Matt Kowta presented his fiscal analysis of whether development in the downtown is viable to a joint commission with the Planning Commission, joined by members of the Finance and Budget Commission as well as Meg Arnold, Chair of the Downtown Planning Advisory Committee (DPAC). The findings continue to show a challenging fiscal picture for development in the downtown.

However, others saw a caveat that this picture represents a snapshot with high construction costs and low vacancy. As Planning Director Ash Feeney put it to the Vanguard, “We should focus on putting together a land plan that allows for scale and density on parcels where we have the greatest ability to achieve viable results.” For instance, the G Street Corridor and Hibbert Lumber.

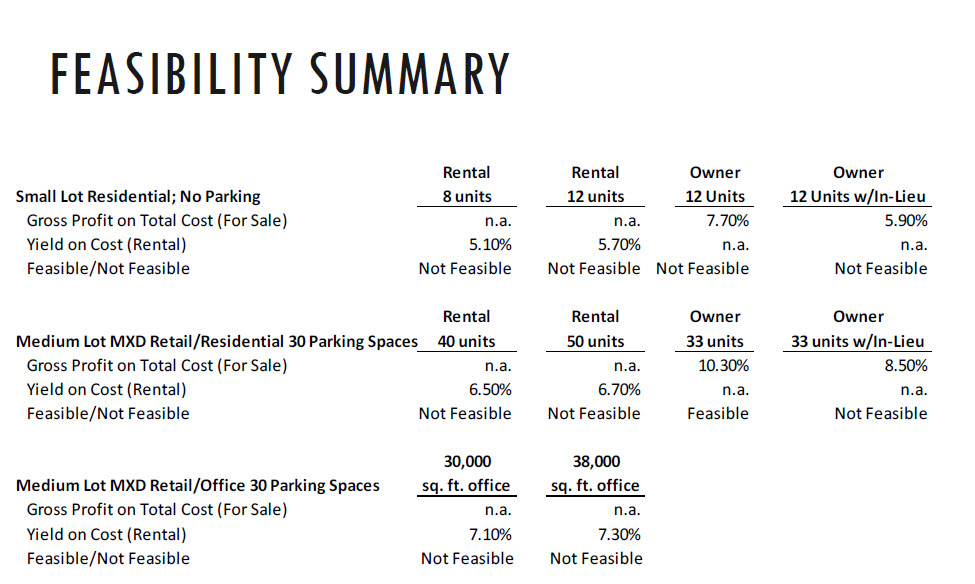

As Matt Kowta explained, they are looking at three primary prototype projects – small lot residential at 6000 square feet, medium lot residential over retail at 12,000 square feet, and medium lot office over retail at 12,000 square feet.

As previously reported, they looked at various configurations and sizes as well as ownership and rental possibilities. What they found is, of the ten scenarios, only the ownership medium lot residential projected to more than 10 percent gross profit and therefore was considered to be viable.

Among his assumptions is that retail and residential are renting about $2.50 per square foot, while office is renting at $2.90 per square foot. To meet the threshold for rentals, they have to achieve an  8.5 percent yield on cost, while a for-sale must return at least a 10 percent return on costs.

8.5 percent yield on cost, while a for-sale must return at least a 10 percent return on costs.

Even here he said, “It’s not extremely profitable, but it’s marginally profitable.” He said, “We’re falling short currently with those small lot projects.“

He noted that the mixed is “close” but “not way out of the realm of possibility.“

Mr. Kowta said, overall, they are “seeing challenges to feasibility.” But this problem, he noted, is “not exclusive to Davis.”

The biggest problem can seen looking at the trendline showing the construction cost inflator. Their estimates show about a 36 percent increase in construction costs between 2008 and 2009.

“We think that’s actually understated,” he explained. “There is a very steady upward trend in these costs.”

Some of his key takeaways for feasibility:

- Small lot residential projects not feasible as modeled

- Economics improve with density

- For-sale residential may be feasible on larger lots and at higher densities

- Office over retail may work in very unique circumstances

- Incorporating parking and/or affordable housing challenges economics further

- In current environment, owner-users may develop but returns are unattractive for investor/developers

But at the same time he pointed that some downtown projects do get built. The question is why.

From his perspective, “Not all projects are created equally.” He sees that some owner-users view feasibility through different lenses, some developers will have different cost structures and some have different feasibility thresholds – for instance, “locally rooted developers may view risk differently or believe strongly in long-term upside.”

