By Alex Achimore

By Alex Achimore

Much attention has been given recently to the possibility that shopping centers and strip malls have unintentionally become land banks for new housing that California desperately needs. Clearly, between the internet and the pandemic, the retail business has changed significantly over the last decades and there are many retail centers now that are nearly or completely empty.

Even before the internet, the overbuilding of retail centers had been predicted in many quarters for a long time, but the retail development industry has been an efficient engine of procuring sites, signing lease agreements with national chain stores, and  convincing banks to finance with the promise of, if not great profits, significant cash flow through sales. If nothing else, pure momentum has been enough to continue new development of standard forms despite a growing number of failed shopping centers and strip malls.

convincing banks to finance with the promise of, if not great profits, significant cash flow through sales. If nothing else, pure momentum has been enough to continue new development of standard forms despite a growing number of failed shopping centers and strip malls.

In Davis, the owners of a classic, 1960’s-style strip shopping center, Brixmor Property Group, a national company that owns over 300 retail centers around the United States, took a hard look at adding housing to their plans to renovate the aging and partially empty University Mall.

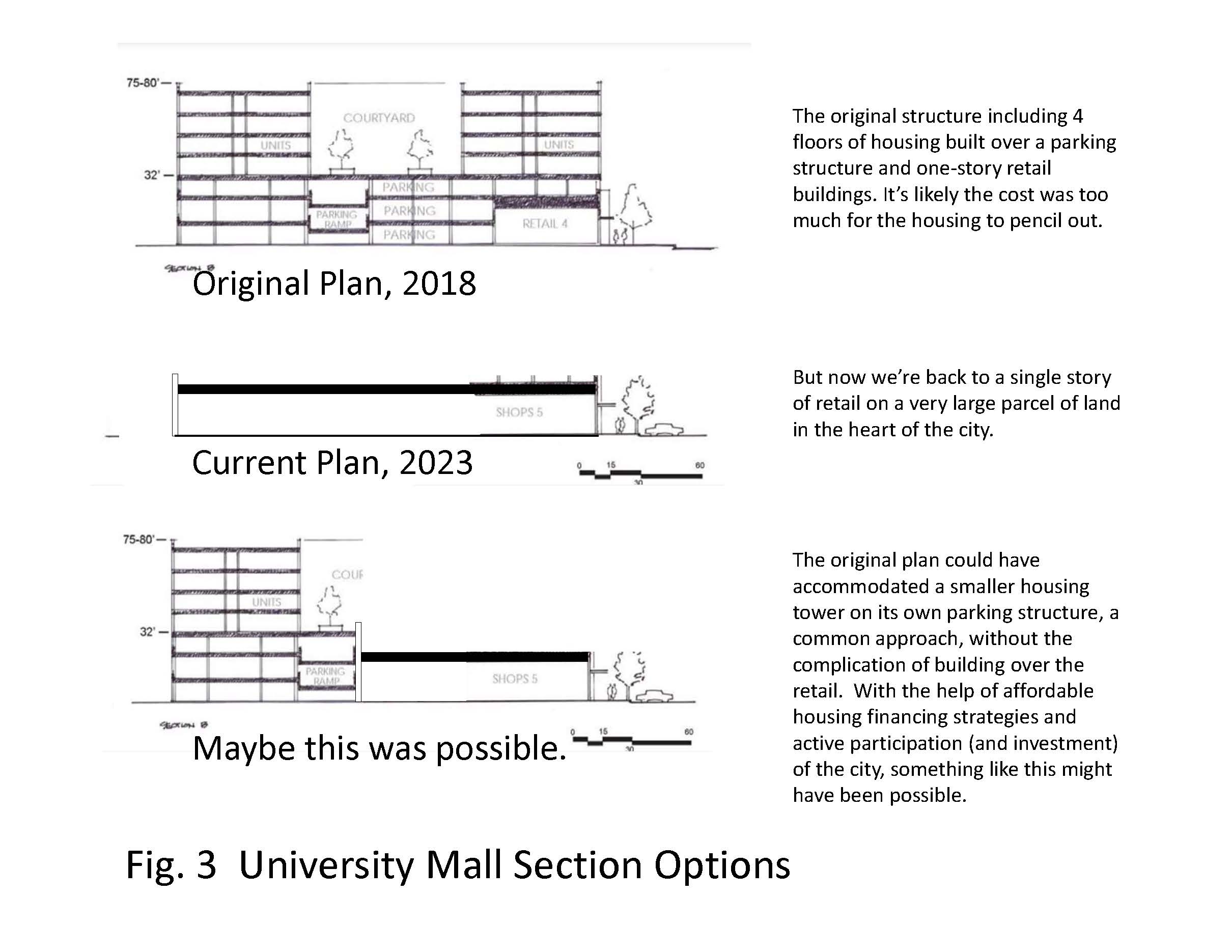

Brixmor prepared a plan for a total reconstruction of the retail facility, and at the city’s urging included a 264-unit residential complex with a parking garage, rising to 72 feet at its highest. They took a pause during the pandemic, but ultimately decided against the housing component, saying they could not find a housing partner and would move forward with retail only.

There was some neighborhood opposition that cited the height and the sense that so much new housing for UC Davis students should be built by and on the University rather than within the city limits. It’s not clear whether the oft-raised notion that “it’s the University’s responsibility to house their students” is a red herring and the opposition still would have emerged around even a smaller affordable housing project aimed at Davis’ workforce.

There was some neighborhood opposition that cited the height and the sense that so much new housing for UC Davis students should be built by and on the University rather than within the city limits. It’s not clear whether the oft-raised notion that “it’s the University’s responsibility to house their students” is a red herring and the opposition still would have emerged around even a smaller affordable housing project aimed at Davis’ workforce.

But there was also significant disappointment in the wider community that no housing would be included given the size and location of the site. Between letters, call-ins and emails, there were over 90 commenters, with 80 in favor of some type of housing, 12 in support of the project without housing.

