One of the Vanguard’s biggest criticisms of city budgeting, going back to at least 2008, is the fact that the city’s deferred maintenance and other unmet needs was not counted against the budget but rather put into a separate “unmet” needs category.

One of the Vanguard’s biggest criticisms of city budgeting, going back to at least 2008, is the fact that the city’s deferred maintenance and other unmet needs was not counted against the budget but rather put into a separate “unmet” needs category.

This past budget cycle, the initial budget contained no funding for road maintenance and the acting city manager claimed that the city would be in the black in the out years of the budget, despite the fact no money was set aside for road maintenance when deferred maintenance costs would be running $15 to $20 million dollars.

During Tuesday night’s budget discussions, this was an issue that Councilmember Sue Greenwald took up.

“A number of years ago, I pointed out that we were essentially balancing the budget by calling our deficit ‘unmet needs,'” she said. “As we’ve mentioned, they’ve accumulated and we’ve said that… we wanted to know what services we could restore. I don’t think that’s a very accurate way to describe it. We are not restoring services, we are trying to catch up with unmet maintenance needs that are getting really severe.”

Much of the discussion focused on points that have largely been raised previously, about the deterioration of Davis’ roads, the loss of external revenue sources, and the need to make up these gaps, at least in the short-term, through general fund monies.

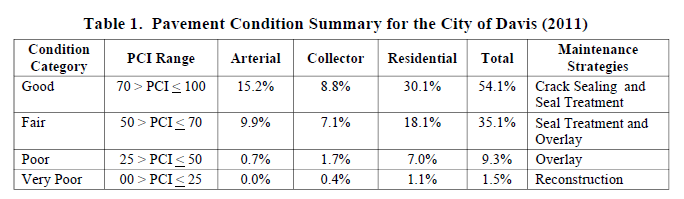

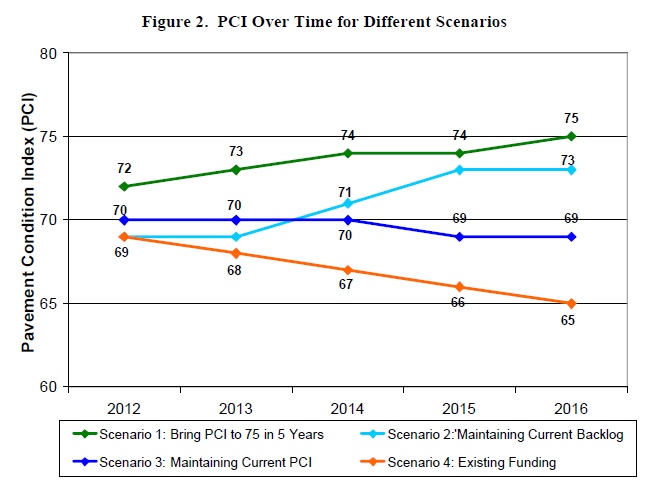

According to Bob Clarke’s presentation, since 2006 the City’s overall PCI (Pavement Condition Index) dropped from a PCI of 71 to a PCI of 69.

The City has relied on State and Federal funding to finance a major portion of the pavement maintenance needs, and the City supplemented these funds with local revenue (local match).

However, as he noted, these grants are typically restricted to arterial streets, which only make up about 33% of the total street system.

Money for non-arterial streets typically has to be provided through local funding sources.

On Tuesday, Mr. Clarke argued, “Additional revenues must be obtained to enable the city to devote adequate resources to pavement repair in order to prevent steady deterioration of the road network.

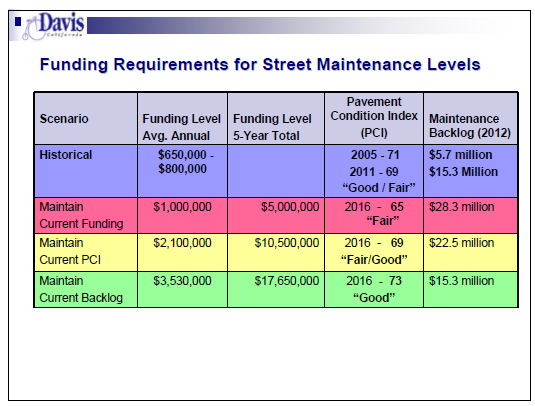

According to Mr. Clarke’s presentation, even if the proposed level of funding ($1,000,000 per year) is continued for the next five-year period, the condition of the network will deteriorate, with the average PCI decreasing from 69 to 65.

