If you look at the polling numbers released by the school district you arrive at a very simple conclusion – they are where they were a year ago and, given what we are asking, they are considerably lower in support of a new tax than they were in April 2016 for a status quo tax.

In April 2016, EMC polled 74 percent support for a parcel tax – when the voters went to polls, 72 percent voted for Measure H. That’s pretty remarkable to have a poll so accurate that it was within the margin of error of the actual outcome seven months later.

There is good and bad news then with the new poll – the good news is that it is not so bad and they are not far away from the goal. The bad news is that the district is probably realistically going to need to lift support, from 62 to 65 percent, to upwards of 67 percent in order to get their measure passed.

As they discussed on Thursday night, the key for the district will be to connect the district’s strengths – the teachers are doing a good job (71 percent) and providing a good quality of education (74 percent) to the need to attract and retain high performing teachers and educational staff (89 percent believe important) during a time when the district is not competitive in terms of compensation.

From the district’s standpoint, that is the obvious messaging that they need to connect in the minds of voters. But there are a lot of speed bumps in the way of that.

Within a sea of good numbers for the district are some less good numbers. The district management of money is not seen as highly rated, with only 31 percent with a positive view, 34 percent not knowing,  and 35 percent with a negative view.

and 35 percent with a negative view.

Some of that is probably out of the hands of the district, but those are the numbers they have to fight. The trust issue is there as well. Most of the numbers have been within the margin of error over time, not “I trust the Davis Joint Unified School District to properly manage tax dollars.”

It is unclear why this is the case, but support has dropped from 65 percent last year to 56 percent this year.

And the other polled number of concern: “Taxes in this area are already high enough; I’ll vote against any additional tax measure, even for Davis schools.” That number polls at 37 percent – a number that if it held would be sufficient to block a parcel tax.

But there are inconsistencies here as well with “Maintaining the quality of our schools should be a top priority, even if it means raising taxes” being at 79 percent – a slight drop from 83 percent in 2016.

These numbers suggest that if the district wants to put a parcel tax forward, they are going to have to run a robust campaign. Personally I have argued this for years – start with a basic educational campaign, get your spokespeople out to PTA meetings, the rotary club, service organizations, neighborhood associations, anywhere that you can get people who do not normally come out to school board and city council meetings.

The reality is that this is going to be a hard sell, but I come back to the point that I made back in August – we have a good district but, if given trends, we are not going to stay that way unless the community is proactive in maintaining quality of programs and that has to start with competitive salaries for teachers.

The data analysis shows that DJUSD needs between $2.8 and $3.2 million to close the compensation gap. That will require either the additional revenue of a $200 parcel tax or the comparative reductions through staffing.