One of the most important points made at the Planning Commission hearing was that the typical salaries of retail workers are not enough to cover living in Davis. While bringing jobs to the city is very positive, we remain unaffordable to much of the workforce here, and likely to the majority of the future employees at the U Mall.

It certainly is not any developer’s individual responsibility to address Davis’ housing problems, let alone to fully house the workers it employs, but some form of impact fee or cost assessed to future commercial development is very justifiable

But with so much expectation riding on the potential to add housing to shopping centers, reflected in several new State laws that reduce parking requirements and override community opposition if affordable housing is included, it’s important to understand exactly why it didn’t work out at U Mall.

Was it the potential of opposition, or an overly ambitious plan, and was there really nothing else the city could have done to make it happen?

Was it the potential of opposition, or an overly ambitious plan, and was there really nothing else the city could have done to make it happen?

Brixmor states they spent considerable time looking at ways to incorporate housing, but perhaps the business models for the two uses couldn’t allow the site to be shared, and unless something is altered in that formula, it may be rare that we see shopping centers be redeveloped with both components.

Yes, there are more and more recent examples of shopping centers being razed for new housing, but barely any that come back with the two together. An internet search turned up one, La Placita in Santa Ana. But it’s much smaller overall, the retail is very much ancillary to the housing, and it was developed by a non-profit who could live with smaller margins and had the expertise to assemble a complex package of financing that is typical in the affordable housing development world.

At the U Mall in Davis, it seems likely that the owner, being a retail company, first determined the maximum the amount of retail space that would fit on the site in a conventional, one-story strip mall, perhaps just like the plan they have now, and then asked a housing developer what their ideal project size would need to be. It would certainly be larger than what they might need if they had the site to themselves because it had to cover the additional cost of building over the mall, and apparently 264 units was the answer—unquestionably a very large project even if built directly on the ground.

What if the site were bigger? A good asset manager always tries to maximize the value and return of the asset, so it’s likely Brixmor still would have filled that one “to the max” with retail, and the housing would still have to be built entirely overhead.

