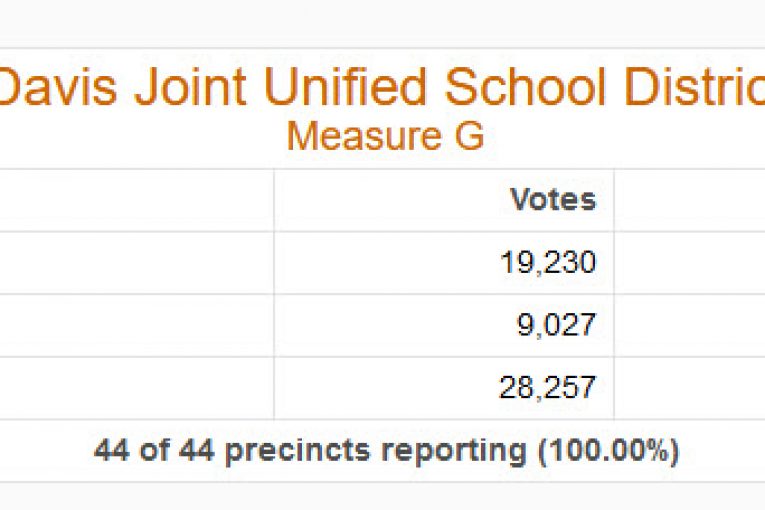

Many believed from the start that Measure G, the parcel tax measure for Davis Joint Unified that will fund teacher compensation increases, could win a narrow victory—as defined under current state law where school parcel taxes are required to receive a two-thirds majority in order to prevail.

However, the first election returns put it at just 63.9 percent of the vote—a percentage that increased to 65.1 by the end of the night. To many it seemed a long shot that the measure could pass.

But on March 27, the latest tally moved the yes percent to over 67 percent. On Wednesday, Yolo County completed their canvass and the measure received just over 68 percent of the vote—a total that would not have surprised many going into the election results, but is absolutely shocking given where things were on election day and shortly thereafter.

Evan Jacobs, spokesperson for the campaign, told the Vanguard, “Our campaign team expected a close election. We had about 62 days between New Year’s and election day to educate voters on the pay gap for Davis teachers and how students benefit from great educators. Given the excitement around the Presidential primary we knew that our message would take time to sink in.”

He added, “Our campaign volunteers leaned into the effort of reaching voters, and a large group of community leaders helped amplify our message. The campaign provided credible information about why the measure was necessary and earned the trust of voters.”

Mr. Jacobs said, “The increased levels of support in the ballots counted after election day reflects the difference our volunteers made in educating voters and activating supporters. This effort continued through election day and was crucial in the successful outcome of the measure.”

Yolo County Elections put out a statement on Wednesday that they finalized the canvass process and certified the election.

There were 117 thousand registered voters in the county with 64,858 ballots cast for a total turnout countywide of 55.3 percent.

They noted, “This marks a record for Yolo County for number of registered voters. The prior high-water mark was 113,132 registered voters as of November 2018. This election’s voter turnout of 55.3% was higher than the last Presidential Primary Election in Yolo County. In the 2016 Presidential Primary Election, voter turnout in Yolo County was 53.6%.”

“Even with all the challenges associated with COVID-19, we were able to still certify an accurate and transparent election two weeks prior to the Governor’s extended deadline and had the highest primary election turnout since 2008,” said Jesse Salinas, Yolo County Assessor/Clerk-Recorder/Registrar of Voters.

In addition to the Measure G result which was up in the air, two county supervisor races hinged on close races as well.

In Davis, the 4th Supervisorial is headed to a runoff, where Jim Provenza fell short of a 50 percent mark needed to avoid a running off—he received 48.43 percent of the vote. He will face Linda Deos in the fall, who received a surprisingly strong 37.5 percent of the vote.

The 1653 vote difference becomes interesting because a third candidate, David Abramson, received a solid 14 percent of the vote at 2127. That will make the 4th District one to watch for the  fall.

fall.

In addition, Angel Barajas, the former Mayor of Woodland, defeated four-term incumbent Duane Chamberlain, who had been the longest running elected official in the county.

Mr. Chamberlain led after Election Day by a scant 90-vote margin. Angel Barajas dominated in the post election day balloting, winning by over 440 votes and a 52.4 to 47.6 margin.

He will add a Latino voice to a board that was seen by some lacking as in diversity.

When we spoke to Alan Fernandes, one of the school board members who served on the parcel tax subcommittee following the March 27 totals, he was fairly confident that the results would now hold up, though he said he was not ready to “spike the ball in the end zone” just yet.

“I did believe we would get there, but I didn’t think we would open up a full percentage point in the last tally—and that’s what happened,” he said.

“The next step in terms of the parcel tax negotiation is already all done,” he said, noting that they will have to appoint a committee. This increase will take effect in July, the next fiscal year.