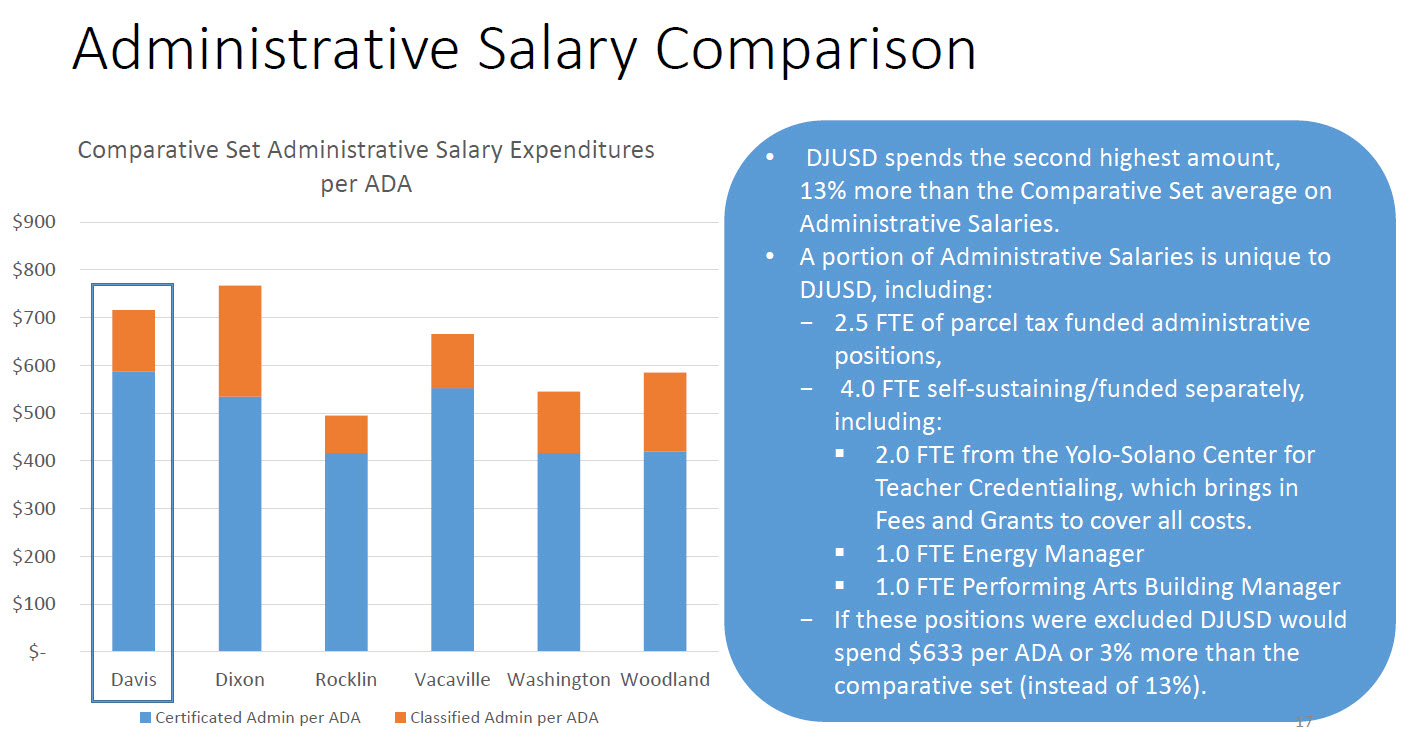

When I talk to people in the community about the compensation gap, they remember administrative salary increases. The folks on the school board need to understand that I get people who have never voted against a parcel tax in their lives balking at supporting the next one because of this issue.

You can argue the math here – the administrative salaries are not large enough to make a real difference. But the perception is important.

And the data provided by the district shows that “DJUSD spends the second highest amount, 13% more than the Comparative Set average on Administrative Salaries.”

It is an easy talking point that the opposition can raise that will resonate with the voters.

One of the keys to the LA Parcel Tax loss is that the business community opposed the parcel tax and put money in behind that effort. If you have the usual opposition to the parcel tax, you might be able to survive this issue, but if you have real and organized opposition, this issue taps into the 35 percent figure on the management of tax dollars.