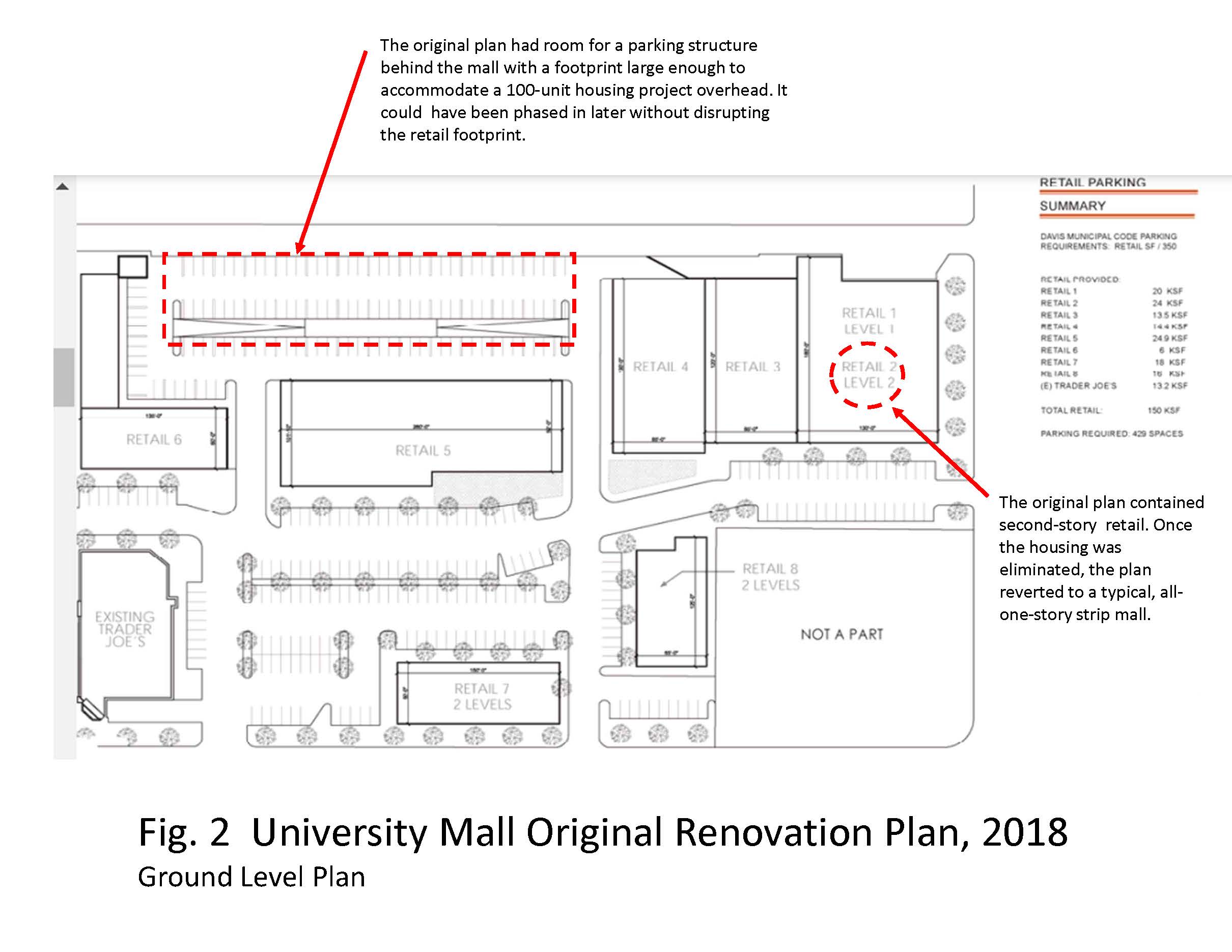

To their credit, the original plan did make some major adjustments from a conventional layout, including a small amount second-floor shop space and some parking in the rear, to fit the targeted retail amount and still leave room for raised parking and access to housing overhead.

But presumably Brixmor rejected plans that would have reduced the retail leasable area from the theoretical maximum, even if it could have lowered the cost of the housing portion. If that’s a constraint, the concept may have been doomed from the start.

But presumably Brixmor rejected plans that would have reduced the retail leasable area from the theoretical maximum, even if it could have lowered the cost of the housing portion. If that’s a constraint, the concept may have been doomed from the start.

Another presumption from the direction they took is that the extra cost of building on top of the retail is more than the cost of an empty piece of land in that location.

We don’t know how hard these numbers were crunched, and such terms as “cost prohibitive” or “we’d have to over-ex” aren’t necessarily indicative—they all can be boiled down to numbers, and it would have been helpful to hear more detail about the comparison to a raw land price.

But Brixmor also named other factors that discourage the placement of housing over shopping centers, including the retail tenants’ perception that it crowds out the ground plane that both are competing for use of. It would probably slow construction as well—the structure would be more complicated, albeit almost anything is more complicated than a one-story big box.