The amount of this deferred maintenance is estimated to increase from $15 million to $28 million. This backlog will continue to increase steadily if additional funding is not achieved. As maintenance is deferred moreover, the cost for repair solutions increases.

“Even putting this back into the budget would only slow down the deterioration of our infrastructure,” Councilmember Greenwald said.

“We’re getting squeezed in two ways,” Councilmember Dan Wolk added, “We have this deteriorating infrastructure and federal and state funding that’s going away, essentially we’re being asked to look to local dollars to try to build our infrastructure up to where it was in the 80s or back up to a standard where we appreciate.”

“When we talk about unfunded liabilities,” he said, “this is one of the major ones.”

If we want to improve our roads, he said, we have to look at local funding “because it seems like we can’t rely on state and federal funding to do that. There’s got to be some hard decisions that this council has to make.”

Stephen Souza noted, “We’ve watched this deterioration and we need to figure [it] out and I’m glad we’re thinking about other avenues to go down because our brothers and sisters in state and federal government don’t have the money to be providing for our infrastructure anymore and we have to address this problem.”

“It’s a problem that we kind of saw coming but it is hitting us and we’re dealing with it now,” he added.

“I agree with the points you’re making Dan, it’s something that we just have to deal with, it’s here, it wasn’t here in 08-09. It’s here now and we’re dealing with it – as mature adults would,” Mr. Souza quipped, to the bewilderment of some.

The critical question comes back to how to fund local infrastructure and how to account for it in the budget.

“We’re evading the big issue,” Councilmember Greenwald warned. “The budget is not a realistic budget. We’re still saying that the budget is on its way to being balanced by having this enormous category of unmet needs.”

“In the end we’re going to have to spend money on our roads, on our sidewalks, our bike paths and we have to start putting it in the budget and we have to start spending it,” she stated. “We need to start being more realistic because what I’ve heard tonight is more kicking the can down the road.”

Councilmember Greenwald then moved to direct staff to come up with a budget that reflects the true deficit, which includes a concept of the city’s unmet needs.

Councilmember Wolk seconded the motion.

City Manager Steve Pinkerton said, “You want a budget that reflects our physical needs, both ongoing and the deficit.”

Councilmember Greenwald said that we need the budget to reflect both unfunded liabilities and unfunded needs and a way to pay them down, just as the city has a plan to deal with unfunded health liabilities.

Mr. Pinkerton said, “We have $420 million infrastructure and right now, we’re not budgeting enough to deal with that infrastructure.”

The council would then unanimously support the motion, and for the first time seemed to recognize what to many seemed like a huge disconnect, the fact that there were mounting deferred maintenance and unmet needs costs, the amount is going up over time, and yet there has been no accounting for it in the budget.

As Councilmember Greenwald put, it was disingenuous to have these mounting costs and suggest at the same time our budget was balanced.

How this will work, of course, remains to be seen.

—David M. Greenwald reporting

I didn’t watch all of the budget meeting last night. But from the part I watched, I thought the really big news was Paul Navazio’s announcement that CalPERS is not going to raise its pension funding rates for 2012-13 and that CalPERS expects to not raise its rates for the next three years. Did I hear that right, David? Perhaps I misunderstood what Paul said.

I have looked (on a Google news search) for any news stories regarding this development and have found none. If it is true, it is pretty big news.

As of their last “Annual Valuation Report,” CalPERS had told Davis (and other agencies) that the miscellaneous funding rate for employers was going to rise from 18.018% this year to 18.800% next year and then to 21.200% for 2013-14; the public safety funding rate for employers was going to rise from 25.907% this year to 26.800% next year and then to 30.300% for 2013-14.

The savings to the City of Davis from having no increases in the funding rates (assuming salaries stay flat) is roughly $1.06 million a year, comparing 2011-12 to 2013-14.

