The biggest test to date is coming for the four person council as they are set to at least begin tackling the biggest issue facing the city – its unfunded liabilities and retirement pensions.

The biggest test to date is coming for the four person council as they are set to at least begin tackling the biggest issue facing the city – its unfunded liabilities and retirement pensions.

On Tuesday, the Council will discuss the City’s unfunded liabilities – the California Public Employees’ Retirement System (CalPERS) Pension Plans and Retiree Medical Benefits.

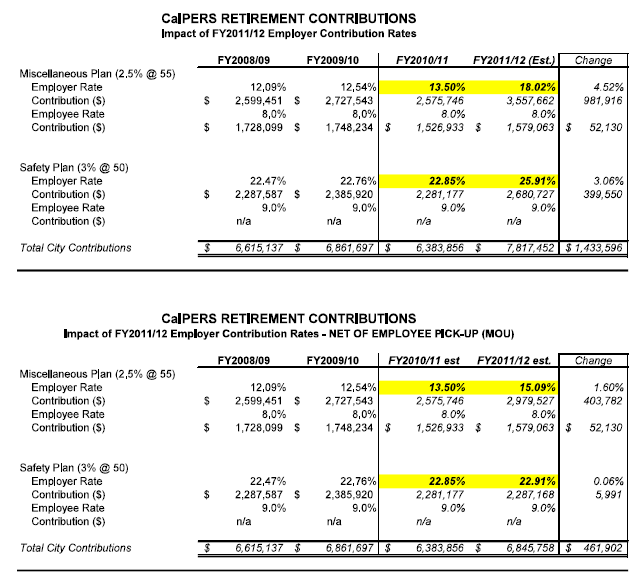

Last month, the city received relatively bad news on the CalPERS front, looking at increased rates. In the short term, the impact will be relatively small as most of the increased PERS contribution rates will be subsumed by agreements with employees – most of them anyway – to contribute to the first 3 percentages points of the increase.

However, the longer term implications are stark and unavoidable. Worse yet is what will happen when CalPERS downwardly revises future earnings potential, in light of sluggish markets and investment losses.

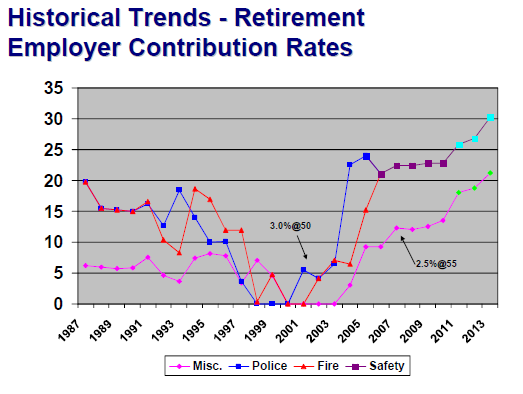

Here we can see that in the 1990s, in response to the huge economic boom, the funds became superfunded. Then during the last decade, the employer contribution rates soared back to historical levels and then some.

One thing lost in this analysis is the other variable that has occurred, which is the doubling or more of city employee compensation, particularly public safety, in the last decade at the same time the formula was increased and at the same time contributions soared again.

There are considerable questions that the current summary does not address. One of the big ones is how the city plans to get on top of this issue.

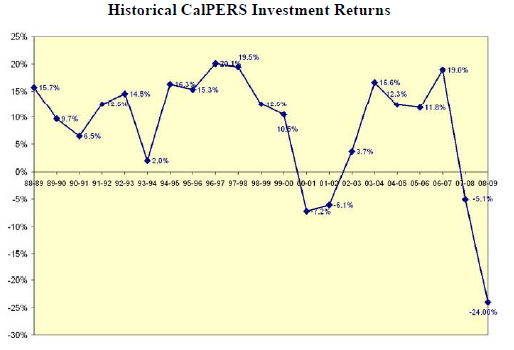

Leave aside the collapse of the financial markets in 2008, which has played a role, but the bigger problem is structural and it goes back to 2000 when the fund was superfunded. One of the problems is that the original assumptions on which PERS based its rates were flawed.

Because they were flawed in the past, they created a de facto unfunded liability as PERS did not require employers or employees to pay enough in the system.

We have been told for years that public safety employees live shorter lives than non-safety employees. Thus, we justified a higher pension rate of 3% and a lower retirement age at 50. That assumption is untrue, safety workers live on average about the same length of time as non-safety workers.