He also noted that projects which achieve scale “may be better able to absorb soft costs.”

There are some ways he suggested to mitigate feasibility problems. One strategy would be to modify projects to optimize economics. Here small condo projects may not be practical, but more density will hold land costs constant while improving the ability to generate revenue.

Second, he suggests leveraging publicly-owned land. By the city contributing public land, it would reduce costs and therefore improve feasibility.

Third would be to take stake in the project, either by the city becoming an anchor tenant or partnering with developers “to obtain subsidies for catalyst projects that meet state and federal objectives.”

The city could also invest in public improvements and prioritize ones “that can help private projects.”

Finally, the city can take steps to reduce time and risk for developers. They can do this by providing clearer planning guidelines, limiting discretionary decision-making, clearing the way for environmental approval through a Specific Plan EIR, providing a fast-track path to entitlements, and following through with streamlined and efficient building permit and inspection procedures.

Matt Kowta noted, “This is the one we really heard over and over again in the public stakeholder meetings.”

Cheryl Essex of the Planning Commission made the comment, “I wonder about the term feasibility, it seems like your using it in a broad sense.” She noted, “It’s a disinterested investor feasibility summary – someone who doesn’t care at all about Davis and is looking for somewhere in the country to make some money.”

She said, “I think there are opportunities in Davis for our local builders that do care about Davis and are willing to invest with a lower potential return if they can get the financing, because they have a greater understanding of the plan.”

She added, “I don’t feel quite as pessimistic as I did at first glance.” Ms. Essex said, “I think there will be people who will step up and do some of these projects with a lower threshold.”

Matt Kowta, “I think that’s very possible. I think that’s why we’ve seen some of the projects around town that we have seen.” He noted that what justifies that is “some perception of lower risk.”

Matt Williams of Finance and Budget said his concern about what they’ve seen “is it’s really in the form of a black box. It’s in the form of one answer.” He said, “We are not seeing… ways that we could make them more feasible.

“What are the assumptions that are going to move the needle the most and what are going to move the needle the least?” he asked. He suggested the need to be more interactive in how they look at the variables and determine which ones will move the needle the most.

One of the common complaints from members of Finance and Budget is the fact that the model from Mr. Kowta was described as proprietary, and therefore he would not turn over the data and model to them to adjust.

Doug Buzbee, also a member of the Finance and Budget Commission who also consults for developers, was pointed: “I think that as good as your analysis is, it’s wrong.” He said, “The reason I say that is you’re not the developer.”

He noted, “Any developer is going to analyze these things in a different way.”

He noted that, in his experience, a 10 percent rate of return “in my experience, that’s probably not feasible. That’s my experience as a developer.” Mr. Buzbee added, “My experience is that developers, the ones who run sophisticated pro formas, are looking at 20 percent internal rates of return.”

Mr. Buzbee added, “Rather than trying to understand every potential scenario… Our responsibility as a local government is to set the vision, I think that’s what the DPAC and the Planning Commission are moving toward, the vision as to what we want the downtown to look like… and then our job is to remove the barriers that we have control over.”

He said, “We can’t make construction costs go down, we can’t make rents go up… But we can impact the barriers that we have control over such as extraordinarily costly affordable housing policy.”

On the other hand, Ezra Beeman submitted a revised model with some revised assumptions. In an email he said, “Here are some of my own resulting conclusions and thoughts, for consideration.”

For instance, he found, “Three story office/retail and residential sales projects earned 14% and 12% for investors, respectively, with adjusted assumptions.” Naturally these were more feasible.

In his comments he noted that the buildings were not selected to “make the most money” or get “the most development in the shortest amount of time,” but rather because they adhered to the vision laid out by Opticos and the DPAC.

“We have a vision,” he said. “How fast are we expecting to get there?

“This is a point in time study,” he noted. “These are economic forces. What I learned in the analysis is if you were to take the costs in any one of these projects… what you find is that the number one, two and three portion of costs come from construction, land, and if you’re in a leasing model, it’s going to come from financing.”

He pointed out that those are factors out of their hands, whereas the impact of development fees hardly moves the needle.

Meg Arnold, Chair of the DPAC, said that “the feasibility is really critical.” She said, “If it ends up being infeasible from an economic perspective, why exactly would (we) be bothering” to do this effort?