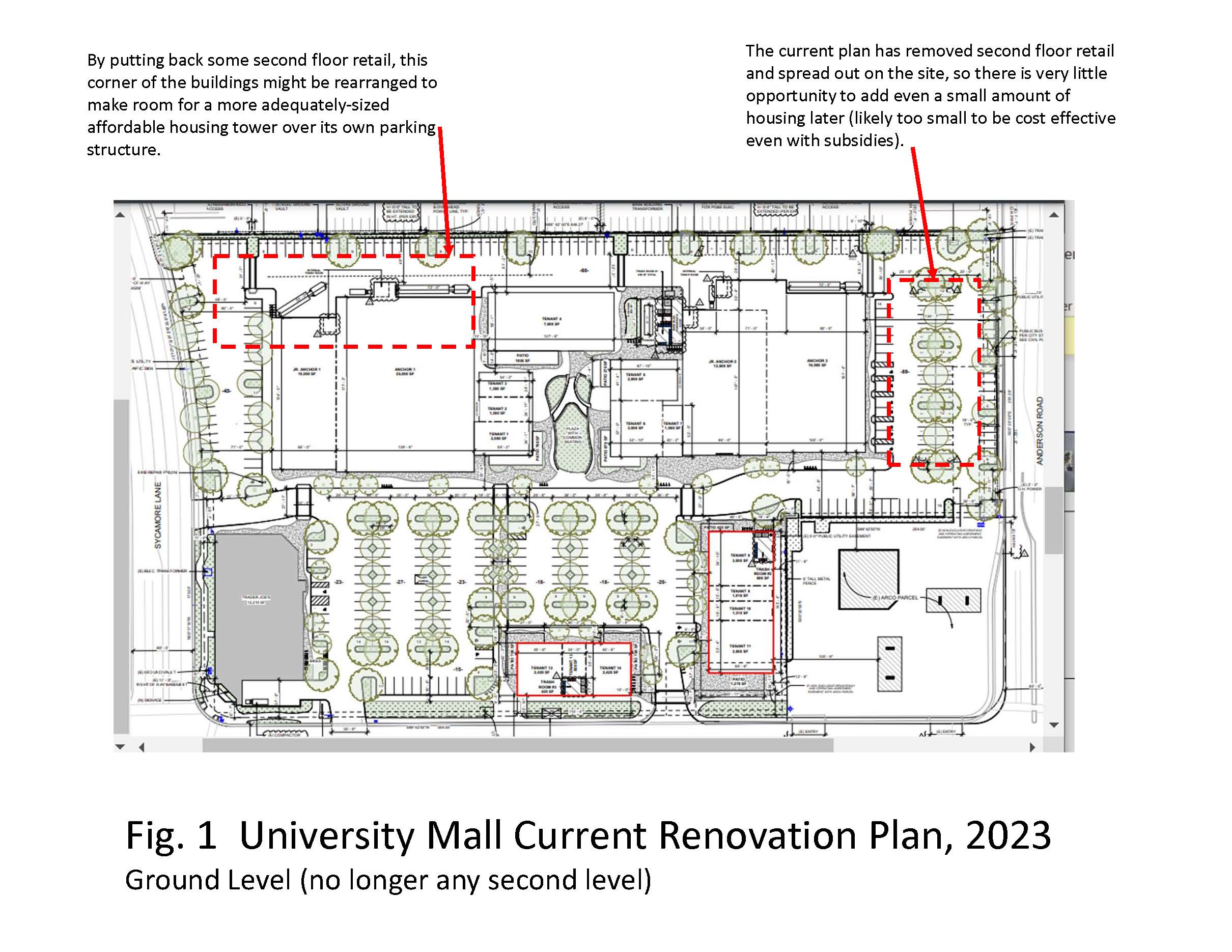

Brixmor stated they weren’t opposed to adding housing in a side-by-side arrangement along Anderson Road, but again, having maxed out the retail, there isn’t much room left. A housing tower that would fit over the eastside parking between the building and Anderson (including its own parking in a raised deck) might yield 12-16 units per floor of a mix of 1- and 2-bedrooms.

Talk of adding the Arco site seems unrealistic both because of the likely cost to purchase the property and the fact that connecting to a building over the Anderson Road parking would cut off an important access point to the retail center—hardly seems desirable. In any case, even both those footprints together appear to be too small to make a market-rate rental project pencil out.