Moreover, people are living longer than PERS forecast, they are retiring earlier, and they are receiving a higher salary. When PERS changed the formulas for calculating pensions, they were effective not only into the future but retroactively. The result was a huge amount of money that would be owed retirees, that was unfunded.

In my view, the City of Davis has been slow in reacting to this crisis. This goes back to before the collapse of the financial markets in September 2008. During the 2008 campaign, there was a stark contrast between the views of Don Saylor and Stephen Souza on the current budget situation and those of Sue Greenwald and candidate (and my wife) Cecilia Escamilla-Greenwald.

Both Mr. Saylor and Mr. Souza focused on the fact that the council had a balanced budget with a 15-percent reserve as evidence of fiscal management and prudence by the current council.

The problem was that while they accurately stated those positions, there were uncertainties and hazards beneath the surface. We had seen a huge growth in salaries over the previous decade which left us vulnerable should the economy, and specifically the real estate market, decline.

We had tied up more and more money into pensions and retirement plans. This would consume a larger and larger share of the general fund, but we also had a large and growing unfunded liability that left us $60 million short in our retirement health obligations.

The bottom line is that the council majority contributed to the problem, giving, for instance, the firefighters a 38% pay increase over the previous MOU, while implementing pensions of 3% at 50 and 2.5% at 55 for non-safety workers, and we were late recognizing the problem.

Other cities have gone much further, but ours has always maintained an outward position that the issues are solvable, that we are better off than many cities, and that we will be able to fix the problems.

The problem with that approach is that it sent a signal to the bargaining groups in the last round of negotiations, that all was well and that they could get away with minor tweaks to the current contracts – which they did in a series of 3-2 votes.

Meanwhile, other communities are fixing their problem. For example, the City of Campbell last week became the first city to agree to a lower-cost pension system for new employees. So while the current employees will retain the pension they received at their hiring (or a higher a pension based on increases over the last few decades), new employees will be on a less expensive plan.

Likewise, the City of San Jose, who has been running an operating deficit for the last decade, will negotiate a similar retirement benefit in its municipal pension system.

The City of Rancho Santa Margarita is also in the process of adopting a two-tiered system ,where they move from a 2.5% at 55 plan to a 2% at 60 plan.

They figured out, as staff turns over or new employees are hired, for every $400,000 (and change) in payroll, the city would save 5.2% in contributions or roughly $21,000 annually.

In Davis we may be talking about the salaries for less than four employees. Given the number of employees that the city hires, that is hardly chump change.

However there is the fine print, and that requires turnover, so it is not an immediate savings.

The problem, as we have noted, is we fully expect a two-tiered system is the way most communities will go, but I do not believe them to be sufficient.

First, as I have argued many times, if you are not hiring new employees, there is no immediate cost savings.

Second, long-term, new employees basically will have twenty years to figure out a time to ask for a pension boost rather than taking a salary increase. The result is the two-tiered system is probably unsustainable.

As I have laid out here numerous times, I do not believe that there is one solution.

A key point that needs to be reiterated and rarely has been in these discussions, one reason the pension policies are coming back to bite us so hard is that we raised salaries by unsustainable rates during good times when the real estate market was booming.

Despite this, we financed the firefighters’ 38% salary increase in the middle part of the decade through the half cent sales tax. No one wanted to really point this out during the renewal election last spring, but that is the truth.

Had we merely held salaries to the rate of inflation, we would have millions of dollars to cushion this downturn and the rate hikes. Any future strategy is doomed if we continue to, in good times, increase employee salaries that much beyond the rate of inflation.

Beyond holding current salaries to the rate of inflation, there are four ways I would propose fix this problem, each one wrought with difficulties and problems.

First, we need to increase the employee contribution rate. The MOUs started that process, but at the very least employees should be picking up their full employee share. Right now, for non-safety, the employees do not do that at all.

Second, we need to see about lowering the benefit amount. There are arguments that this is a vested right – but is a future benefit, not received, really vested? In other words, if I agreed to pay you 3% at 50, am I obligated to pay you that in two years or just up until the time a new rate is negotiated? Moreover, when the employees retroactively got bumped from 2.5 percent to 3%, an amount not previously budgeted or funded, was that not a gift of public funds?

Third, we need to raise the retirement age from 50 to at least 55 for safety and from 55 to at least 60 for non-safety. That would really help the city’s unfunded health retirement benefit unfunded liability because it would reduce the period of the benefit from 10 or 15 years down to 5 to 10 years. That is anywhere from a 33% to a 50% savings that could be used to help pay for pensions.