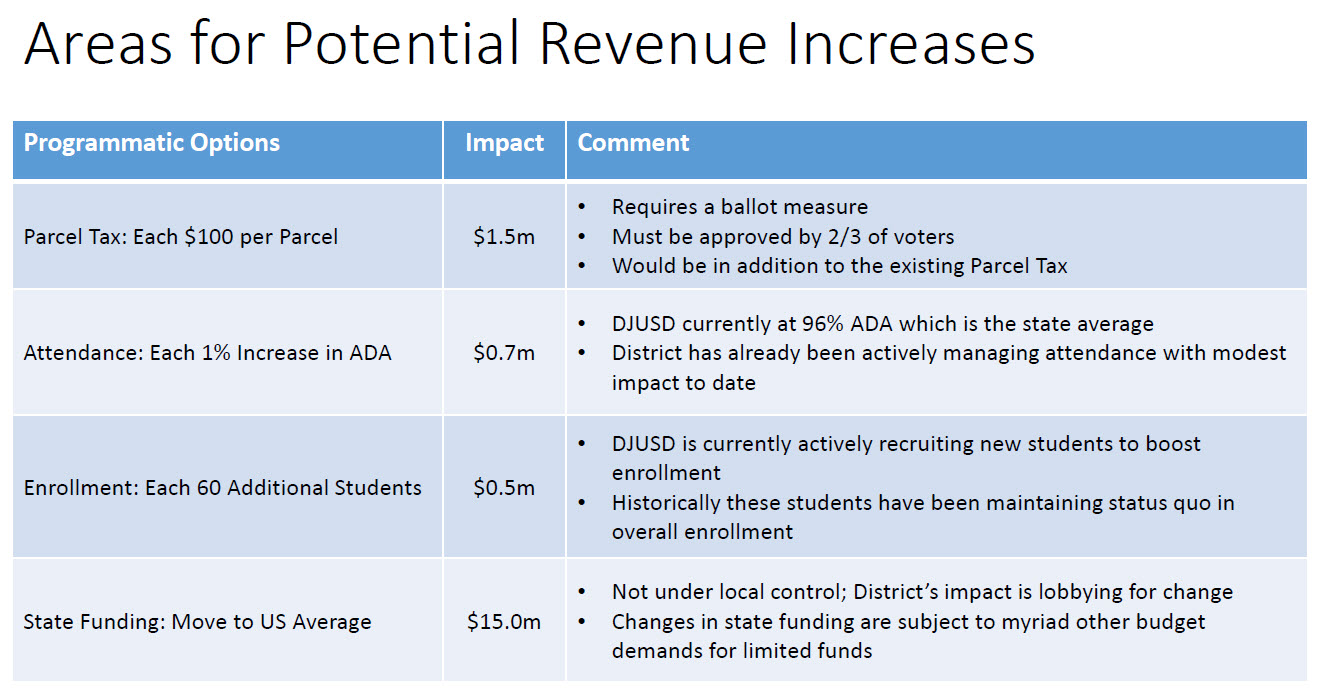

Are there other ways to produce additional revenue? I’m going to go with no. The idea of increasing the ADA (average daily attendance) is going to be a huge hassle for parents. I already had a letter from the district questioning legitimate absences for my daughter and threatening to make me get a doctor’s note – I can tell you, it’s just going to tick people off and $700,000 is nice, but doesn’t move the needle.

Increasing enrollment is fine, people really don’t understand the math there but the district can take on another 60 to 120 students easily without increasing staffing or facilities and that is largely pure revenue – another $1 million.

Nice, but again doesn’t move the needle.

State funding is not under local control and would not help the district close the compensation gap.

Bottom line: if we go the revenue route, it is going to need to be a $200 parcel tax.