What about an affordable project that didn’t require the ARCO site? It’s theoretically possible Brixmor could lease the air rights above the eastern part of their parking lot to a non-profit housing developer at a nominal amount to cover loss of parking during construction.

It would not enhance Brixmor’s bottom line but (assuming the lease amount is adequate) wouldn’t hurt it either.

Would the Brixmor shareholders see that as a giveaway? Possibly. But given the current plan, that parking area by itself still might be too small to build an adequately-sized project.

In the affordable housing world, a minimum of 50 units is a commonly-recognized threshold, 60 plus better, even with essentially free land, likely too big for the available area.

Brixmor’s original ground floor layout, presumably an acceptable plan for the retail component, tucked a small amount of shop space in a second floor of one of the anchor tenants and left a much better footprint behind the buildings that could have been developed separately without overlaying the rooftops of the mall.

That area was to contain a parking structure and ramp access to the 264-units, and when housing was eliminated, the upper level retail was all put back into one-story buildings—maximum area, minimum building cost.

But it does indicate that the retail could have lived with a little less ground floor space and perhaps left enough room for an appropriately-sized affordable housing tower—a quick diagrammatic study indicates 100 units in four floors over a raised parking deck.

If Brixmor isn’t in the market-rate housing business, they certainly aren’t in the affordable housing business, arguably much more complicated to negotiate. So it’s certainly not reasonable to expect them to recognize this kind of opportunity, and, without any financial incentive, pursue it on their own.

But it begs the question, what if the city had the wherewithal, including both expertise and a robust Housing Trust Fund, to broker and contribute to such a deal without hurting the bottom line of the current retail-only scheme?

The ships have all sailed, but in theory the city could have asked Brixmor to keep their $50,000 and pay their architects to design an alternate to a small area in the back of the north-west corner of the retail buildings. It could put back the same amount of second floor retail they had in the earlier plan and squeeze the building over just enough to fit an affordable housing tower.

Maybe not 100 units, but likely at least 60. It could be treated like an option—give the city 90 days to come up with a proposal, or revert to the current plan. That would not delay the project at all—construction is far more than 90 days off–and the knowledge gained from the experience of trying would be invaluable to future projects here, worth even losing the $50,000.

It remains to be seen whether Brixmor’s bet that they can lease up the U Mall with national tenants (hopefully they have done their homework and understand UC Davis’ particular student demographics) and make enough money on the extraordinary investment required to completely rebuild will pay off.

Alex Achimore is an architect and a member of Interfaith Housing Justice Davis.

What is this organization? How long has it been around? How many members? What is its mission?

I couldn’t find any info on it so maybe the author or someone can provide links.

https://www.davisvanguard.org/2022/09/the-next-conversation-on-housing-with-leah-rothstein/

Is it being suggested that (had the mall included housing), THOSE workers would have been able to afford the housing onsite?

And if not, who is this “mythical workforce” (that would move into such a site)? Seems to me that students themselves are the primary “workforce” for the types of retail/restaurant businesses in Davis. And what they earn is not going to pay for their full costs.

In any case, pretty-well written article, overall.

Davis is extremely fortunate to have a developer willing to redevelop and maximize a commercial mall in the first place. (And malls need convenient access and parking to attract anyone outside of the immediate vicinity.) Putting housing anywhere on the site would likely negatively impact that need. (Again, you can “pretend” or “hope” that folks outside of the vicinity will “bike” to the mall, but reality suggests otherwise.)

In most other cities, such a mall would have gone out of business a long time ago (replaced by one on the periphery of the city – which would also be struggling by now). The proximity to UCD (and surrounding student housing) is likely what makes it viable as a commercial mall in the first place.

It could be that there’s already enough student housing recently-built (or in the pipeline, on-campus and off) to meet anticipated demand. For that matter, UCD is reportedly committed to housing increases in enrollment on campus.

In any case, I’m looking forward to the redeveloped commercial mall, and the fact that I (now) won’t have to abandon my periodic shopping at Trader Joe’s (and whatever else the mall is able to now attract).

I wish that others could appreciate the result, as well.

The new University Mall will fail just as badly as the current mall and County Fair Mall in Woodland. It lacks the land space to accommodate enough stores to really draw enough people to make the stores profitable. Malls in general have been on a downward spiral the past several years. Brixmoor has every right to try, but that doesn’t mean they will succeed. Before I left Pennsylvania in 1994, I had actually shopped at Montgomery Mall more than once.

