to be reduced to affordable levels. Either that or we close half the prisons and fire half of the California Highway Patrol.

[b]Rifkin: I presume–but don’t really know–that all of the property tax monies which fund the schools count toward that 39% minimum. [/b]

[i]It doesn’t. I think property taxes are collected by the counties and distributed to the school districts. The state supplements property tax money up to a set amount as “revenue limit” money. Districts that bring in enough property tax to reach that set limit without any state money are “basic aid” districts that are mostly unaffected by state budget cuts. [/i]

I see. I looked up the state budget numbers ([url]http://www.ebudget.ca.gov/pdf/BudgetSummary/Kthru12Education.pdf[/url]). This fiscal year, 39% of the state’s GF went to the schools. Those general fund revenues included no property tax monies, as you stated.

Of the revenues going to K-12 schools, 57% come from state funds. So 39% of the state’s GF budget is equal to 57% of the K-12 budget. The other 43% of school monies come from local property tax money (22%), federal funds (14%) and other local sources (7%).

From calottery.com: “In FY 07/08, revenues from the Lottery generated $132.20 per pupil, or $1.104 billion total and supported over 8.392 million students in California’s public schools. These funds were in addition to the $9,488 per pupil, or $59 billion provided by California’s general fund.”

This from the Bee editorial section: [url]http://www.sacbee.com/2011/02/01/3366844/its-time-to-cut-size-of-state.html#disqus_thread[/url]

Related to the Texas budget deficit Red Herring, see here: [url]http://www.census.gov/govs/statetax/09staxrank.html[/url]

Note that in 2009 California took in $101,007,459 in tax revenue, compared to Texas’s $40,786,875. California has a population of 37,253,956 and Texas has a population of 25,145,561. So, California’s tax revenue is only $2,711 per person and Texas extracts only $1,622.

A related consideration: economies of scale. Even though CA has more people, wouldn’t one expect some greater efficiencies? Shouldn’t we expect a lower tax revenue per person for a state with a sigificantly larger population?

Note that in 2009 California took in $101,007,459 in tax revenue, compared to Texas’s $40,786,875. California has a population of 37,253,956 and Texas has a population of 25,145,561. So, California’s tax revenue is only $2,711 per person and Texas extracts only $1,622.

It might even be worse than that, because Texas has a severance tax on petroleum and California doesn’t. Texas is the second biggest petroleum producer, after Alaska. The rest of the country helps to subsidize Texas government by paying that severance tax when paying for Texas gas at the pump.

A related consideration: economies of scale. Even though CA has more people, wouldn’t one expect some greater efficiencies? Shouldn’t we expect a lower tax revenue per person for a state with a sigificantly larger population?

There are stats that show that California has some better efficiencies of government than other states. I will have to dig that up later today.

“Texas has a severance tax on petroleum and California doesn’t.”

wdf1: I think the $40,786,875 is total tax revenue… including taxes on oil production. [url]http://www.window.state.tx.us/taxbud/revenue.html[/url]

You care comparing one wormy apple instead of looking at the entire tree.

[url]There are stats that show that California has some better efficiencies of government than other states.[/url]

Again, one frost-bitten orange, and not the entire tree. If CA was more efficient, it would only matter in the numbers. For example, if my company sold 100 million widgets instead of 50 million, and my total expenses were higher per widget, then I would not be benefiting from economies of scale even though I might have a smaller HR staff.

Messed up the URL link on the previous… [url]http://www.window.state.tx.us/taxbud/revenue.html[/url]

One more time…

[url]http://www.window.state.tx.us/taxbud/revenue.html[/url]

Don’t know why it is not working…

Here is the link not using the “[url]url[/url]” tag…

http://www.window.state.tx.us/taxbud/revenue.html

Again, one frost-bitten orange, and not the entire tree. If CA was more efficient, it would only matter in the numbers. For example, if my company sold 100 million widgets instead of 50 million, and my total expenses were higher per widget, then I would not be benefiting from economies of scale even though I might have a smaller HR staff.

I respectfully disagree. It matters because then you see what the money is being spent on, and what the comparable funding structure is in other states. For instance, how much money is financing bonds and infrastructure and how much is paying for employees?

The California economy has benefitted from state water projects, especially agriculture and the L.A. area. Also the U.C. system. Texas doesn’t have either of those, though I would concede that the U.T. system is probably closing in on Cal’s system if they’re not there already.

There are also some differences in values: Californians have traditionally valued more environmental regulation than Texans. That can cost money, but it’s what most residents want.

California K-12 education was once mostly funded by local property taxes, but now is funded to various degrees by state and local property taxes. Are schools in other states funded more by state money or by local money? Because your figure for comparison is state tax revenue, which doesn’t show how much local property tax goes into the schools.

So you can be dismissive and look at the big numbers to make your point, but what does all that really mean? what are you getting for your money?

wdf1: First, I am only talking about our state budget. I agree that a more comprehensive total state budget comparison should factor the local taxation situation. However, I think I read that average county and city tax revenue in Texas is also quite lower than it is for CA.

Second, I get your points about CA greatness, but I think you should only measure the nuanced and qualitative value when you are living within your means.

It seems very wrong to make the case that California is so much better in so many ways, when we are in such fiscal dire straits. It reminds me of the guy driving the $80k luxury car and living in a McMansion but funding all of it with home equity loans. He was basically living a lie until the truth came out. Should we be impressed with his car and house compared to the guy living within his means? I think not. If California has all these wonderful benefits, then apparently we have been living a lie because we could not, and cannot, afford them.

If I take your view and overlay it on my business, they I end up pleading with my Board to allow me to take out another operating loan to fund an operation that does great things at a perpetual loss. I have to do great things and also show a profit. We may have more government projects and services than Texas, but the point is that we funded them with money we did not have, and our children do not have. We cannot tax our way out of this problem… we need to lower our expectations for what government does and should do and make drastic cuts to balance the budget now, and make the structural changes that ensure our children can afford to live here.