She noted that the DPAC is charged with envisioning what the future downtown will look like. “This is not the future downtown in 18 months,” she said. “This is the future downtown unfolding over the next two or three decades.

“In that context, the comments we have heard tonight about the point in time analysis and the fact that conditions will change is really really important to keep in mind,” Ms. Arnold stated. “It’s not a binary decision – this is not feasible, this is feasible.

“The decision that we’re facing is not an entirely binary decision,” she added.

Ashley Feeney pointed out that this was a picture right now, and they are using a static pro forma model for a plan that is expected to last for 20 years.

“It’s a 20-year outlook and if we focus too much on today’s picture in time, that may be a distraction over the overall 20-year period,” Mr. Feeney explained to the commission. “The variables that are outside of our control are going to change.”

—David M. Greenwald reporting

Here’s the data Matt Kowta presented on construction costs since someone raised it with me privately.

How would that compare with the projected/corresponding increase in rent/sales price, in future years?

Ron, the rent trend reported by the annual UCD Apartment Survey from 1975 to 2018 shows a CAGR of 5.26% over that 44-year period . If you remove the impact of the California CPI over that same period, then the CAGR over and above the California CPI is 3.76% for that 44-year period.

The 36 percent comes from Matt Kowta’s presentation – see the chart above.

I saw the chart… did the math… looked up the source (per graphic) 36% ONLY makes sense for 2008- 2019 (est)… I get charts, and I get CCI’s… the article referenced 2008-2009… attributed to Kowta? Did he ‘mis-speak’?

Repeating… 36% is ~ 2.8 %/annum … that # is credible…

https://www.google.com/search?q=construction+cost+index+2008-2019&oq=construction+cost+index+2008-2019&aqs=chrome..69i57.15947j0j4&sourceid=chrome&ie=UTF-8

… appears to have a link to the RSMeans data cited in the powerpoint presentation, found at,

http://documents.cityofdavis.org/Media/Default/Documents/PDF/CityCouncil/Planning-Commission/Agendas/20190522/05B-PC-slides-5-16-19.pdf

Either what was ‘said’ at the meeting, or what was ‘reported’, is in error… the graph in the presentation appears correct/plausible…

Just saying…

And yet, there’s this:

https://www.davisenterprise.com/business/hibberts-to-retire-changes-in-store-for-ace-rivers-to-reef-hotdogger-good-scoop/

Wondering how Mr. Feeney would explain this “discrepancy”, regarding his comment.

When I brought up the likelihood of the Hibbert Lumber site being used for purposes other than a lumberyard, it was seemingly purposefully downplayed by a commenter on this blog.

Other commenters are questioning the value of Davis ACE.

As a group, I might refer to these commenters as the “Committee to Destroy Downtown Davis”.

No – I won’t report your comment, as mine was rather provocative in the first place.

Regardless, it’s just my opinion anyway. Surely there are folks with other opinions, who don’t value businesses such as Davis ACE, don’t care about impacts on traffic, parking, etc. In short, are looking to make a buck at the EXPENSE of downtown.

As usual, you don’t actually state YOUR opinion – you just attack mine.

But again, how would Mr. Feeney explain the “discrepancy” between his statement and the statement of Hibbert Lumber owners?

Ron… ask Ash Feeney to explain… afeeney@cityofdavis.org… he is the one who could best explain… no one else here can… simple…

Maybe the owners of Hibbert have control of their property and the City is speculating in case it becomes available. Just a wild wild guess.

That’s a reasonable response, but is “different” than what I experienced on here, the other day.

However, Hibbert (or any property owner) does not have total “control” over their own property. Property owners are subject to zoning, neighborhood guidelines etc.

The other motivating factor for my comment is the possible loss of the only lumber yard in town, combined with efforts by some to make it more difficult for Davis ACE and other downtown businesses to survive – while simultaneously claiming that they’re interested in the fiscal health of the city.

The owners of a property/business pretty much have TOTAL control of who they sell to, and what financial consideration… the land is entitled to what it is entitled to… nothing more, nothing less… simple…

The hell it is that “simple”. Sometimes, property owners must “prove” (or, at least state that they’ve “proven”) that their properties are no longer “viable” for their currently-zoned usage, to convince others that there’s a “need” for a change.

Or at least, to provide “cover” for elected officials to approve a change in zoning.

Perhaps not so ironically, this tends to be “proven” much more frequently, if rezoning drastically increases the market value of the property.