University Mall has at least two things going forward that County Fair doesn’t:

1) It has UCD right across the street.

2) Unlike Woodland, there is no new mall on the outskirts of Davis. (That’s the “usual” pattern which causes interior malls to fail.)

In Woodland, Target abandoned County Fair Mall for Gateway (where CostCo is located). I don’t know what’s currently occupying the former Target site, but I think that a Burlington Coat Factory store did, and might still be there.

Regardless, County Fair Mall was able to attract a Walmart grocery store at the former Mervyn’s site, which appears to be successful. (I believe that the mall owner actually sold that portion of the mall to Walmart.)

In any case, Brixmor has determined that University Mall redevelopment is a good investment, and apparently a better investment than including housing on the site.

And yet, some wanted to compromise that space by adding housing. Thereby making it more expensive and complicated to redevelop – not to mention less-accessible by those who don’t live close to it.

But you’d have to ask Brixmor why they think it’s a good investment. Malls aren’t all the same. Trader Joe’s does well in there, and I believe World Market did as well. Perhaps The Graduate, too – though I never went in there.

Again, proximity to UCD is probably what makes this worthwhile.

I don’t know what Montgomery Mall is, but I once (probably) shopped at Montgomery Ward. Does that count for anything?

But again, Davis is fortunate to have a developer willing to redevelop the mall. You’d think that people would be expressing appreciation for that, at least.

I’m looking forward to seeing what they attract.

Let’s look at the record of the stores and restaurants that used to be at University Mall instead of always making assumptions about the viability of businesses there. IGA Market, Forever 21, World Market,

Gottschalks (department store)

Rubio’s (fast food Mexican restaurant), La Esperanza (Mexican restaurant) are just some of the businesses that have shuttered since 1994.

Walter: You’re the one who started making negative assumptions about viability, not me. Some of the businesses you’ve listed have been struggling or gone completely out of business everywhere – not just at this one mall.

But if they’re not viable without housing onsite, then they also probably wouldn’t be viable with housing.

More importantly, Brixmor (who unlike you or me) is actually in the mall business and believes there’s sufficient demand to redevelop the mall. I was surprised that they’d be willing to do so, as well. But I would think that they’re in a better position than you or me to make that judgment. They’re also the ones who are “putting their money where their mouths are”, so to speak.

How about if we wish them luck, and support the businesses which will be housed there. And thank them for taking on this project.

My guess (for University Mall) is that more restaurant/food service may be provided, going forward. Again, due to proximity to UCD (as well as all of the student housing that’s already around that area, under construction, or planned).

But again, can some appreciation (at least) be shown to Brixmor, for their willingness to redevelop the site?

Only in Davis would some “complain” about what Brixmor has agreed to do. How about letting them proceed, without giving them any more problems (or causing any more delays)? Every day that goes by with empty stores is a loss for Davis – directly caused by pushing them to do something they didn’t want to do in the first place.

There are a couple of thoughts that occur to me when processing this…

1) I don’t buy the thought that there is some logical or rational reason why residential and commercial could not have co-existed at this site. Mixed use development is a centuries old idea, and has been successfully done countless times in countless cities across the globe…. the bulk of MOST buildings in our largest cities are mixed use…. so no, that is not it.

2) It is much more likely that Brixmoor is simply used to a different business model and a different kind of tenant…. aka… strip malls. We need to not under-estimate the primacy of the “business model” of the owners in locations like this… If a company who specializes in building and running strip malls owns the property… guess what they are probably going to do with it?

3) Which means that the responsibility for the fate of this particular property is squarely on the City… this should be a lesson learned. If we wanted mixed-use, we should have re-zoned the parcel specifically for the use we intended – removing the option for a strip mall entirely.

There may be some legal reason we cant do that… if so I’d be interested to hear it. Obviously, the city would have to become proficient in understanding what kind of building forms and sizes make economic sense to develop… so that it actually gets built…

4) Now of course… if the city were to be visionary in its planning function, it would have also realized that we need housing SO badly, that they should have up-zoned not only the u-mall, but the apartments behind it, and the older residential across from trader joes etc as well… ALL of those properties should probably be the height of the Identity project on oxford circle… and we shouldnt have considered for a moment that it was a good idea to reduce the height of any of them…

Davis needs to grow UP… quickly… which is why this opportunity lost is such a shame.

Tim has some good thoughts regarding this topic.