The other factor is while that would increase the number of years the city pays into retirement funds during employment, it would reduce the number of years CalPERS would have to pay retirement. There may be practical issues of age for a firefighter or a police officer moving past 50 in retirement, but those could be addressed by further study.

Fourth, the other fix here is more long-term. Part of the pension spike problem had to do with the large increase in salaries given employees. With higher salaries comes higher pensions. By freezing salaries and holding future increases to inflation, we could reduce our pension funding liability due to inflation and attrition.

None of these are easy solutions. Some will take changes to state law to enact. Most will take approval at the bargaining table.

The city needs to change its stance on bargaining. First, it has tended to downplay fiscal concerns, meaning that during the time that they needed to drive hard bargaining decisions, they were downplaying the problem.

Other cities may be worse off than we are, but we still face severe challenges moving forward, particularly if the economy continues to stagnate. The last round of MOUs barely moved the ball further, but the city tried to spin it like these were great concessions. As you can see just from these numbers, the city has failed to make advances in addressing challenges.

In order to gain concessions, the city needs to acknowledge we are in crisis, call on joint sacrifice and lay out the truth – the city cannot continue to provide the current level of services at the current level of compensation for employees. Something has to give. The council needs to decide what needs to give and they need to do so quickly.

My concluding thought is that I look forward to hearing what Joe Krovoza and Rochelle Swanson, who are unencumbered by past decisions, have to say on this issue. I know what they said during the election and in private, now is the time to step up. I am pleased so far with the progress of this council, but in many ways that was the pregame show, this is the entire ballgame. They have to be strong and forceful and they have to ask tough questions and push the debate beyond the simple rhetoric that we have heard for the past several years.

—David M. Greenwald reporting

[quote]Worse yet is what will happen when CalPERS downwardly revises future earnings potential, in light of sluggish markets and investment losses[/quote]

David

You are right that this is a serious problem, indeed the most serious problem the City faces imho. However the downward revision still assumes a long term return of 7.25%. CALPERS is still in LA LA land. As I have blogged before, over the next 7-10 years some of the wisest folks (e.g., Robert Shiler, Professor at Yale you did see that housing crisis coming) predict that returns will be low or zero.

I wish I could paste a graphic but its too large (I’ll try later). If one looks at the long term trend in US stock returns its very clear that we are still well above this trend and the market would have to correct about 25-30% downward for us to get back to the trend.

Other metrics like long term P/E which Shiller, Grantham and Hussman use (NOT short term P/E which Wall Street generally uses–believe it or not corporate profits are close to all time highs) or something called Tobin’s Q (Price to replacement value) indicate that the stock market is still substantially overvalued even after a lost decade. Can it still go up? Yes. Indeed the third year of a presidential term is typically bullish. But long term it will revert to trend–which requires either a move down or a very long period of going sideways (zero return). Its called a secular bear market (averages 16-20 years) and we’re in one. In case you think I am nuts look at Japan. The Nikkei peaked around 1989 at around 40,000 and fell to ~7500 in 2003. Today, over twenty years later its just over 10,000–75% below the peak! The US market has had several periods of over a decade in which returns were essentially zero, including two in the 20th century (after depression and in 70s–early 80s).

Bottom line: CALPERS 7.25% projection is far too high and as a result Davis and other cities will find themselves in even worse shape. All the more reason to do something now!

We also learned that CALPERS had to adjust the calculations because people are living longer, which should be filed under DUH!

The trend has been for people to live longer and nothing unusual has happened recently (indeed female life expectancy increases have been slowing). How did the six-figure earning actuaries at CALPERS miss this??? Did they train alongside the financial analysts at Moody’s and Standard & Poors who gave AAA ratings to toxic mortgage securities many of which are now in foreclosure? Indeed, I’ll even cut our council a little bit of break here. They have been mislead by CALPERS and though CALPERS has made adjustments its still behind the curve. But even CALPERS estimates show an unfunded liability in the tens of millions–lets get on top of this so our kids can have a better life.

[i]”The City of Rancho Santa Margarita is also in the process of adopting a two-tiered system ,where they move from a 2.5% at 55 plan to a 2% at 60 plan.”[/i]

The City of RSM staff report ([url]http://www.cityofrsm.org/civica/filebank/blobload.asp?BlobID=7494[/url]) (see page 3) explains how much money they will save moving to the new pension plan every year: [quote] As staff turns over or new employees are hired, for every $402,568 in payroll, the City will save 5.2% in contributions, or $20,970 annually.[/quote] Yesterday, the City of Pittsburg (near Antioch) announced it too is changing its new hires from 2.5% at 55 to 2.0% at 60. You know when we are well behind Pittsburg, we are moving too slowly.