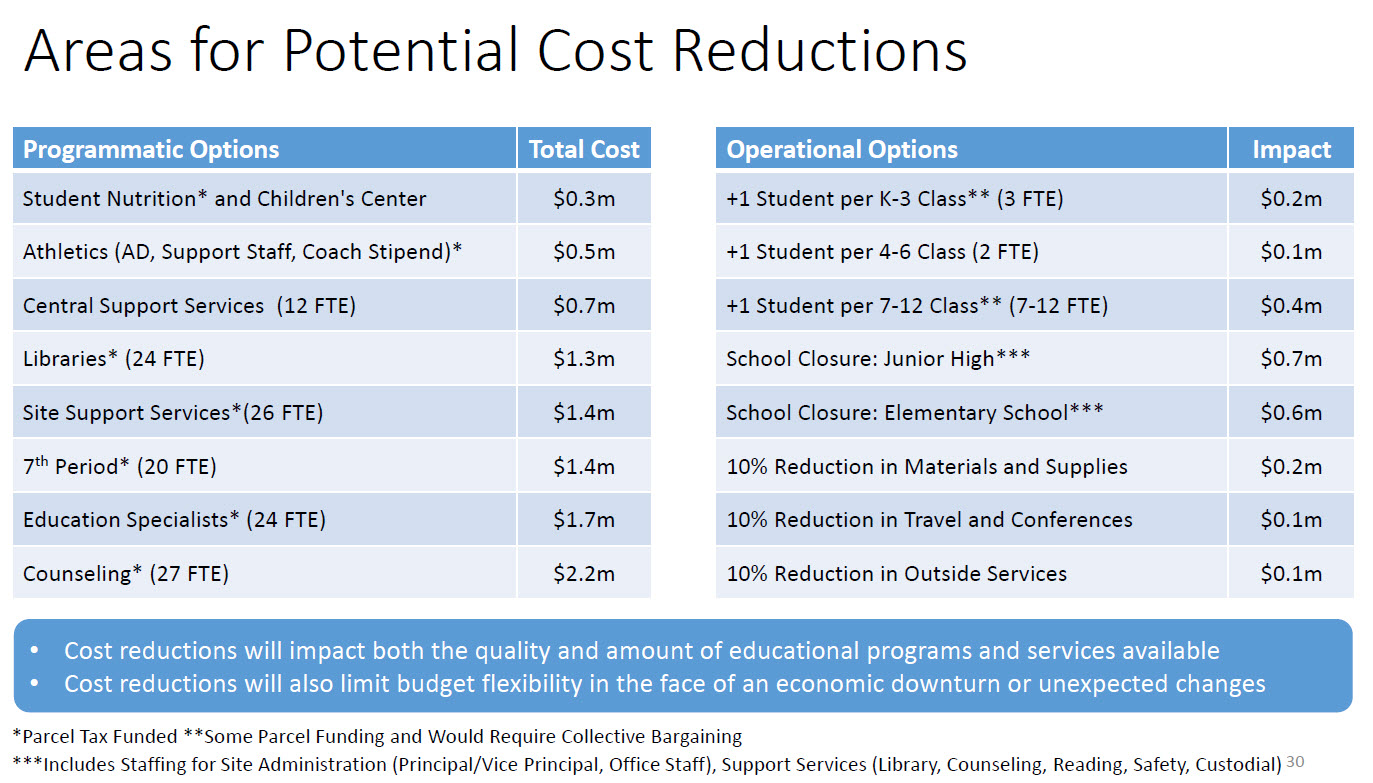

Can we cut our way to this?

The answer is clearly yes. If the parcel tax fails, then the district needs to pull this chart back up and figure things out.

The answer is clearly yes. If the parcel tax fails, then the district needs to pull this chart back up and figure things out.

This chart shows a few ways to get there. One way would be to simply put another parcel tax on the ballot at the same $620 level and shift money from things like 7th period, libraries, paraeducators, and counselors to compensation. That is where the money is and, while it would clearly take another vote, it would be a relatively simple sell.

Would I want to eliminate 7th period day, cutback on paraeducators, counselors and libraries – no. I think the quality of education would be harmed. But I think the district does itself a disservice to argue we can’t do it.

From the district’s perception, the first step here is to put the parcel tax before the voters and attempt to sell the voters on the plan to increase revenue to close the compensation gap, arguing that this is the way to maintain our high quality education.

If that doesn’t work it becomes a matter for the voters to prioritize between programs and compensation.

We now have the analysis available to show the voters the tradeoffs involved.

—David M. Greenwald reporting

Its clear that the problem with the district is that we (as the residents of the city) expect the school system to be an excellent school system, compared to the rest of the state and the nation – our housing values depend on this perception – however, we do not have the funding from the state to make that happen.

Our district is funded at $15million less than the average school district IN THE US! Yet we know that our cost of living is higher than the average in the US due to housing prices. If we cut all of the possible places to cut that are suggested in the table – a belt tightening that would devastate our district’s ability to provide a good education for our kids – they add up to less than $15million.

The problem here is a complete disconnect between perception and reality in the Davis citizenry. Every number written in that article is a drop in the bucket compared to the $15million – which gets us to the national average, not to, say, what Massachusetts spends per student which is much more. We Davisites insist on touting our “wonderful schools” but are unwilling to see what it takes to maintain those schools.

We have to decide that being an excellent school district is a “Davis community value” – much like our values of a bike-able town and non-sprawling growth. This is a value we have to defend – with our own money – because like those other two values, it brings us community pride, and it brings us wealth (through our housing values).

I am skeptical of measures of “one grade level above or below” as are measured in national surveys of schools. However, this very crude comparison of districts across the US shows that while Davis is doing better than the national average in preparing its students, it is clearly below the mean when compared to districts with the same income.

https://www.nytimes.com/interactive/2016/04/29/upshot/money-race-and-success-how-your-school-district-compares.html

A little bit of paint along the side of the road does not a bike lane make. Simply cheering our schools does not make them great. In both examples, we have to put our money where our mouth (our value) is.

One of the problems with an aging community, with demographics skewing to the older (retirees) and much younger (college students) ends, is that you have fewer and fewer people directly invested in the quality of the school district.

Simple answer: build housing. Why do we make this stuff so difficult?

Simple but incomprehensible. How do you expect more housing the help?

Really? You don’t think housing would provide places for families with children to live?

Another variable, Craig, is ready availability of good-paying jobs… at least within Davis… the variable you point out is very much “in play”, as well… particularly as to MF housing large enough for a family to choose… and close to parks/GB’s, etc.

Multi-variable issue…

You have all of these university faculty and staff that come to UC Davis and live somewhere other than Davis. A lot of them are sending their kids to DJUSD through the transfer program, its an easy fix.

