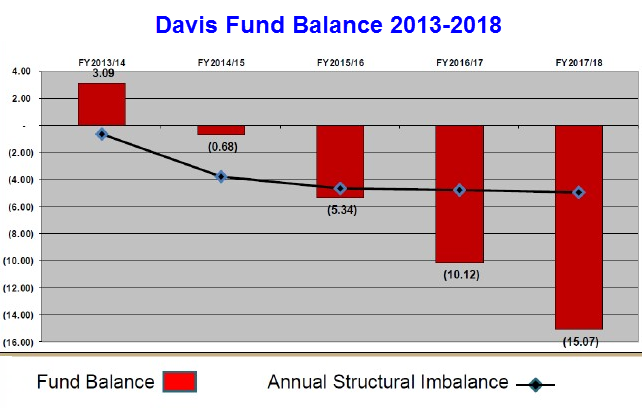

The projections for the city of Davis’ budget are headed in the wrong direction over the next five years and, while some of these blows are self-inflicted in the sense that the city is finally addressing their unmet needs and dealing with rising water costs, some of it is coming from the state and changes to CalPERS (California Public Employees’ Retirement System) accounting rates.

The projections for the city of Davis’ budget are headed in the wrong direction over the next five years and, while some of these blows are self-inflicted in the sense that the city is finally addressing their unmet needs and dealing with rising water costs, some of it is coming from the state and changes to CalPERS (California Public Employees’ Retirement System) accounting rates.

Last year, facing similar problems in San Jose, the voters overwhelmingly approved a pension reform plan and now that plan is going to be tested in court in a trial that started a few weeks ago, but has yet to receive a verdict.

As the Mercury News reported on July 21, “The judge’s ruling will affect similar debates over government pensions throughout the state and across the country.”

The unions are, of course, suing to block the measure.

Judge Patricia Lucas “is expected to take months to decide the Measure B case, after lawyers submit written closing arguments, and appeals are likely. But much is riding on the outcome.”

“Unless it’s implemented,” said San Jose’s lawyer, Arthur Hartinger, in opening statements to the judge, “the city’s pension and post-employment benefit programs are unsustainable and out of control and threaten the city’s ability to provide essential city services.”

“The city has made an express promise,” said John McBride, a lawyer representing several city employees, in opening statements. “Here is a benefit you will have an entitlement to earn.”

After the hearings, Robert Sapien, the San Jose Firefighters’ union president and a plaintiff in the case, “said he felt employees had presented a solid case, and noting that Reed is seeking a state ballot measure to soften pension protections,” added that “it doesn’t seem like they have a lot of confidence.”

“City employee unions say that under a ‘vested rights’ doctrine, established through a series of court decisions dating back more than half a century, government employers cannot cut employees’ pension benefits. They insist pension rates are protected both for work already rendered and for the rest of their careers,” the paper reports.

The city is challenging this. Some of this will not impact Davis – at least not directly and not immediately. “City lawyers point to San Jose’s charter language and argue it reserves the right of voters and their elected officials to make future changes to retirement plans.”

The Mercury News writes, “San Jose’s pension troubles are rooted in benefit increases, flawed assumptions and market losses for the city’s pension fund. As a result, the annual cost to the city more than tripled in a decade, consuming more than a fifth of its general operating fund. City officials cut everything from police and fire department staffing to library and community center hours to cover growing costs. And with the retirement funds still $2.9 billion short of promised benefit costs, the bill continues to rise.”

The numbers may be different, but the city of Davis is facing similar challenges.

For the city of Davis the impact is expected to be high. Changes to the CalPERS methodology will result in a 54 percent increase for safety pensions over the next six years, and 59 percent increase for the rest of employees.

Davis is facing huge cost increases, despite being in better shape than many in the state and despite reforms that have been accepted by five of seven bargaining units.

“The sobering news is the fact that PERS [has] reduced their rate of return,” Davis City Manager Steve Pinkerton said during a June budget workshop, noting that their actuarial believes, in addition to the quarter percent reduction, there will be an additional quarter percent reduction. “They’re likely finally going to acknowledge that people live longer and that certainly impacts the PERS liability as well.”

Based on these projections, they are anticipating that rates will go, in the miscellaneous category, from just under 23% of payroll up to over 31% of payroll in the next five years.