What you now speak of, Ron, is politics… not law… yes the scenarios you posit are possible…

But I doubt the current owners would take the risks involved… and the buyers would have to accept, at least in the present, that “it is what it is”…

An agency has no obligation to entitle land use changes based on ‘viability’… they may choose to, but politics, judgement, but not obligation…

I stand by my previous post.

g’nite…

Great – give away public land to development interests!

How do you know it wasn’t part of a private, Mexican land grant? And before that, was “owned” by no one except Native Americans?

What does UCD land have to do with this, and how is your repeating of this irrelevant history important? Do you think I don’t already know the history of this, regardless?

More importantly, do you have some relevant point to make? For example, you think it’s a good idea to give away public land to private development interests?

1. I just know… Mexican land grants were not private… Spanish/Mexican governments… you affirm my point.

2. Native Americans, generally, did not have, nor believed in, ‘ownership’ of property… ‘rights’ to fish, hunt, occupy territory, yes… but not ownership… hence the ‘purchase’ of Manhatten Island… they got goods, for something that they did not feel they owned… it was the Europeans who were “into” land ownership.

3. UC was just like the government grants to “homesteaders” … land grants…

4. Think I made my points… your premise as to,

Nothing new under the sun… if the government felt there was a public purpose to be served… homesteaders were ‘developers’… those receiving Spanish/Mexican land grants were ‘developers’ the government(s) wanted the land [that they asserted sovereign rights to] to be occupied and developed… not just vacant…

Maybe UCD has a History XYZ class that you could benefit from, to gain perspective…

Oh… another reason to study history… some of the CA land grants, by Spain, occurred before Mexico was even a ‘country’… have seen the documents, or copies thereof… have you?

Your questions appear to be ‘blowing smoke’… will leave to others…

Ron… understand the word “grant”… i.e. gift… or in any event, transfer of ownership…

No… Exact opposite… whatever..

Besides a History class, consider a Real Estate one… learn about ‘Grant Deeds’…

Ron O. said “Great – give away public land to development interests!” Yep. That’s the big “ask” that’s sure to come.

Got to agree with you on that one.

Not disagreeing, per se, but most city land was acquired by exaction or ‘gift’… in either case, no “cost basis”, per se. Not inherently “a gift of public funds”… but that is arguable… I know that.

Just saying, but if the gov’t entity has acquired it, by any means, it is an “asset”… value and purpose TBD.

It would not be a ‘gift’ but rather an investment. The City might include a parcel of land in a project, for instance a connecting surface parking lot, and receive some consideration in return. Done well, the City receives far more in return than the status quo. Turning Mace 395 over to the Land Trust at a financial loss to the City was a ‘gift.’

Mark West: right on cue, just as I predicted, here comes the “ask.” A few days ago you were pushing a laissez-faire approach and didn’t want Big Government to “choose winners.” Now, you’ve apparently forgotten that and are pushing for developers to get hand-outs.

Perhaps you missed the “and receive some consideration in return” part of Mark’s comment.

I expect that if 5th Street ever gets redeveloped, there will be some involvement of the public properties (city corporation yard, school district property) in that process. It’s likely that some of it will be included in exchange for some consideration to the city. Likewise the school district property on B Street, which has been the subject of development discussions off and on over the years.

Mark: despite your call for the government to not “choose winners” or play “favorites,” I understand that you are looking hand-outs for the development community for certain projects.

I also understand that while you have been calling for downtown to go to 5-6 stories to make redevelopment pencil out, the actual analysis in BAE report shows that would barely move the needle at all in terms of project feasibility.

” . . . and there will be a great deal of “scrutiny”. (Unfortunately, it might be among the first places that some development-minded individuals “look”, given the likely public subsidy that could occur.)

Is this the location where the community garden is located?

Yes. Most of the property between L and Pole Line is owned by the City of Davis, DJUSD, or the DMV. It was identified by the 2010 business park task force as one of the areas for possible development.

Is that per year? Really? If so, no wonder they’re generally wealthy.

Where can the average schmo get returns like that?

Doug Buzbee said, “We can’t make construction costs go down, we can’t make rents go up… But we can impact the barriers that we have control over such as extraordinarily costly affordable housing policy.”

Yet, looking at the actual BAE report figures, for the Medium Lot MXD Retail/Residential pro type with 33 owner units, a 10% affordable housing requirement using an-lieu fee only drops the gross profit on total cost figure from 10.3% to 8.5%.