Not sure of your 1:11 post… the folk you describe are not DJUSD voters, and even if there was more, and more affordable housing, they may well choose to, for other reasons… many variables…

With housing opportunities they would be

Perhaps, Craig, perhaps… facts not in evidence… suppositions that appears logical… but may or may not be factual, for many reasons… you may be correct, and it may be that additional housing, and affordability would not change any factors significantly… we do not know… I know I don’t know, and I question whether you know… but, go with what you believe… I know not whether you are right or wrong… simple as that…

“You don’t think housing would provide places for families with children to live?” The problem is amount of money we get for each student. David may be the only person who believes that you can add students without adding cost.

“people really don’t understand the math there but the district can take on another 60 to 120 students easily without increasing staffing”

DJU needs either more revenue per student or lower costs.

From the district’s standpoint, more parcels that don’t have students, but pay the parcel tax, would actually be optimal.

Increasing the parcel tax is the surest way to create more revenue per student.

Craig Ross said . . . Really? You don’t think housing would provide places for families with children to live?

Craig, the only way that additional housing is going to provide places for families with children is if those families are fiscally able to outbid the other demographic groups for the housing. Do you think families have the financial where-with-all to outbid seniors for added new for sale housing? Do you think families have the financial where-with-all to outbid groups of UC Davis students for added new apartment rental housing?

NOTE: I’m not saying that we don’t need additional housing. I’m simply saying that it isn’t likely to address the schools enrollment and fiscal issues.

“increasing the parcel tax is the surest way to create more revenue per student.”

Completely not true, 100% false. Increasing the parcel tax requires a vote and as the article above indicates it looks unlikely to pass. It’s still a ways a away so anything can happen but the odds are they economy will be in worse shape then which will make people less likely to approve.

On the other hand we could stop taking transfers and stop renewing transfers where possible. This could be done immediately and is “the surest way to create more revenue per student”.

We cannot remain competitive with surrounding area schools as long as we are looking at a teachers’ exodus. Davis has long been known for its parks/greenbelts/bikeability as well as its schools and UCD, but we have to be willing to defend and fund them, or people will increasingly be unwilling to pay a premium to come move to Davis for its quality of life and schools.

Not all competent teachers, seeking to work in DJUSD, have kids, or seek to live in Davis… so, they ‘pay’ no premium… (except perhaps commuting costs…)

Early to mid-level career teachers usually take a pay cut relative to nearby school districts and also have commuting time/costs to work here, so that it’s hard for them to see DJUSD as someplace they wish to stay beyond just until something better opens up elsewhere.

Meanwhile, I was shocked when I flipped through an area magazine and saw realtors mentioning good schools as reasons to move to Granite Bay, parts of Natomas, Folsom, and on and on… for folk moving to the greater Sacramento area for new jobs, but when it came to Davis, it was simply mentioned that we have UCD and greenbelts, but with limited housing inventory, that people should snap up any houses they like if they wish to live here – with NO mention of our district’s also having good schools! Which clearly we won’t be able to keep that going for us anymore if we can’t pay to retain our teachers!

Grace, your 1:38 post…

Who do you blame for pointing out, not pointing out the obvious? The area magazines/realtors, or DJUSD, Davis realtors, and sounds like folk like you for not “messaging” appropriately?

Believe David’s piece well points out what needs to happen if folk want to pass a parcel tax…

What will your active participatory role be, if you believe in it? How will you act to ‘cheerlead’/inform/convince voters?

I care not to know what you plan, but those choices will be on you and others, who appear to believe the measure is needed, and at what level, if it is to pass… on this, I fully agree with the thrust of the article.

You need to “own” the fact that you, and others, have some “s’plaining”, and ‘some selling’ to do… “you” as a group ain’t there… act, don’t whine…

Who knows… folk might be convinced and pass it handily…

We definitely need to do a lot more selling of its need, but it sure would help if the ask is actually significant enough to be worth backing!

It was foolish of the board to have approved raises for its top paid employees if it could not afford to do likewise for all its rank and file teachers too, but even if say the Superintendent were to become a $0 paid volunteer position, we couldn’t afford to pay our teachers median area pay. Nor cut our way out to doing so without choices that Davis parents would find unacceptable such as cutting music classes, honors/AP classes etc.

“when it came to Davis, it was simply mentioned that we have UCD and greenbelts, but with limited housing inventory, that people should snap up any houses they like if they wish to live here – with NO mention of our district’s also having good schools!”

Because people can live outside Davis and still attend DJU schools. Other than convenience of transportation there is no reason to spend $400 per foot for an old house rather than $200 for a new house for the same schools.

If that were the case, housing demand wouldn’t be what it is. Suggest you re-think your comment.