Per my count, there have now been about 100 agencies affiliated with CalPERS which have created a new, lower second tier pension formula for new hires. However, not all of them have made, in my opinion, smart changes. Placer County, for example, just adopted new contracts which:

*Change the retirement formula for future public safety hires from 3 percent at age 50 to 3 percent at age 55;

I did a quick back of the envelope calculation and figured that sort of non-change change will save Placer County about 1% of their pension contribution costs annually as jobs turn over.

The irony of Placer County making such a tepid, ultimately pro-union change is that it’s a very Republican County. They have 97,840 Republicans to 58,609 Democrats. (By contrast, Yolo County has 25,175 Republicans to 48,882 Democrats.) So my long-held contention–that the ownership of politicians by the public employee unions is largely a Democratic Party phenomenon–does not hold in Placer County. The cops and firefighters there seem to own the GOP, too.

Rich… what about current employees and existing retirees? David appears to be advocating changing the current laws where it would be possible to at least change the formula for those currently working. Are you assuming we have to be stuck with a 2-tier system?

Three words: Massive Retroactive Changes…

There is absolutely no reason the council can’t go back and have some serious changes made for existing employees and those already retired. The fact that most of the benefits given to this group happened after they were hired invalidates claims that they were hired with a certain expectation. It was simply the idiotic prior majority that gave away too much. Now is a chance to correct this mistake.

I have ZERO concern or interest in these employees retirement plan. Social Security is available to all of them- there is nothing sacred about people who have wallowed in the public trough for their entire career.

[quote]Social Security is available to all of them[/quote]Equine manure…. as far as I know, there is no way that anyone in the public sector can take their public pension assets and “buy in” to SS. If you advocate that most public employees will have zero for retirement, that is your free speech right. I would counter that all benefits and taxes for SS should disappear… that would be a great economic stimulus…

to the extent that SS should disappear, you have a fan. Individuals should be responsible for themselves.

as to CALPERS vs. Social Security, its a choice… http://cityemployeesassociates.com/CALPERS_and_Social_Security.html

as many people have found in the private sector when their pensions evaporated, life sometimes doesn’t turn out the way you planned. Thats no reason for the public to have to continue to shovel money into the public trough.

[quote]as far as I know, there is no way that anyone in the public sector can take their public pension assets [/quote]should have clarified… some state employees (maybe university) have their pension benefits “coordinated” with SS… very many local employees do not… many employees of local agencies, if that was their only employer do NOT…. even if an employee was covered by SS, their SS benefits will be reduced, dollar for dollar, by what they get in a public pension… for the city employees, if we eliminated PERS pension, many would have 0 pension… of course, Gunrock is entitled to advocate that. Gunrock, are you relying on only your personal savings for your retirement? Perhaps we should eliminate PERS, STRS, the university retirement system AND ss, and we could free up a lot of money…

[i]”David appears to be advocating changing the current laws where it would be possible to at least change the formula for those currently working.”[/i]

I have been told (by the Human Resources Manager for the City of Davis) that State law prohibits reducing the formulas for any current employees. The only reductions which can legally be made in pension formulas are for future hires. Hence, a two-tiered system until all current employees retire or transfer to other agencies or leave for some other reason.

However, there is something we can do–in contracts, not unilaterally–to make current employee costs affordable as pension rates increase: To wit, we can cap “total compensation.”

Take for example a non-public safety employee who makes a base salary of $104,401.20 this fiscal year (2010-11). Currently, such an employee costs the City of Davis roughly $176,151.38 a year in total comp:

Salary $104,401.20

PERS* $22,441.04

Health care $20,571.27

Retiree Medical $18,043.56

Life Insurance $4,896.00

LT Disability $2,448.00

Survivor Benefits $24.00

Medicare $1,513.82

Worker’s Comp $1,812.50

Total Labor Cost $176,151.38

*The current cost for PERS is 21.495% of salary for a Misc. employee. That is 13.495% for the employer rate, which the City pays; plus 8% for the employee rate, which the City pays. (There is a provision in some contracts for some Misc. employees to pay some small part of the Employee share. However, for this example, I will presume it is zero. In most cases, it is zero or very close to zero, still.)