Several caveats that would cause this margin to narrow further:

– this does not account for a density bonus that would be applied for an affordable housing component. Set at proper thresholds, this is one of the key components that a local government can use to provide a de facto subsidy.

– nor does it account for the downward market pressure on land costs for properties subject affordable housing requirements (land costs do not exist in a vacuum but are dependent on the return on investment).

Still, not even considering these and other factors that could mitigate affordable housing impacts on profitability, in BAE’s model the gross profit declined by only 1.8% with a 10% affordable housing requirement. This does not support Buzbee’s accusation of “extraordinarily costly affordable housing policy.” On the other hand Buzbee’s tatement that 20% returns are needed (rather than the 10% threshold in the BAE report for for-sale projects) does put an extraordinary barrier on any development being feasible at all.

Actually we can. It’s called Measure R.

Half right… but I get it… we certainly can make rents go up (and home/property prices) with measures J/R… demonstratively proven…

Construction costs an entirely different matter, and other “drivers”… if we “doubled down” on the measures (J/R), would not matter… unless we had no construction, and then construction costs would be zero… some would espouse that approach… I’m not favoring that approach…

There are “costs” to ‘no construction’…

One interesting conclusion of the BAE analysis is that going from 3 stories downtown to 4, 5, or even 6 stories would not have a appreciable affect on project feasibility.

We can see this in the ““Medium Lot Mixed Use Office Over Retail: prototype. That one is analyzed at 3 stories (at 32,000sf office) and 4 stories (40,000sf office). It should be noted that the “yield on cost” only goes from 7.10% to 7.30% (or increase of 2.8% net yield for an additional floor) with the increase from 3 to 4 stories (Table 14, p. 14). The feasibility targets is (p. 42): “8.5% yield on cost for income-producing projects.”

And even at 5-6 stories, this type of development wouldn’t be feasible. Keep in mind also, once you get to around 5 stories (threshold of “medium-rise” development), construction costs per square foot start rising. So the ~3% total net yield per additional floor in going from 3 to 4 stories won’t translate going to 5 or 6 stories and incremental returns will be less. Even if it did, project yield would still only be about 7.7% at 6 stories compared to 7.10% at 3 stories.

One broad conclusion; construction costs are too high and rents are too low to support feasibility for much downtown redevelopment.

And even though going up to 5-6 stories doesn’t change that equation to any significant degree, what we will see from the developers is a push for that anyway, along with a push to get rid of affordable housing requirements and a push for public subsidies.

David Greenwald stated elsewhere “Economics here are going to improve with density which is part of why I think we need to be thinking four to six stories.”

This statement is directly contradicted by the data in the BAE report itself that shows—as I discuss in the above comment—that increased density has minimal effects on project feasibility .

’twas noted last night the video feed was not working, so many people who wanted to tune in did not see the meeting. It supposedly came on at 9pm, two hours into the meeting near its conclusion. I am curious if this important meeting was ‘lost to history’ or if the two missing hours were recorded and will be posted online today.

Likely, not (lost to history)… as for posting today, likely not… this isn’t first time… usually problem has been in the streaming, not the recording… probably should be up by Monday afternoon, unless there was a problem on the recording…

https://cityofdavis.org/city-hall/city-council/city-council-meetings/meeting-videos

Scroll down on the page… looks like it’s there already…

Did not check for completeness…

My review of the video tells me that the video is complete

Thanks for that, Matt… and I understand you were there, in real time… and would know.

Davis is becoming a “mini-San Francisco”, albeit without the lesbian and drag-queen bars.

https://www.washingtonpost.com/lifestyle/style/how-san-francisco-broke-americas-heart/2019/05/21/ef9a0ac0-70ea-11e9-9eb4-0828f5389013_story.html?noredirect=on&utm_term=.f97ea7578531

From the presentation

Look at the actual numbers in the BAE report and see what they say. Economics “inprovements” with density are very small. For example adding one floor to the 3-story model office over retail prototype goes from 7.10% to 7.30% yield on cost. Going to 5-6 stories would likely be even less of a marginal yield increase (or perhaps even negative, depending on construction type).

The question remains: why are you pushing 5-6 stories downtown? The numbers don’t support it.