“(The pay raise) will bump up in July,” he said. “They’ll see a raise.”

Every teacher’s pay will go up by $2900 annually.

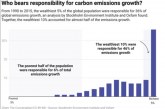

Alan Fernandes explains that, by making it a flat increase, it will increase the pay gap as a percentage more on the bottom range than the top range. The pay gap is a lot larger at the lower levels and closes markedly on the upper levels.

“Our newer teachers had a bit wider gap,” he said. “One of the ways we addressed that, every teacher got a flat dollar increase… starting July 1.”

This pay increase, Alan Fernandes said, puts the district at the level of compensation now for surrounding school districts.

Given the economic uncertainty that awaits DJUSD and other school districts, the passage of the parcel tax seems to have come at the right time.

“We believe that the voters… are supportive of our public school system,” Alan Fernandes said. “In Davis they know the value that it brings back to them.

“This is a community that is totally supportive and all about public education,” he added. “Two-thirds is the highest standard that can be in place. As long as you meet that two-thirds threshold, it’s hard to argue otherwise that this community isn’t always willing to answer the call when our public school system needs something.”

He pointed out that they offered to the community a no-sunset, cost-of-living inflator to support our educators “and our community seems to have answered the call.”

Board Member Joe DiNunzio is expected to release a statement that will be added to this story later in the morning.

—David M. Greenwald reporting

Why did it take so long to count the 65,000 votes cast in Yolo County? Yolo was the 52 of 58 counties to report to the Secretary of State’s office. I recognize that we are in an emergency situation but so are the other 57 counties. The last few elections it seems Yolo County has lagged in getting the votes counted. I wonder why?

I feel that is a question that really needs to be asked – no one has wanted to ask it previously.

And I wonder, “what does it matter” if Yolo was 52/58? Someone had to be…

It still was done within the allotted time, and then some… one likely reason is that with the high # (& %-ages) of provisionals, conditionals, and ‘last-minute’ VBM’s, which all require signature verifications, plus imposition of the 6 – foot ‘rule’ during the process…

Am confident Jesse Salinas would be happy to answer, if asked [I’ve always found him and elections staff to be very responsive to phone and/or e-mail contact… it frankly (altho’ I’m not) didn’t matter to me… it just means the nominal paycheck for being a poll worker was delated by a week or so… a de minimus concern…

Frankly (altho’ I’m not), I’d be more interested in the stats as # of early VBM’s, provisional, conditional, and last minute VBM’s… curious as to %-ages… it’s an ‘engineer’ thingy…

HUH? Doesn’t make sense… what am I missing?

Also will be interesting to see how quickly DJUSD will post the forms for exemptions… I suspect they’ll wait for the last minute… minimizes the number who can choose that option…

[Footnote: DJUSD website still has Measure G as ‘pending’… no form…]

No reason it would be anything else.

Just as Yolo being 52/58 ….

Am assuming your referent was, “I suspect they’ll wait for the last minute… minimizes the number who can choose that option…”

Yet, you said/posted,

Interesting…

Particularly as you have not addressed how the increase in teacher compensation increases (your words) the pay gap for those on the lower end of the scale…

Stunning . . .

Gregg Cook, a more prominent opposition voice in this campaign, based his position in part on the belief that there was money coming from the state which would take care of any salary shortcomings in the district.

On 6 March 2020:

Others mentioned additional funding from a potential statewide measure on the November ballot. Given where we are economically, it’s hard to believe that those state sources will materialize for the district the way Cook and others had hoped. The state May budget revise is likelier to revise downward many proposed budget line items. At this point it’s a good thing for local teachers and staff that things turned out the way they did, and noting that Cook’s letter to the editor was curiously titled, “Davis teachers deserve better pay.” (link above) Indeed they do.

For the Davis school district, local school parcel tax funding have been a more reliable funding source than the state budget.

Yes… understood… and agreed…

Main reason we would donate our ‘senior exemptions’ to DJUSD or other educational entities… it’s not about the $$$. But, due the SALT changes, we are no longer able to at least get a deduction for local taxes (particularly increases)… so, guess it is a little about the $… if we could contribute to DJUSD, as a ‘charitable donation’ (no one seems to answer that question, asked repeatedly by me) we likely would… otherwise, it is more cost-effective to donate to educational efforts, whether for parochial schools, or foreign educational entities…

We’d be real open to contribute ‘locally’, but have also supported (and continue to support) global efforts… it’s a logical decision… but, looking at ‘biggest bang for the buck’… anything we ‘save’ by taking our exemptions will go to education… but the $$ goes farther if they can be considered by IRS/State to be contributions to charity… and, as you point out, that’s kinda’ where DJUSD is… big diff between what we do willingly, and what folk say we HAVE to do… just wired that way…

Our charitable contributions (beyond taxes) was 5 – figures last year… over 10%… but SALT legislation has made us re-think WHERE those $$,$$$ go…