The employer contribution rate is going to increase from 13.495% this year to 21.2% in 3 years, according to CalPERS. The $104,401.20 a year employee in question is going to get a 2% salary increase on July 1, this year, per the terms of the current contract this employee is operating under. If there are 5% annual increases in medical insurance costs and 2% increases in salary the following years, the total comp for this employee to rise to $201,525.91 in 2013-14:

Salary $113,007.21

PERS $32,998.11

Health care $23,813.81

Retiree Medical $20,887.68

Life Insurance $4,896.00

LT Disability $2,448.00

Survivor Benefits $24.00

Medicare $1,638.60

Worker’s Comp $1,812.50

Total Labor Cost $201,525.91

That 14.4% total increase computes over 3 years to a 4.59% annual compounded inflation rate in the cost of compensation. There is no reason to think the City of Davis’s revenues will be going up that fast. In fact, they might not go up much at all.

If we cap total comp costs in the labor contracts, we can control the bottom line, regardless of what happens to medical insurance rates (which are in fact going up).

So take that same employee in 2013-14 and assume the pension rates rise as projected by CalPERS and that the medical insurance costs rise by just 5% per year, but instead of inflating this person’s salary by 2% per year, we adjust it so that total comp rises by say 2% per year. Here is what that person would cost the City of Davis in 2013-14:

Salary $101,838.00

PERS $29,736.70

Health care $23,813.81

Retiree Medical $20,887.68

Life Insurance $4,896.00

LT Disability $2,448.00

Survivor Benefits $24.00

Medicare $1,476.65

Worker’s Comp $1,812.50

Total Labor Cost $186,933.34

I would argue that if the gov’t workers (including fire and police) are not willing to make some concessions, the bankruptcy judges will make the concessions for them as city after city is headed for bankruptcy…

From capoliticalnews.com: “Legal and municipal-finance experts say rising pension costs, combined with dwindling state and federal aid, could push more cities to follow Prichard’s lead [Prichard, Alabama stopped paying pensions bc money ran out], or at least raise the prospect as possible leverage in contract negotiations with public workers. “Right now we are looking at a major squeeze on municipalities and I would fully expect more cases to be filed than traditionally have been,” said David Skeel, a professor at the University of Pennsylvania Law School who focuses on bankruptcy law. Mr. Skeel said the question of whether a municipality can cut benefits to current retirees is a “big issue” emerging from the smattering of recent cases in Chapter 9, which provides a route for municipal bankruptcies.”

Retirement benefits are a nice goodie, but hardly a right. If they get too expensive, the city should simply drop them.

This is like driving a car forward by looking in the rear view mirror. If I ran my business like this I would be out of business. This problem should have been corrected long ago. Overhead should be broken down , monitored and modified bi annually. This style of management is why California is in the tank.

[quote]I would argue that if the gov’t workers (including fire and police) are not willing to make some concessions, the bankruptcy judges will make the concessions for them as city after city is headed for bankruptcy…[/quote]

ERM–you are right. The courts in Vallejo have been reluctant to rescind pension benefits, but bankruptcy judges in the auto and airline industry have essentially abrogated pension benefits in those industries. Cities and States are next.

A national index of municipal bonds fell to an all time low today.

Watch Illinois.

Retirement benefits are a nice goodie, but hardly a right. If they get too expensive, the city should simply drop them.

Just curious – do you understand what is meant by contractual agreements?

As an earlier post asked, and I will ask again, how are YOU paying for your retirement?

jrberg… I believe Gunrock is saying, for public employees, no retirement benefits, period..

to clarify… no PERS, no social security, nada…

Rich…for a private sector worker? what is the total cost for an employee at the same salary you quote… assume the employee has given up COLA’s and the employer is paying the employee’s SS contribution…

Dr Wu – I am interested in what is happening in the muni bond sector -can you please provide info or a link to the muni bond index that you referred to in this thread?

Dr. Wu: “ERM–you are right. The courts in Vallejo have been reluctant to rescind pension benefits, but bankruptcy judges in the auto and airline industry have essentially abrogated pension benefits in those industries. Cities and States are next.”

The irony is that Vallejo had the opportunity to rewrite the fire/police contracts through bankruptcy, but chose not to, which has set a bad precedent.

From Wall Street Journal: “To permanently bring its spending in line with its tax base, however, at some point Vallejo will have to do something about its pensions. U.S. bankruptcy judge Michael McManus, as the National law Journal reported last March, “held the city of Vallejo, Calif., has the authority to void its existing union contracts in its effort to reorganize.”

But when it came to voiding those contracts on pensions—a major driver of public expenses—the city blinked. The “workout plan” the city approved in December calls for cuts in services, staff and even some benefits, such as health benefits for retirees. However, it does not touch public-employee pensions. Indeed, it increases the pension contributions the city pays.