“You’re going to start to see an 8 to 10 percent increase on an annual basis,” he said. Previously, when PERS said everything would be okay after the recessions, the projected rate was about 23 percent.

“Compared to other cities this isn’t bad, but on a percentage basis you’re looking at far more than the three percent we were projecting for revenues,” he said. In total it will be a 60% increase from this year to 2018-19 on miscellaneous employees; it’s slightly less of an increase, 54%, for public safety.

For public safety it goes from 29% of payroll up to 39% by 2018-19.

What these numbers mean is that, combined with the costs for OPEB (Other Post-Employment Benefits – retiree medical), more than half of the payroll will be going to pensions and retiree health care by the end of this period.

On retiree medical, they are projecting a 4% increase from year to year. It goes from $3.79 million this year to $4.43 million in 2017-18.

“Though PERS did give us an unpleasant surprise this year, where it’s probably going to exceed… it looks like double-digit rates on CalPERS next year,” Mr. Pinkerton said.

The Mercury News notes, “San Jose was one of two major California cities where voters overwhelmingly approved pension reforms in June 2012. San Diego’s Proposition B called for replacing pensions for all new hires except police with 401(k)-type retirement savings accounts, and a five-year freeze on current employees’ pay that would count toward their pensions. San Diego has since negotiated the five-year pay freeze and put new hires on 401(k)-type plans after defeating unfair labor-practice challenges.”

San Jose’s case is taking direct aim at the “vested rights” doctrine.

Jack Dean, vice president of California Pension Reform, noted, “All of the state’s pension reform activists are watching this case with great interest.”

—David M. Greenwald reporting

It is not just San Jose and Davis:

http://www.pensiontsunami.com/

As long as Bernie Madoff’s fund kept growing he was fine (aka he had the cash flow to hide the problem), just like as long as San Jose was growing (~50% bigger in 2010 than 1980) and Davis was growing (~80% bigger in 2010 than 1980) they were fine (the problem was hidden).

A kid can ask a Dad for a penny today and get him to promise to double what he gives him every day for a month and many Dads (who don’t understand exponential growth) will say OK and wonder how to come up with $100K+ at the end of the month to pay the kid.

We have no chance of keeping all the union pension (and OPEB) “promises” (that were made by people who either did not understand exponential growth or didn’t care since they wanted union campaign cash). Our only choices are 1. Hide the problem a little longer with massive growth, 2. reduce benefits, or 3. Reduce spending on everything else…

I vote for: 2. reduce benefits

A blog I read every day has an article on pensions today:

http://www.zerohedge.com/news/2013-08-06/america’s-urban-distress-why-public-pension-problem-worse-you-think

Davis can solve the pension problem (on paper) by “deciding” on a 15% return (starting next year)…

[quote]We have no chance of keeping all the [s]union[/s] [u]Social Security [/u]pension (and [s]OPEB[/s])[b]Medicare[/b] “promises” (that were made by people who either did not understand exponential growth or didn’t care since they wanted [s]union campaign cash[/s][b]political support[/b]). Our only choices are 1. Hide the problem a little longer with massive growth, 2. reduce benefits, or 3. Reduce spending on everything else… [/quote] Am open to this, as long as it “across the board”. Social Security and Medicare were based on the false assumption of exponential growth. Social Security and Medicare are prime examples of Ponzi schemes. Ironically, if the decision is to substantially reduce the public employee pension/medical benefits, particularly for those who are retired, they will have (in many cases) no recourse to SS?Medicare benefits.

BTW… there is only one true “union”, based on State-wide/national affiliations within the municipal system in Davis. The fire dept. However, there are many other unions, including DTA,and several @ UCD. Yet the context of article and comments would imply those others are sacrosanct.

Go figure.

Many people that work in the private sector have had their benefits cut so why should public employees be exempt?

@ GI: my point was partly, why should only City of Davis employees be singled out to bear the brunt (see article speaking only of municipal workers, NOT State (including CSU & UC), County, Schools)? Many in the private sector, until recently, were much higher compensated, in salaries, 401(k) matches, bonuses, etc. [particularly professionals]. Stuff happened. Looks like you want “payback”. Did you personally suffer those losses, or are you speaking philosophically?