“If that were the case, housing demand wouldn’t be what it is”

Have either bought or sold real estate in Davis? I have.

Jim Hoch said . . . Because people can live outside Davis and still attend DJU schools. Other than convenience of transportation there is no reason to spend $400 per foot for an old house rather than $200 for a new house for the same schools.

Jim, your bolded statement is only true if the “source” school district agrees to allow the out-of-district student to attend Davis schools. If that “source” district says “no” then the student can not attend DJUSD schools.

The quote continues, so I don’t want to be accused of taking it out of context, so I will state that for me, these words are the critical point. It was foolish to approve raises for the top paid employees, period.

“Jim, your bolded statement is only true if the “source” school district agrees to allow the out-of-district student to attend Davis schools. If that “source” district says “no” then the student can not attend DJUSD schools.”

There are actually two ways to transfer with slightly different requirements. However the people in “North North Davis” are concerned about this issue. Note that denial of an exit permit can be appealed to the county board of education. There was a thread earlier on LAUSD denying exit permits and strategies and appeals of parents to get out.

As its reason for existence is to address DJUSD’s regionally subpar teacher pay for attraction, retention, and equity, I have to question the wisdom of still considering essentially the same proposed parcel tax from last spring when I recall the DTA president reporting to the board that at that time, teachers seemed lukewarm or else very split about that proposed parcel tax of $190 to fund teacher pay raises. Without a critical mass of teachers enthusiastically sold and supportive on it, I have a hard time seeing a successful robust winning campaign for it otherwise.

I would guess that 1) that amount is not enough to really excite and motivate teachers to feeling it worthwhile to help canvass knocking on doors, make phone calls, and say/write public comments as Davis also has far higher cost of living than surrounding areas and 2) it puts teachers in the awkward position of trying to defend or make the case for a parcel tax solely for their own pay raises.

Trustee Alan Fernandez’s $365 proposed citizen referendum parcel tax idea last summer would have generated more for teacher pay, but was needlessly more controversial/complicated by also including such a large cut to the City with only 1 SRO hire explicitly hoped for from the City’s cut.

I suspect a $390-$420 proposed parcel tax going entirely to DJUSD would likely be the amount needed to adequately excite teachers, especially when also adding more school counselors and nurses to help close the gap toward their recommended student ratios and help broaden its appeal to teachers as well as other voters.

As I believe DJUSD still has about a 1:350 school/academic advising counselor to students ratio for teens and a much improved 1:450-600+ ratio for K-6 as of this year, we are still far short of the ASCA (American School Counselors Association) recommended 1:250 students ratio. Meanwhile, the school nurse’s presence just 1 day a week at CCE for example is woefully inadequate and I frequently hear parents bemoan the relative lack of school nurses anymore. Those are both VERY compelling and popular asks for people to be able to support from across the political spectrum. Those adds are also easy to quantify as desired results afterward for people to see as new hires and added FTE hours.

From DJUSD’s School Safety Task force meetings held last April to get public community input about school safety, more school counselors was also overwhelmingly by far the most popular desired measure from its many participants. It would also be easier for teachers to ask for public support for a measure that would more clearly also benefit students beyond just their own teacher pay. Related, perhaps some more part-time vice principals should also be considered.

Wording should also be added stating that even with our existing parcel tax, that DJUSD is still slightly less than average funded among CA school districts and that CA school districts/students also receive far less state funding than is the national average among states.

Teacher pay also factoring in the higher cost of living in Davis or time/gas for commuting, PLUS more counselors and nurses also sounds far easier to help promote and sell at Farmer’s Markets, NextDoor, PTA meetings, etc.

If another citizen referendum for say $390 or $420 with all of it going to DJUSD for improving teacher pay while also adding more counselors and nurses is still possible to pass with a lower threshold in the spring or fall of 2020 than is needed for a traditional school parcel tax, I’d be happy to help support that too!

Yes Grace, but,

As structured, primarily due to DTA, everyone’s “boat would float”… competent teachers not “attracted”, competent teachers considering early retirement/moving on… boosting final compensation for competent/incompetent/marginal teachers about to retire… boosting the compensation for the marginal/incompetent teachers… same for admin , particularly the very well compensated senior/executive folk… there is where the “s’plaining” needs to happen, or be dealt with in the proposal.