This week, the city did approve a new firefighter contract that trims pension benefits for new hires and requires existing firefighters to pay more into their pensions. But that contract doesn’t touch existing pensions. Nor does it affect police officers or other city workers. It also leaves the city with a $1.2 million shortfall. “The majority [of council members] did not have the political will to touch the pink elephant in the room—public safety influence, benefits and pay,” Vice Mayor Stephanie Gomes told me.

Vallejo’s unwillingness to go after existing pensions and wage other fights necessary to put the city on stable financial footing sets a bad example. Other cities will now find it harder to use the threat of bankruptcy (or bankruptcy itself) to get unions to agree to rein in pension costs.”

[i]”Rich…for a private sector worker? what is the total cost for an employee at the same salary you quote… assume the employee has given up COLA’s and the employer is paying the employee’s SS contribution …”[/i]

HP, I can give you the numbers–I happened to have done a study on this for a column I wrote last year–but I am not 100% confident that they are accurate for the private worker, because there is a great amount a variance. In other words, some private sector jobs which pay an equal salary to the public sector worker will include very lucrative benefits and others will have virtually no benefits at all. Also, many private sector jobs come with bonuses, which may not be paid if the company is doing poorly. But if you set the salaries the same, here is what you will generally get:

[u]Public Sector[/u]

[b]Salary $100,000.00[/b]

PERS $20,500.00

Health care $20,571.27

Retiree Medical $18,043.56

Life Insurance $4,896.00

LT Disability $2,448.00

Survivor Benefits $24.00

Medicare $1,450.00

Worker’s Comp $1,812.50

[b]Total Labor Cost $169,745.33[/b]

[u]Private Sector[/u]

[b]Salary $100,000.00[/b]

PERS $2,000.00

Health care $9,860.00

Retiree Medical $0.00

Life Insurance $0.00

LT Disability $0.00

Survivor Benefits $0.00

Medicare $1,450.00

Social Security $7,500.00

Worker’s Comp $1,812.50

[b]Total Labor Cost $122,622.50[/b]

I also am quite sure that the public sector workers in our area tend to make about 50% to 100% more dollars per hour worked than a public sector worker doing the same job*. (For low-skilled work, the difference is much greater. A privately employed landscape maintenance worker in Davis, for example, will make in total comp about 1/7th to 1/10th what someone doing the same job in the public sector will make.)

To write my column on this topic, I consulted with a job recruitment firm in Sacramento. They told me they don’t place people in public sector jobs, but I gave them a complete desscription of what the City of Davis says is the job of “Deputy City Manager” and they said the private sector equivalent would be an “Administrative Services Supervisor.” The salary for the public sector job is roughly double for the private sector. And the add-ons made the public worker ($173,852.02) cost 250% as much as the private worker ($70,090.02) last year. (Since then, we have given the public sector worker a raise, though I suspect the private sector worker’s salary is the same or less (because of the high unemployment rate).

*The difference in things like vacation time, paid holidays, sick leave and maternity leave are dramatic. Private sector workers get much, much less paid time off at the middle management level and below. At the end of a work year, most private sector workers will work 20-40% more hours than those in the private sector, and I am not counting in that jobs like firefighter, where they are paid to sleep and do very little actual work and still get 20 days off a month plus all that paid vacation time and guaranteed overtime pay each fortnight.

I recall a meeting I had once with Bill Emlen, Paul Navazio and Melissa Chaney in the City Manager’s meeting room. We were going over the labor contracts and I told them I was shocked to see the amount we (the taxpayers) were paying for the time “workers” were not working. Bill turned to me and said, “Yeah. People from the private sector are always surprised at how much time off we pay for in the public sector.”

Note on my 12:08 post: What I list for “PERS” for the “private sector worker” is the amount of the employer contribution to a 401K plan.

Thanks for the information…

“So my long-held contention–that the ownership of politicians by the public employee unions is largely a Democratic Party phenomenon–does not hold in Placer County.”

I think people living in Placer county are just a bit slower to learn the truth about the huge and growing gap between public and private compensation. They will start to catch up as the rest of the country is.

http://www.rasmussenreports.com/public_content/business/jobs_employment/january_2011/support_for_public_employee_unions_declines

[quote]…the city had a negotiating team, fraught with conflicts of interest. In fact, the HR director said across the table from her husband on negotiations for one of the bargaining units – by the way, her own as well as her husband’s.[/quote]

Holy Cow