Am thinking the key is in the last bullet point… then the question becomes are any current property owners interested… the study doesn’t appear to address that possibility… seems to assume new owners/developers… but, it’ll be a ‘crap-shoot’ as to current property owners seeking to “re-develop”, IMO… risk factor…

Other key words are “current environment”… environments are subject to change… should we prepare for the possibility of ‘environmental change’? A change in economic or other “climate”?

Just saying… I care little as to revisions to the CASP… fascinated to the process, though…

The point Bill makes “the question becomes are any current property owners interested… the study doesn’t appear to address that possibility… seems to assume new owners/developers” is the much same point that Planning Commissioner Cheryl Essex made in her questions to Matt Kowta (those questions start at 57:30 and last until 1:04:30 at http://davis.granicus.com/player/clip/1001?view_id=6)

That point was further illuminated during the presentation of the list of projects during the public comment by Mark Grota, secretary of the Old East Davis Neighborhood Association (whose public comment starts at 1:56:15 of http://davis.granicus.com/player/clip/1001?view_id=6)

Bill and Matt – looking at residential summaries, 8 rental units goes from 5.1% expected return to 6.7% at 50 units. It seems like if you build for 100 to 200 rental units, you might be able to get to 8.5% or at least close to it. Or perhaps a mix of rental and ownership units which was not explored here.

Feasibility of course is one calculation. And it calculates from the perspective of the developer rather than that of the city.

The other is the need for housing and given that it is unlikely that the city is going to get peripheral housing approved in the next decade, better utilization of existing space seems the way to go. I think your point is key – owners that might take a bit less return because they are committed to the community.

The current owners of the Brinley properties have made it known they are interested in redeveloping some or all of those parcels.

David Greenwald asked . . . “looking at residential summaries, 8 rental units goes from 5.1% expected return to 6.7% at 50 units. It seems like if you build for 100 to 200 rental units, you might be able to get to 8.5% or at least close to it. Or perhaps a mix of rental and ownership units which was not explored here.”

The ability to spread/leverage “soft costs” across a greater number of units is not linear David. It would only be linear if those soft costs are fixed, but they are not. Soft Costs do vary based on the size of the project, so it does bring the return up, but marginally less so the larger the project gets to be.

I personally believe the quickest way for the smaller projects to improve the expected return is for multiple smaller lots to collaborate/consolidate into a larger project.

Perhaps he should push for residential development on the periphery of Davis? Densification elsewhere within the City boundaries? Your neighborhood?

All of the above?

How would you solve the housing thing (that the City has control over)?

Or do you see no “thing”? A ‘denier’?

Matt Williams: not only is the relationship not linear, but Greenwald ignores information in the BAE analysis that shows it is not linear. And he presents his own non-supported conjecture about the profitability of increased densities to support pushing downtown to 6 stories.

David Greenwald stated: “looking at residential summaries, 8 rental units goes from 5.1% expected return to 6.7% at 50 units. It seems like if you build for 100 to 200 rental units, you might be able to get to 8.5%”

No you would not. To say otherwise is an attempt to twist the numbers in unsupportable ways

First of all, the 8/12 unit prototype is a completely different type of development and lot size than the 40/50 unit prototype.

Second, look at what happens when you go from 3 stories (40 units) to 4 stories (50 units) for the Medium Lot MXD Retail/Residential prototype: yield on cost goes from 6.5 to 6.7%. Going up to 6 stories would maybe get to 7.1% at that rate. But there is a threshold at around 5 stories depending on construction type where construction costs per sq ft go up, so those increased yields are unlikely and, in fact, would likely decline.

There is no substantial economic feasibility justification using the BAE analysis for going from 3 stories to 6 stories.

The people paid to make these determinations, disagree with you Rik.

I also think you’re looking at this backwards. You don’t need a feasibility justification. You have a need for housing and then the question is whether they can get it to pencil out.

Yep. “They” is a key word. City can facilitate, but cannot “do”…

Sidebar, Craig…

Although I agree with the main gist of the report(s) and your comments, perceive that you (and others need to know, re:

that many times, ‘a consultant is someone who you pay, borrows your watch, to tell you what time it is’… in this case, the reading of the watch, the telling, may well be correct (current realities), but “past performance doesn’t guarantee future performance”… one way or the other…

I support densification of residential in the DT, if feasible economically (don’t much care about ‘politically’)… no opinion of “how high”…

Residential densification DT could be VERY beneficial, to the City, and those that do business, live (now and future), and/or visit/shop DT…

Any path to a ‘good answer’ is a good one…