And, I’d like to see a ballot measure/referendum, of the magnitude of which you speak… to fund City infrastructure deficits, protection of programs, employee compensation for City services/City employees… but if the political will is not to do both, I’ll vote for neither… honest truth…

At the levels you propose, if passed (and that would be a huge “if” @ levels you propose) for DJUSD, the City will have ~ 0% chance of renewing, or passing new, City assessments… I could support both, but until folk like you support both, @ similar levels, I will not support the DJUSD play, at the levels you posit… for all the reasons I’ve outlined… the City has always (stupidly, in my opinion) deferred to DJUSD to ‘go first’…

Is it a “community”, or is it “all about the kids”, and those who earn their livelihood “serving (or claiming to)” the ‘kids’? I assert that the City also serves ‘the kids’, and the rest of us.

As its reason for existing is to address DJUSD’s regionally subpar teacher pay for attraction, retention, and equity, I have to question the wisdom of still considering essentially the same proposed parcel tax from last spring when I recall the DTA president reporting to the board that at that time, teachers seemed lukewarm or else very split about that proposed parcel tax of $190 to fund teacher pay raises. Without a critical mass of teachers enthusiastically sold and supportive on it, I have a hard time seeing a successful robust winning campaign for it otherwise.

I would guess that 1) that amount is not enough to really excite and motivate teachers to feeling it worthwhile to help canvass knocking on doors, make phone calls, and say/write public comments as Davis also has far higher cost of living than surrounding areas and 2) it puts teachers in the awkward position of trying to defend or make the case for a parcel tax solely for their own pay raises.

Trustee Alan Fernandez’s $365 proposed citizen referendum parcel tax idea last summer would have generated more for teacher pay, but was needlessly more controversial/complicated by also including such a large cut to the City with only 1 SRO hire explicitly hoped for from the City’s cut.

I suspect a $390-$420 proposed parcel tax going entirely to DJUSD would likely be the amount needed to adequately excite teachers, especially when also adding more school counselors and nurses to help close the gap toward their recommended student ratios and help broaden its appeal to teachers as well as other voters.

As I believe DJUSD still has about a 1:350 school/academic advising counselor to students ratio for teens and a much improved 1:450-600+ ratio for K-6 as of this year, we are still far short of the ASCA (American School Counselors Association) recommended 1:250 students ratio. Meanwhile, the school nurse’s presence just 1 day a week at CCE for example is woefully inadequate and I frequently hear parents bemoan the relative lack of school nurses anymore. Those are both VERY compelling and popular asks for people to be able to support from across the political spectrum. Those adds are also easy to quantify as desired results afterward for people to see as new hires and added FTE hours.

From DJUSD’s School Safety Task force meetings held last April to get public community input about school safety, more school counselors was also overwhelmingly by far the most popular desired measure from its many participants. It would also be easier for teachers to ask for public support for a measure that would more clearly also benefit students beyond just their own teacher pay.

Wording should also be added stating that even with our existing parcel tax, that DJUSD is still slightly less than average funded among CA school districts and that CA school districts/students also receive far less state funding than is the national average among states.

Teacher pay also factoring in the higher cost of living in Davis or time/gas for commuting, PLUS more counselors and nurses also sounds far easier to help promote and sell at Farmer’s Markets, NextDoor, PTA meetings, etc.

If another citizen referendum for say $390 or $420 with all of it going to DJUSD for improving teacher pay while also adding more counselors and nurses is still possible to pass with a lower threshold in the spring or fall of 2020 than is needed for a traditional school parcel tax, I’d be happy to help drum up support for that too!

There are some obvious steps possible.

1: New parcel tax bill with no exemptions at the current rate. If it passes there will be close to an extra $1M(?) in revenue and if it fails, there is no loss.

2: No longer accept any transfers and non-renew current transfers when possible.

3: Given a lower student population and the Da Vinci consolidation plan close Emerson and one elementary school. Given that Willett and Chavez are next to each other one of those would be most likely.

4: Review the paraeducator program. Many of them are worthless and we spend far more there than other districts. I have been in classrooms where there were multiple paraeducators who spent the whole time talking to each other. [edited]

5: Regionalize the continuation school. There are incredible fixed costs for King. That would seem to indicate that a consolidated Davis/Dixon/Woodland solution would save money.

1. That’s possible, but it would have several drawbacks including making the next parcel tax harder to pass.

2. That would reduce revenue

3. Yes if you close an elementary and JHS you could generate about $1.3 million in savings, but the political fallout would be tremendous and may end up costing more in the long run.