When the Vanguard had a budget workshop of its own some time back (cannot remember how long ago that was), with Paul Navazio present, I was very pointed in speaking out about the fact that unmet needs were being placed in a separate category of its own, and then a “magical” wand was being waved over the city budget and declaring it somehow “balanced”. At the time, Paul Navazio did a two-step in response to my comments, trying to explain that somehow that is how “accounting works”, as if I was a nincompoop. I remember feeling very frustrated and angry. As time went on and I learned more about city politics, I feel the entire gimic of an “unmet needs” category fell squarely on Bill Emlen, the former city manager and the then Gang of Three on the City Council. The “unmet needs” category is creative bookkeeping at its worst… and completely dishonest to the public…

Rich: you heard correctly.

[quote]I didn’t watch all of the budget meeting last night. But from the part I watched, I thought the really big news was Paul Navazio’s announcement that CalPERS is not going to raise its pension funding rates for 2012-13 and that CalPERS expects to not raise its rates for the next three years. Did I hear that right, David? Perhaps I misunderstood what Paul said. [/quote]

Do you think CalPERS is doing a two-step, trying to improve its image after so much bad publicity has come out about it? But that in reality the chickens will come home to roost for CalPERS if their projections are not realistic?

Re: Unmet Needs category; CalPERS projections… all more evidence of kicking the can down to the road to escape current accountability and responsibility.

I have to say though… with folks like Mike Harrington in our community… willing to spend his vast fortunes to win political battles by fomenting fear, uncertainty and doubt in the voting population… I can see why political leaders get frustrated and start to limit transparency. While the initial motives for this might be respectable, it then becomes standard operating procedure.

[i]”Do you think CalPERS is doing a two-step, trying to improve its image after so much bad publicity has come out about it?”[/i]

My guess is that this change in rates is formulaic. By that I mean CalPERS has a computer program which tells them what the pension funding rates need to be, given X-number of current retirees, given Y-number of current employees, and given Z-number of the cash value of their entire portfolio.

X and Y probably did not change much. But I guess the computer thinks that their portfolio value had risen sufficiently to suggest they did not have to raise rates. That is my guess. It does assume–perhaps incorrectly–that the decision is not influenced by political considerations*.

Here are some numbers I know. On June 30, 2010 (which is the relevant date for setting 2012-13 rates) the PERS porfolio was worth $200.5 billion. June 30, 2011, the market value of CalPERS assets stood at approximately $237.5 billion. Today their portfolio is worth $217.5 billion. They are still well below their peak some 3.5 years ago, when their assets were valued at nearly $250 billion:

[img]http://3.bp.blogspot.com/_OjftCEBUcYQ/SV6M2oAgKAI/AAAAAAAAEZk/b0q158qDRps/s1600/calpers_2008.PNG[/img]

[i]”But that in reality the chickens will come home to roost for CalPERS if their projections are not realistic?[/i]

*Historically, CalPERS has been much more political than I would have liked. In the Gray Davis era, for example, it was entirely taken over by the public employee unions and it produced dishonest reports which resulted in the enhanced retirement regime of 3% at 50 for public safety personnel up and down the state and likewise 2.5% or 2.7% at 55 for non-safety. CalPERS also has used its economic muscle to direct companies that it owns a lot of stock in to adhere to various political causes. It has also invested heavily in “green” companies for likely political reasons. Following the stock market and real estate market collapses of 2008, CalPERS was politically sensitive–as perhaps it should have been–when instead of raising its rates all at once, it implemented a slower phase in of increased rates.

[quote]But I guess the computer thinks that their portfolio value had risen sufficiently to suggest they did not have to raise rates. [/quote]

Does that seem reasonable to you in this economy?

[i]”Does that seem reasonable to you in this economy?”[/i]

I don’t know. Keep in mind that while our economy has a very high unemployment rate, many large companies are now making strong profits (at least compared with 2 or 3 years ago). And it is profits which generally determine the market value of stocks and the like.

To Rich Rifkin: Hmmmmmm…. not sure if I agree w you or not!