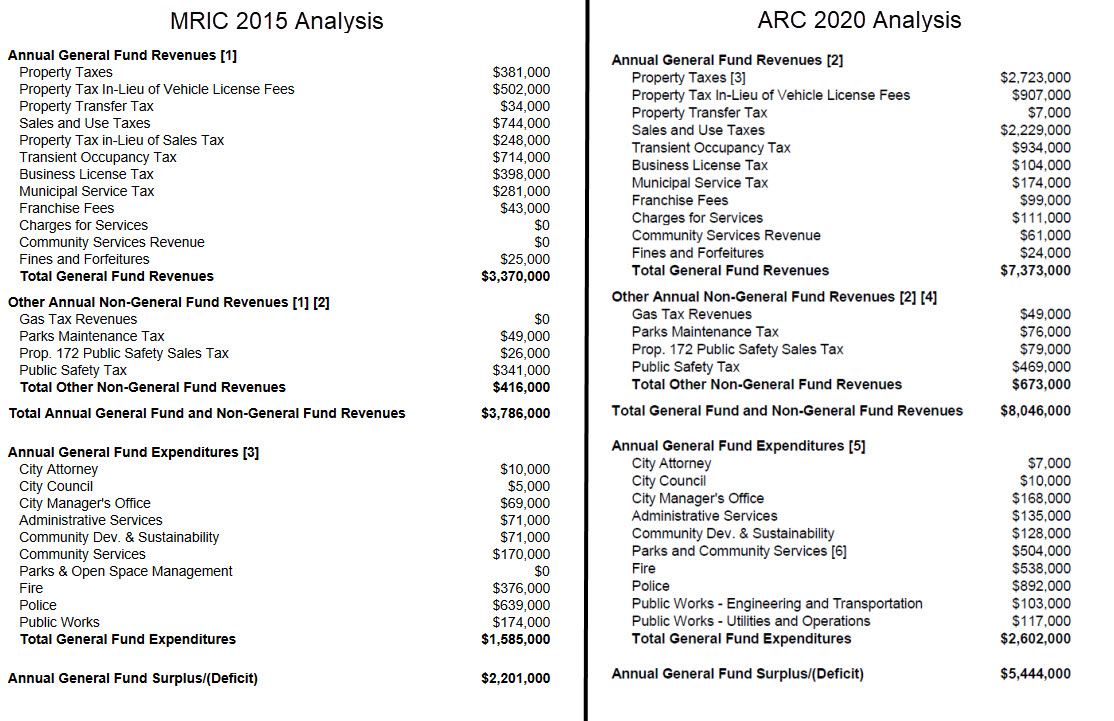

In 2015, with the fiscal analysis of the then-Mace Ranch Innovation Center (MRIC), we were surprised to see that the projected fiscal benefit of the project was only about $2.2 million. Within that number was a projected annual revenue of $3.8 million partly offset by $1.6 million in costs.

While EPS (Economic & Planning Systems, Inc.) at that time found a tremendous overall impact in terms of one-time construction fees and a boost to the areas economic activity, our analysis at that time was $2.2 million was very  conservative.

conservative.

Flash forward to 2020 and the same consultants, EPS, have a very different fiscal analysis of a similar but not identical ARC (Aggie Research Campus) project.

EPS projects that at buildout the general fund gross revenue will be $7.3 million with another non-general fund revenue at $673,000 for a total of around $8 million in annual revenue.

Forecasted expenditures are estimated at $2.6 million, resulting in annual revenues net of cost to the City of approximately $5.4 million. Davis Joint Unified School District would collect $1.37 million annually in school assessments and bond levies.

So what accounts for the difference between the two projects?

A side by side shows some very interesting findings. Some of the revenue differences appear to simply be inflationary and explainable. Some are drastic.

The biggest change is the overall property tax. It goes from $381 thousand in 2015 to $2.7 million. We would have to talk to EPS about how that is calculated. One portion of that might be the housing. But the 2015 projection seemed strikingly low at the time. Remember, you are going to have 2.6 million square feet of R&D space, and remember also that heavy capital equipment from manufacturing is assessed as property tax.

Given the size of the project, the 2015 amount was way too low and the current figure seems much more realistic.

The other big change is that the projected sales tax goes from $755 thousand to $2.2 million. One of the flaws with the 2015 analysis was they made the very conservative assumption that Measure O would expire on December 31, 2020.

Wrote EPS: “Forecasted expenditures are estimated at $2.6 million, resulting in annual revenues net of cost to the City of approximately $5.4 million. Davis Joint Unified School District would collect $1.37 million annually in school assessments and bond levies.”

For this analysis, given the permanent passage of the sales tax in Measure Q, the new sales tax is calibrated into the figure. That alone makes a huge difference and was again a flaw of the 2015 and  why the figures were so conservative at the time.

why the figures were so conservative at the time.

There is an increase in the property tax in lieu of the vehicle license fee which accounts for $400 thousand. There is an increase in the TOT (transient occupancy tax) which is the result of the increase in the city’s TOT tax, and that accounts for another $200 thousand. There is also a charge for service and a community services revenue that represents another $170 thousand increase.

There are a few decreases in projected revenue, as the business license tax falls from nearly $400 thousand to $100 thousand. The municipal service tax revenues drop by about $100 thousand.

But overall the difference here is stark—it goes from $3.4 million in 2015 to $7.4 million in 2020.

On the expenditure side, there is also an increase in costs, but it is just over $1 million, more than offset by the $4 million increase in revenue.

About half of the cost increase is due to a park in ARC that wasn’t included in MRIC. That accounts for half a million dollars of the increase right there. Most other cost increases are incremental from cost-of-service increases. Fire goes from $376 to $538 thousand. Police from $693 to $892 thousand.

We can probably reprise the debate from previous fiscal analysis—it is unlikely that the city is actually adding police or fire service based on a project of this size. So basically they are assigning a fair share allocation of the costs to this project whereas, in reality on the books, those costs don’t actually exist. In that sense, you are overstating the costs of the project just as they have in previous projects.

Moving forward, the Finance and Budget Commission, which will evaluate this more on May 11, ought to look more deeply into the issue of the property tax increase. On the surface it seemed that the 2015 projection was way too low and $2.7 million is more realistic, but we do not know the exact mechanisms for those calculations.

—David M. Greenwald reporting