4. As I laid out in the article, a fall back position of libraries, counselors, Para-educators, 7th period seems the most likely alternative to a new parcel tax. That would require voter approval because the funding is locked into the previous parcel tax.

5. I don’t think there’s enough money there to make much difference.

Your list reads like Jim’s agenda, given that you’ve told me you’ve left town, not sure why you keep pushing for it.

“Animus”, seen on other threads (regarding a previous school board member)?… self disclosed fact that he owns residential property in Davis, likely as a SF rental? Nah, those couldn’t be reasons…

But does go to credibility…

But, David, you ‘opened the door’ as to questioning reasons/motives… I just walked in…

Please note I did not provide link to “Transparent CA”… trying to be ‘good’…

I still own real estate and pay taxes. I would like home values to increase and taxes to not increase.

Everything on this blog is “David’s agenda” though unlike you I supported the last parcel tax and I pay it.

Well, when you say,

What support? Did you, in fact, vote for it? Out of the DJUSD measures since 1979, I voted for every one of them, but one… and I have never spent any real effort opposing any one of them…

And we are paying for every one of the levies, including the two DJUSD CFD’s… do you pay both of those plus the other DJUSD levies? If you still own property in DJUSD that is rental, do you in effect pass those costs on to the tenants, via rental rates? Or do absorb them yourself? If you pass them on, REAL easy to support the levies if, in actuality, someone else is paying it… hence the wisdom in the District doing the Senior Exemption, the “affordable housing exemption”, the structure of the Parcel/CFD assessments where MF folk get the benefits, have no/de minimus costs… representation without taxation, as it were…

Your ‘swipe’ is impotent (as a ‘rebuttal’)… but, you make a good point on this and general resistance to growth in Davis… for you it’s about your “investment”, but not necessarily in “the kids”, or others… thank you for your honesty on that….

“What support? Did you, in fact, vote for it?”

Had a sign on my yard

Wrote a letter of support to the Emptyprise

Voted for it

Jim, your questions today of me are pretty much answered in my post of yesterday afternoon… you must have missed it…

What questions?

I think I heard that about 10% of our kids are now transfers. It certainly sounds plausible that eventually a neighborhood school will logically need to be closed, but as Chavez is a magnet school, that draws kids from all over the city.

I believe this year’s total operating budget for DJUSD was $91 million while total enrollment is about 8700 students. We can quibble about its allocation however you like, but that is still extremely low spending per student when other high cost states such as those in the East Coast are spending $18-$21K per kid.

I just looked it up and it says for 2018-2019, the TOTAL DJUSD district budget INCLUDING the supplement from the Davis School Foundations and local property taxes was $94,900,411 per what appears to be the latest Parcel Tax report. DJUSD also reports its district as having about 8700 students. If you divide those total revenues by 8700 students, that is only $10,908 in spending per student.

No matter how you parse or allocate that, you cannot escape that their total revenues available are still abysmally low compared to other high cost of living states as well as even less than the national average spending among states for spending per pupil as well as for % of state GDP. And as low ranked as CA is for per pupil spending, DJUSD is less than average funded among CA school districts due to the formulas for state funding allocation for which it simply does not qualify for as much, so it MUST be supplemented by local property taxes, local grants, and PTAs until the state contributes its fair share if we do not want many of our kids to get left behind and face a competitive disadvantage from the quality of their public school education.

And yes, I am a homeowner so no I don’t take it lightly when I say we need another tax. However, of the significant chunk of our annual property taxes, the school district actually gets very little of it, while most City employees are very well paid compared to others in the area, especially those at the upper echelons.

I reject the idea that renters don’t pay. Indirectly but they pay!

Of course, renters pay as any higher costs get passed down to them via their rents. It’s just less directly broken out and apparent to them for each’s renter’s share. I simply wanted to clarify that I am a homeowner who lives in my home who thus has to pay for any additional taxes as I cannot pass on any new higher taxes to renters.

I question whether any other renter pays. Apartments are priced based on what they can get, not what is costs.

Does it matter and if so why? Many people vote for taxes that they will never pay. The school district has to find ways to stay afloat. There are limit ways. From the school district’s perspective, they have a clear preference to maintain current levels of service. That will be their first choice. The voters will either support that choice or they won’t. If they don’t, the district has paths forward – most of which are suboptimal. None of that is impacted by whether renters pay directly, indirectly, or not at all.

“They” can get, a lot.