The following is a memo from Gruen Gruen + Associates/ A. Plescia and Company.

Introduction

This memorandum summarizes an initial development economic analysis of the currently proposed student housing project at the 47-acre Nishi site. The primary purpose of the initial analysis is to identify what amount of investment, if any, in off-site public infrastructure the project can feasibly support under an assumption that approximately 12 percent of the housing units are allocated for affordable housing.

The initial analysis summarized in this report follows the same methodology, and employs many of the same market, cost, and financial assumptions identified in the preliminary draft real estate economic analysis of prototypical multi-family development prototypes completed recently by APC and GG+A. We understand the site is currently planned to include 38 student housing buildings that will be efficient, three-story walk up buildings (i.e., no common area amenities or elevator cores within the buildings) along with 10 smaller buildings dedicated to laundry facilities and common

study areas.

Total Student Beds and Estimated Rents

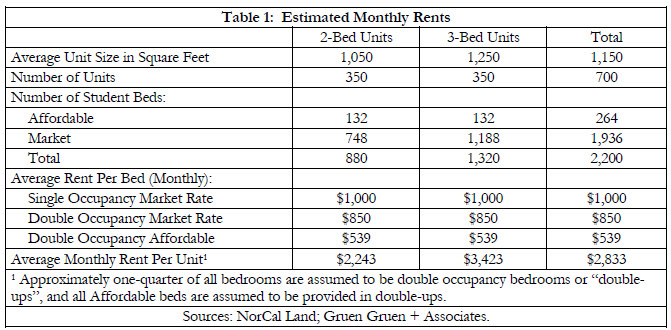

The January 24, 2018 Nishi Residential Development Planning Commission Hearing packet indicates that 700 apartment units are currently planned with the capacity for approximately 2,200 student beds on 33 net acres of land (excluding 13.9 acres of site area dedicated to open space and detention area outside of the residential building and parking areas). The unit mix will include an equal proportion of two-bedroom/ two-bath and three-bedroom/three-bath units. Affordable housing on-site is proposed to include 264 student beds (approximately 12 percent of total beds) reserved for Extremely Low and Very Low income full-time students. Table 1 summarizes the estimated monthly rents for the two- and three-bed units.

We assume an average monthly rent of approximately $2,830 per unit or approximately $2.50-per square-foot. Because the proposed development is seeking entitlement for up to 2,200 student beds, the rent estimates assume about one-quarter of bedrooms are double occupancy bedrooms (i.e., two student beds in one bedroom), and that all affordable student beds are provided in these double occupancy bedrooms.

Development Costs

We estimate a total development cost, before land and off-site public infrastructure, of approximately $335,000 per unit or $263 per gross square foot of building area.1 This reflects hard construction costs of $200 per gross square foot, impact fees equal to about $18,700 per unit (per the estimate summarized in the January 24, 2018 Planning Commission packet, indicating total impact fees and construction tax of $13 million), other soft costs equal to 16.5 percent of hard costs, and financing costs of about $15 per square foot (based on a five percent loan interest rate and two-year loan period).

Supportable Land Value, Off-Site Improvement Costs and Proposed Level of Affordable Housing

Based on the same prototypical investment, permanent debt, and timing/lease-up assumptions summarized in our preliminary draft real estate economic analysis of multi-family rental projects in Davis, the Nishi project as currently planned is estimated to support a total upfront payment of approximately $19.5 million for land and public off-site infrastructure, while providing affordable beds approximating 12 percent of the total beds. This is based on an annual rate of return requirement of 18 percent on equity investment.

The City estimates that off-site public improvement costs may total $16 million to $19 million: an underpass is estimated at $16 million and an additional $3 million may be needed to construct a bridge over Putah Creek Parkway. If the 33 acres of net land area (net of open space dedications) are assigned a market value of $10 to $15 per square foot, this equates to an additional $14.4 million to $21.6 million.

Therefore, the requirement of payment for off-site infrastructure and provision of 12 percent of the beds for affordable housing suggests the developer will obtain a lower return on investment than is typically targeted for new development in Davis. Assuming the developer is willing to accept a lower return on investment, the proposed infrastructure and affordable housing requirements are reasonable.

A similar report for Nishi 1.0 was presented to the Finance and Budget Commission on January 11, 2016. As is reflected in the minutes of that meeting, Katherine Hess, Andy Plescia and Susan Goodwin fielded FBC questions following their presentation. Andy Plescia requested a day or two to reply to the list of questions presented to him. As next steps on this item, the Finance & Budget Commission created a series of Motions during this item, which Bob Blyth will consolidate and forward to City Council. Copy of the staff report is included with these Minutes.

As an FBC member, I can’t help but wonder why Council is choosing to use the information of this 2018 Plescia report without the benefit of an FBC review of the report.