@ GI: my point was partly, why should only City of Davis employees be singled out to bear the brunt (see article speaking only of municipal workers, NOT State (including CSU & UC), County, Schools)? Many in the private sector, until recently, were much higher compensated, in salaries, 401(k) matches, bonuses, etc. [particularly professionals]. Stuff happened. Looks like you want “payback”. Did you personally suffer those losses, or are you speaking philosophically?

hpierce

[quote]Did you personally suffer those losses, or are you speaking philosophically? [/quote]

I’m speaking both personally and philosphically. I worked for a company that went through bankruptcy and there was no golden parachute for us. We took pay and benefit cuts to help the company stay alive. Working for a city, state or Federal gov’t shouldn’t be any different. If the gov’t can’t afford to pay the benefits then the workers will have to sacrafice like everyone else. What make public workers think they are immune from economic conditions?

hpierce wrote:

> why should only City of Davis employees be singled out

No need to signal out San Jose and Davis (but that is what this post was about).

The US, California, Davis and UCD all will all have the same problems if they don’t keep up the massive growth (the US growth is slowing the most and has had had to borrow larger and larger amounts each year)

The US has ~35% more people since 1980, California has ~60% more Davis has ~80% more and UCD also has about 80% more.

Exponential growth is easy at first (doubling the penny for the first few days) but it will be tough for the US, California, Davis or UCD to keep up the rate of growth.

The bigger you get (and the more retired people you need to pay and provide health care for) the harder it is to grow…

It sucks to have someone break a promise, yet I don’t think I’ll get a penny from Social Security (despite paying the maximum in to the system for decades).

Fortunately my Dad sat me down as a young boy after reading an article (I think it was in one of the early issues of Mother Jones) and explained that in 1955 there were ~8 workers paying in to Social Security for every one person getting a check, and it had dropped to ~4 to 1 in the 70’s and I would have no chance of getting paid if the current trends continued (it is currently under 3:1 with the Baby Boomers just starting to retire) so I better make other plans.

Most Americans have not made “other plans” like I have so the sooner we try and “fix” the problem the easier (aka less painful) it will be to fix. Unfortunately due to the “political pain” of ANY changes I’m sure I’ll watch every system end up like Detroit where we are talking about 90% across the board cuts and everyone saying “we never say it coming”…

“Many in the private sector were much higher compensated.” I’m not sure the data has supported that for the past 20 years. One of the biggest differences, of course, is that in the private sector, you fund your own 401K. The issue is not about “payback.” It’s about a systematic problem, through which public employee unions have created an unsustainable series of benefits, and immense defined benefit pension plans (far better than anything in the private sector, while remaining highly compensated. In many scenarios, those same individuals are able to retire after 25 years of service, or in their early 50’s, leaving the taxpayer holding the bag for the next 30 years.

Here is a very interesting policy idea coming from Obama. There is little I have agreed with in his economic policy. Since Obama had zero executive experience and also did not have experience with budget management and general finance and economics, I wonder if his six years as President has finally resulting in his education.

[quote]Community bankers and mortgage lenders across the country are viewing with skepticism President Obama’s call to do away with government-backed mortgage giants Fannie Mae and Freddie Mac, as the president unveiled his latest housing plan during a speech in Phoenix.

The president, after touring a construction site in Arizona, endorsed the call by many in Congress to phase out Fannie and Freddie, while still calling for 30-year mortgages to be available to borrowers. The government-backed mortgage giants were caught in the housing crisis which ended in a $187 billion taxpayer bailout.

The idea is to have the private sector play a bigger role in guaranteeing loans.

“For too long, these companies were allowed to make huge profits buying mortgages, knowing that if their bets went bad, taxpayers would be left holding the bag,” Obama said of Fannie and Freddie. “Private capital should take a bigger role in the mortgage market — I know that sounds confusing to folks who call me a socialist.”[/quote]

The relevancy of this is that Freddie and Fanny were directly responsible for the housing and mortgage-backed securities bubbles that inflated tax revenue that allowed Democrats to give away so much to the public sector unions. The pain was not really felt until the bubble popped.

So, do you support abolishing Freddie and Fanny? Do you think the private banking and mortgage industry can take care of business well enough without them?

The loss of Freddie and Fannie would have an impact on bank capital to lend because they currently drive the secondary market that allows these lenders to free up capital to lend again and again. So, with tighter capital we will see tighter credit. That means some marginal prospects for home ownership might not qualify. But then again, it is clear that many marginal prospects should NOT qualify.