Actually I have the 2% at 55 retirement package. I do not get safety retirement despite the fact that I do have to work in the prisons frequently, although not all of the time. With this new contract I took a 4.62% pay cut and my contribution toward retirement went from 5% to 8% of gross in excess of $513.

I agree that many in corrections (and attorneys in the Office of the Inspector General) get safety retirement with little to risk of harm or exposure to inmates.

JB: A related consideration: economies of scale. Even though CA has more people, wouldn’t one expect some greater efficiencies? Shouldn’t we expect a lower tax revenue per person for a state with a sigificantly larger population?

There are a few references on employees per capita that I’ve found that pretty consistently show that for staffing levels, California state government runs very well compared to other states. This reference pointedly mentions Texas in its comparisons, but this was three years ago:

[url]http://www.ccsce.com/PDF/Numbers-oct08-govt-employees.pdf[/url]

It reminds me of the guy driving the $80k luxury car and living in a McMansion but funding all of it with home equity loans. He was basically living a lie until the truth came out. Should we be impressed with his car and house compared to the guy living within his means? I think not. If California has all these wonderful benefits, then apparently we have been living a lie because we could not, and cannot, afford them.

Or in another framework, it reminds me of another guy who is paying off all kinds of student loans to pay for his college degree, but his college degree gives him more opportunities in the job market.

wdf1: good article. It does indicate some greater efficencies. However, it does not satisfy the economies of scale argument.

The analogy is CA’s 10 employees taking care of 1000 customers and an annual operating budget of $2M and Texas’s 12.5 employees taking care of 750 customers with an annual compensation budget of $1.5M… in this case I don’t think you can argue that CA is leveraging the economies of scale. In fact, the type of data/message in the report referenced is generally used to demonstrate that CA PEU employees are overworked to justify more tax and spend.

I have a realted discussion with some of my more highly-compensated employees. They are paid more so I expect more. When they ask for more money, I ask them what more they are going to do for the organization. Given the pay and benefit levels CA PEU employees make, they should work 10-12 hours days, 6.5 days a week. I know many, many private-sector workers doing the same for much less.

“Or in another framework, it reminds me of another guy who is paying off all kinds of student loans to pay for his college degree, but his college degree gives him more opportunities in the job market.”

Education is tricky here… it can provide more opportunities, but it may also limit opportunities. How many parents of college-educated children would object to their little darlings taking a job flipping hamburgers to earn money and gain some work experience? I don’t generally like to hire people with more education than the job requires.

In any case, unless the student makes a large enough salary to enable him to pay off his accumulated debt, the student loans are not a viable investment… and the aquisition of his more highly-educated persona is just another example of socialized charity defended by dubious claims of social benefit.

How many parents of college-educated children would object to their little darlings taking a job flipping hamburgers to earn money and gain some work experience? I don’t generally like to hire people with more education than the job requires.

Education is like a tool (knowledge plus a portfolio of skills) that you can always carry with you. It can be used for good, for bad, or not used at all. Someone who is smart and dedicated will make it all work for him (or her) in difficult circumstances. On balance, I think most end up using it to advance themselves in a way that generally benefits the economy.

Your work example depends on the context. I would appreciate my college-educated kid willing to work, whatever job it may be, during this tough economy. It would look good on a resume to demonstrate the ability to get and hold a job during difficult times, and show a kind of work ethic. I would also hope for him to be looking around for a job that would be a better fit for his education, perhaps seeking out volunteer opportunities connected to his career field to maintain some kind of currency.

From a manager end (hypothetically you), you might have a chance to “try out” potential talent from the ground floor. As the economy improves and perhaps you’re evaluating potential expansion, you can promote him if you like, or perhaps let him go after awhile if it doesn’t appear to be a good fit.

and the aquisition of his more highly-educated persona is just another example of socialized charity defended by dubious claims of social benefit.

or in the merit-based system of education, it allows a person of lesser means a chance to demonstrate his abilites against the trust fund babies. For instance, Barack Obama and Bill Clinton. But those may not be examples that you would warm up to… 😉

“or in the merit-based system of education, it allows a person of lesser means a chance to demonstrate his abilites against the trust fund babies. For instance, Barack Obama and Bill Clinton. But those may not be examples that you would warm up to… ;-)”

Nice left hook! And I mean “left”! =)

You and I are on the same page on education; I am all for providing opportunity for people to stand on their own based on their own self-determination.

But there are two broad domains of competence I look for in a job candidate – soft skills and hard technical skills – and their level of education may or may not be an indication that they have the soft skills. Soft skills are those required to maintain successfully relationships. It includes the skills to interact, communicate, negotiate, collaborate, and manage conflict, with corworkers, partners and customers. School does not not generally teach soft skills… parents do, coaches do, and work/life experience does.

Frankly, I would prefer kids go to work for 2 full years full-time before attending college. I think they would make better college students, and then better employees after they graduate. It would also help them separate from their desparate parents who telegraph anxiety over their kids becoming “somebody” they respect.

I have a realted discussion with some of my more highly-compensated employees. They are paid more so I expect more. When they ask for more money, I ask them what more they are going to do for the organization. Given the pay and benefit levels CA PEU employees make, they should work 10-12 hours days, 6.5 days a week. I know many, many private-sector workers doing the same for much less.

Talking about state employee salaries, generically, California has a higher cost of living than Texas. Rent/housing is more expensive in the L.A. and Bay areas than in Houston, San Antonio, and Dallas/Ft. Worth. Maybe the coastal views of the sun setting over the ocean and snow-capped peaks are worth something.